Falling Energy Prices Disguise a Relatively Hot CPI

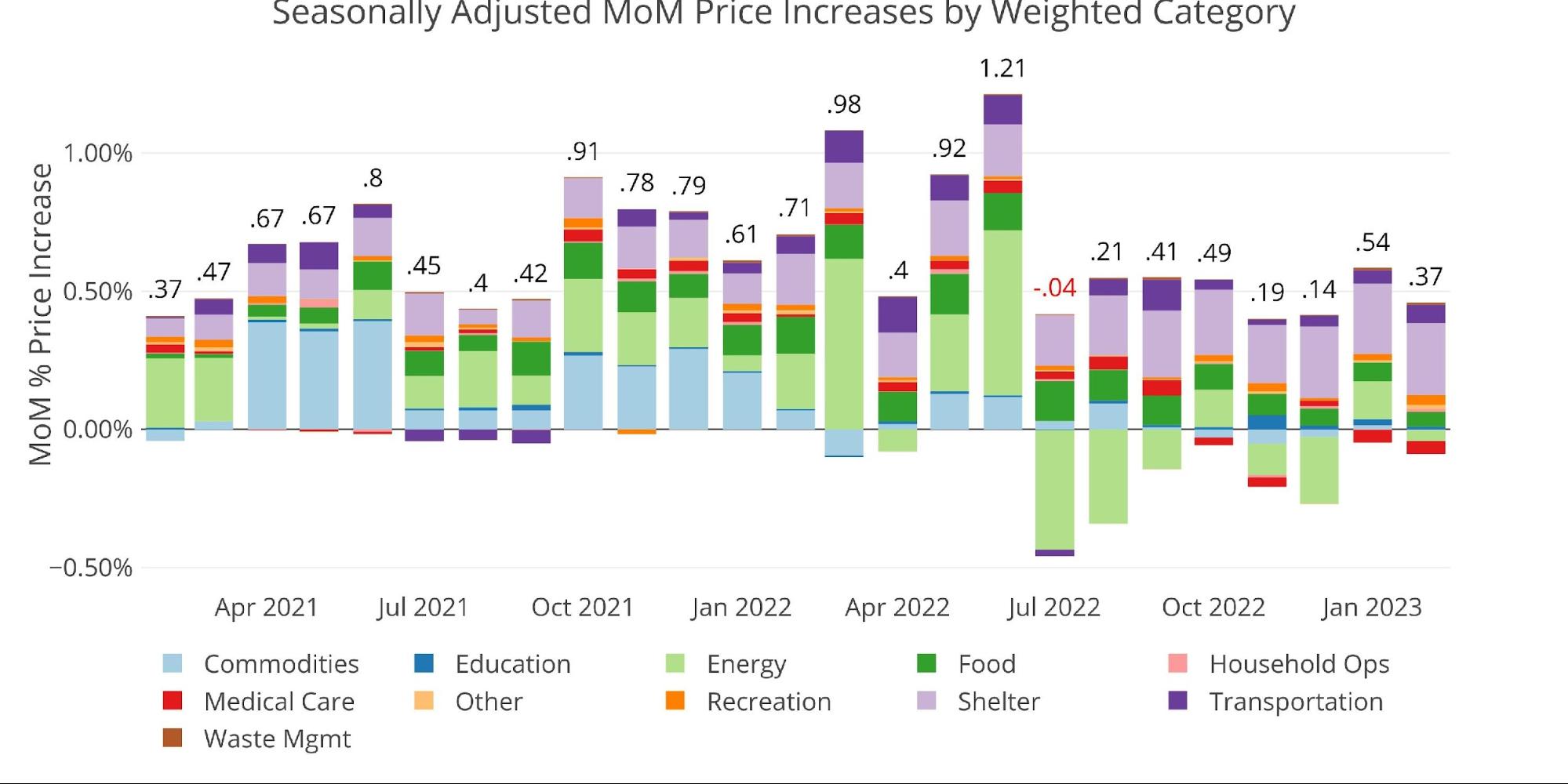

The CPI came in at 0.37% for the month of February. While this was in line with expectations, it is still a 4.5% annualized increase in prices.

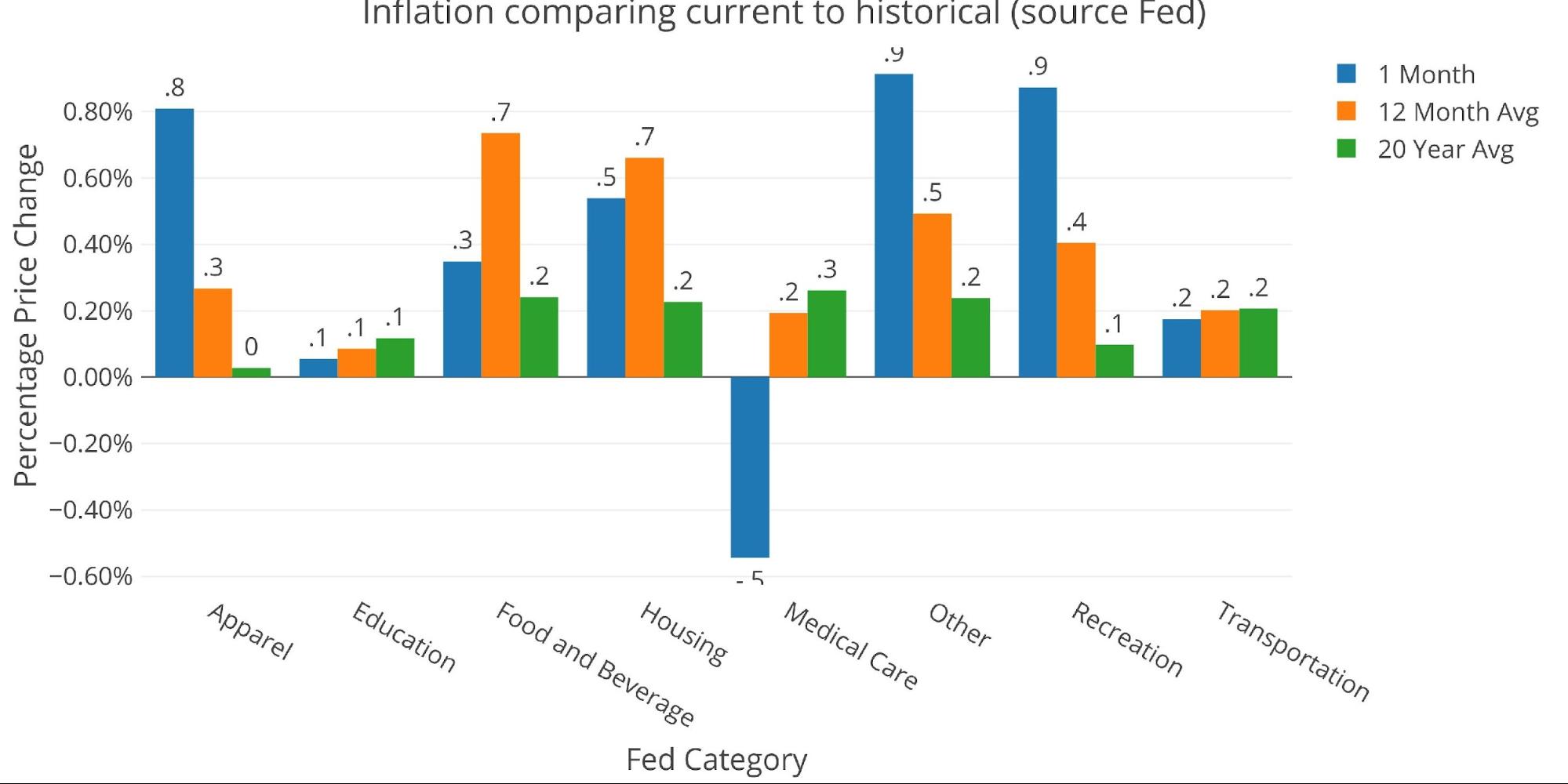

Figure: 1 Month Over Month Inflation

The YoY CPI came in at 6% even which was down from 6.4% last month. The driver for this decline was that last February the CPI registered at 0.71%. So, 0.71% was replaced with 0.37%, helping drive down the YoY number. This is good, right?

Not exactly. If we look at the February 2022 CPI shown above, we can see that 0.2% of the move was driven by Energy vs. -0.04% for the latest month. Thus, energy accounts for almost the entire move down. The second thing to consider is that Shelter contributed 0.18% last year but 0.26% this February. That is a big jump in Shelter expense, and Shelter costs tend to be much stickier.

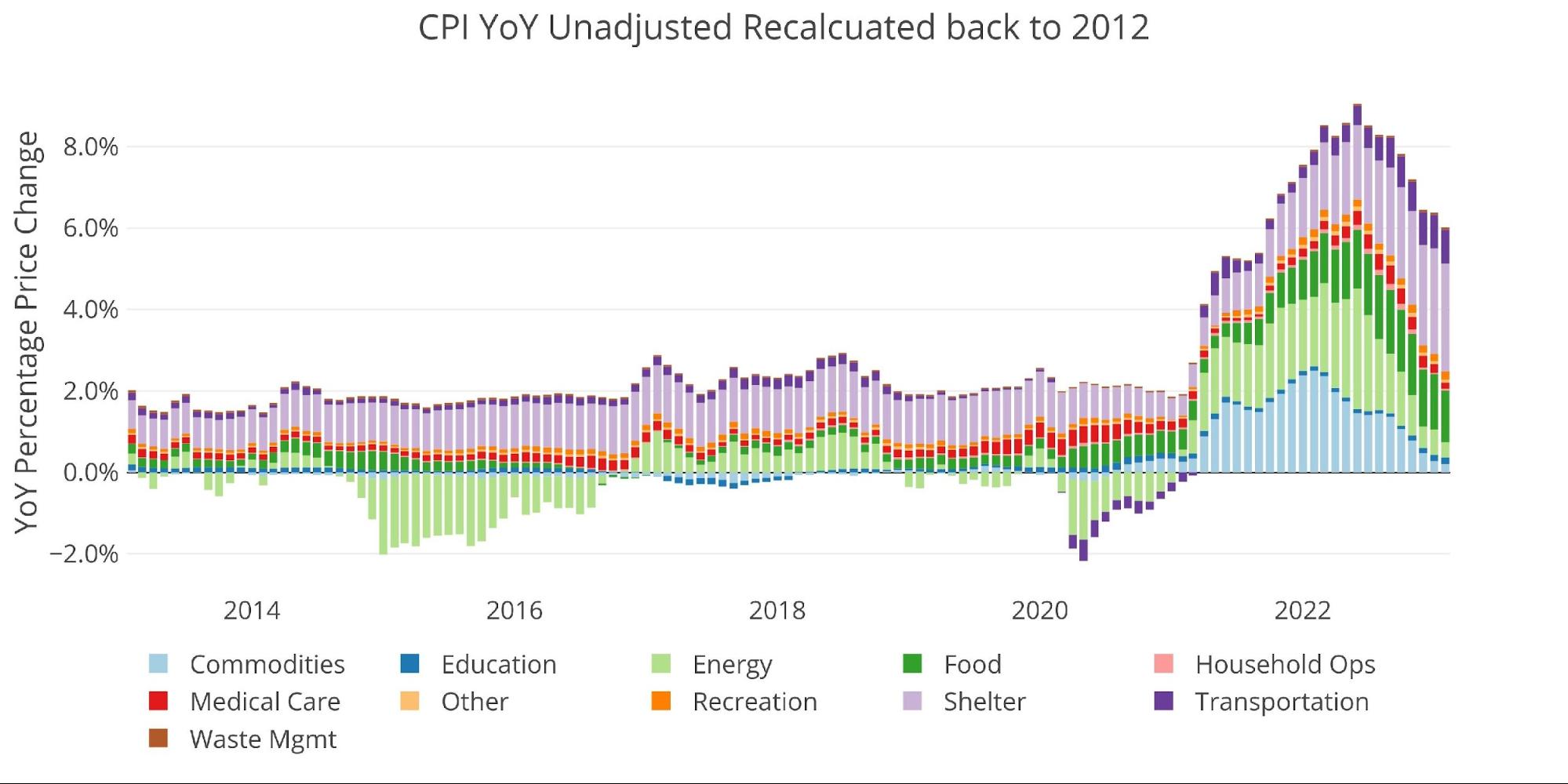

This can be seen more clearly in the chart below. During the trend downward, Shelter has been growing while Energy and Commodities (e.g., used cars) have been shrinking. The problem with this is that Energy primarily came down due to the usage of the Strategic Petroleum Reserve. That has now ended. It’s likely that oil and energy at large are in a bottoming phase and will move higher in the near future. At this point, you could have elevated Shelter and surging commodity prices which could easily drive the CPI back near recent highs.

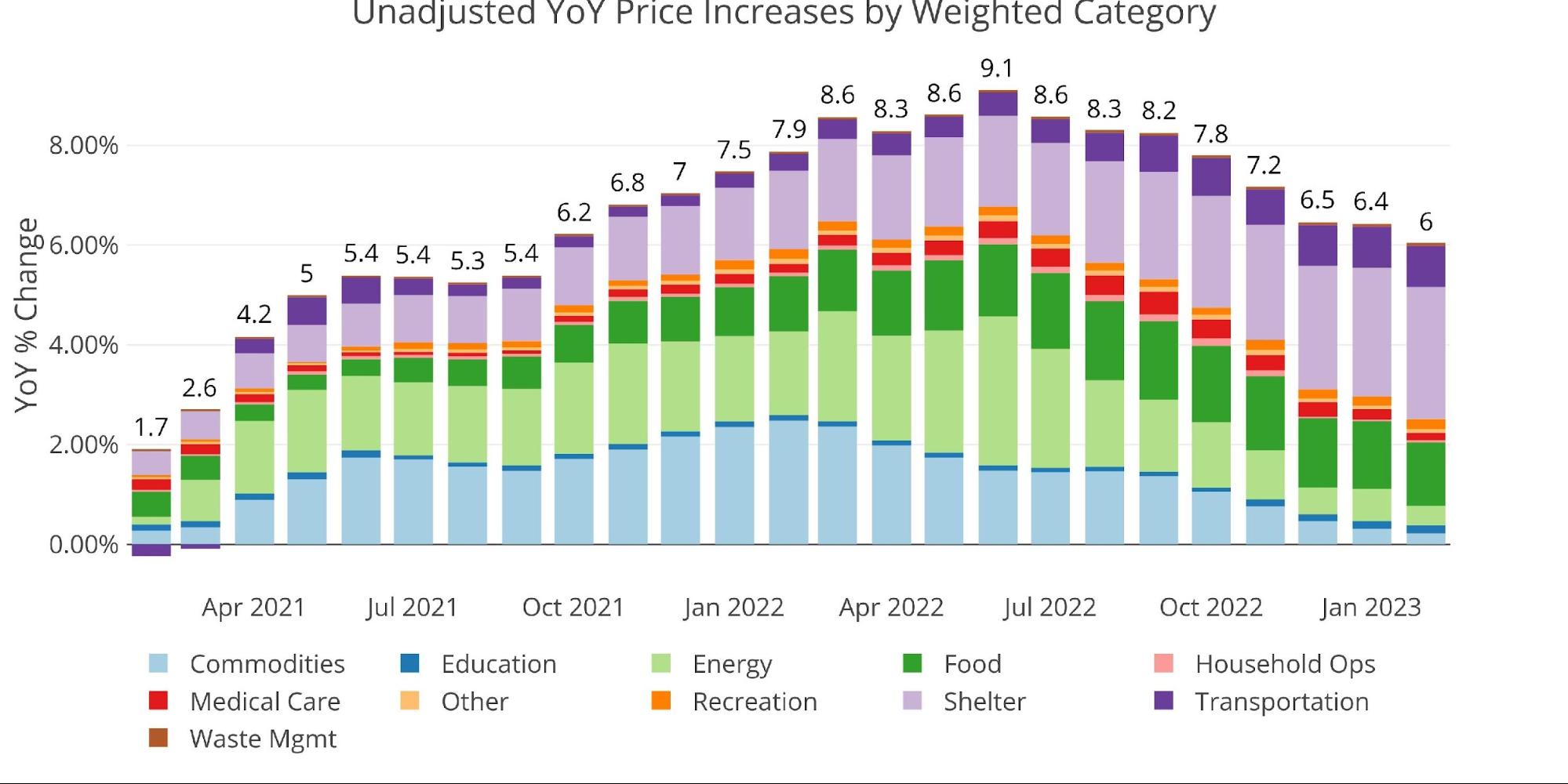

Figure: 2 Year Over Year Inflation

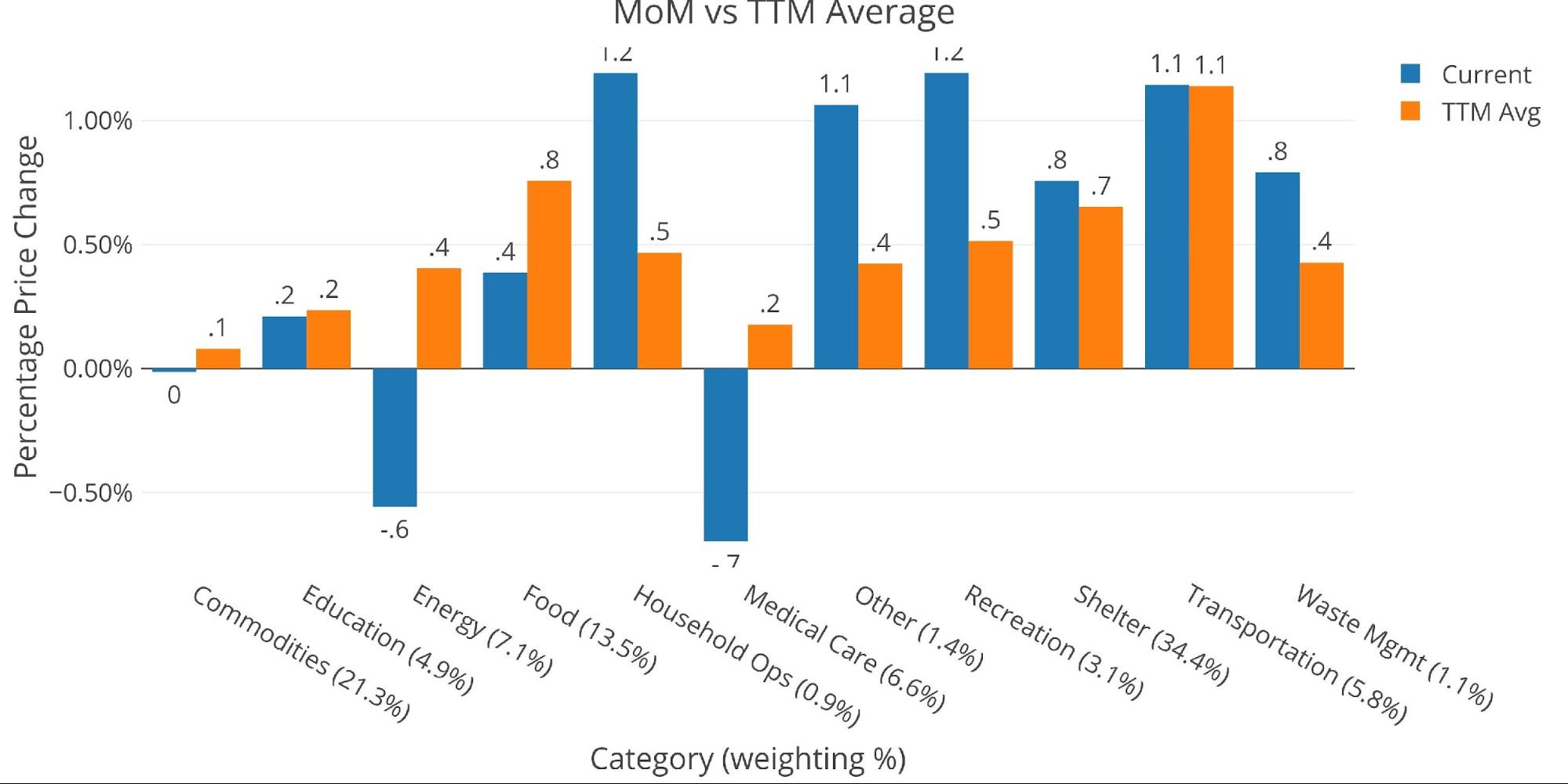

When looking at the 12-month trend, you can see that 6 of the 11 categories are still higher than the 12-month average. This does not suggest that inflation is subsiding. Four categories are more than double the 12-month trend (Waste Management, Recreation, Household Ops, and Other).

On the other side, it was good to see that Food was lower by half but is also still annualizing to almost a 5% increase.

Figure: 3 MoM vs TTM

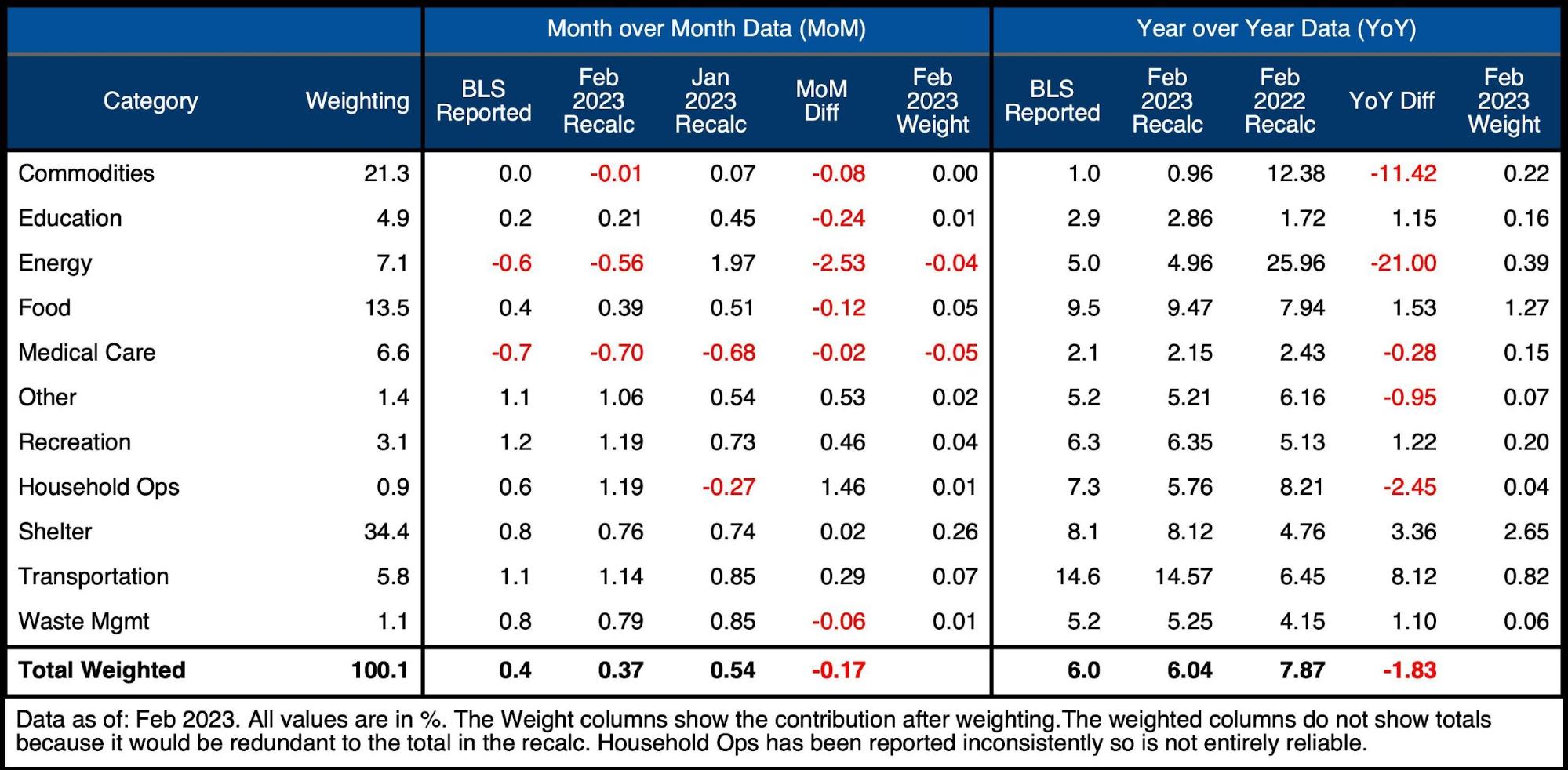

The table below gives a more detailed breakdown of the numbers. It shows the actual figures reported by the BLS side by side with the recalculated and unrounded numbers. The weighted column shows the contribution each value makes to the aggregated number. Details can be found on the BLS Website.

Some key takeaways:

-

- Shelter increased at an annual pace of 9.5%. This is finally above market rates, but well below the double-digit increases seen in the actual market for most of last year

- Food was driven lower by smaller increases at the Grocery Store 0.3%, even while Beverages (up 1%) and Food Away From Home (up 0.6%) remain elevated

- Energy came down entirely due to a big drop in Fuel Oil (-7.9%) as Gasoline was actually up 1% MoM

Figure: 4 Inflation Detail

Looking at the Fed Numbers

While the Fed does have different categories (e.g., Energy is in transportation), their aggregate numbers match to the BLS. Some categories are much larger in the recent month (i.e., Apparel, Other, and Recreation). The Fed actually showed Housing as below the 12-month trend.

Figure: 5 Current vs History

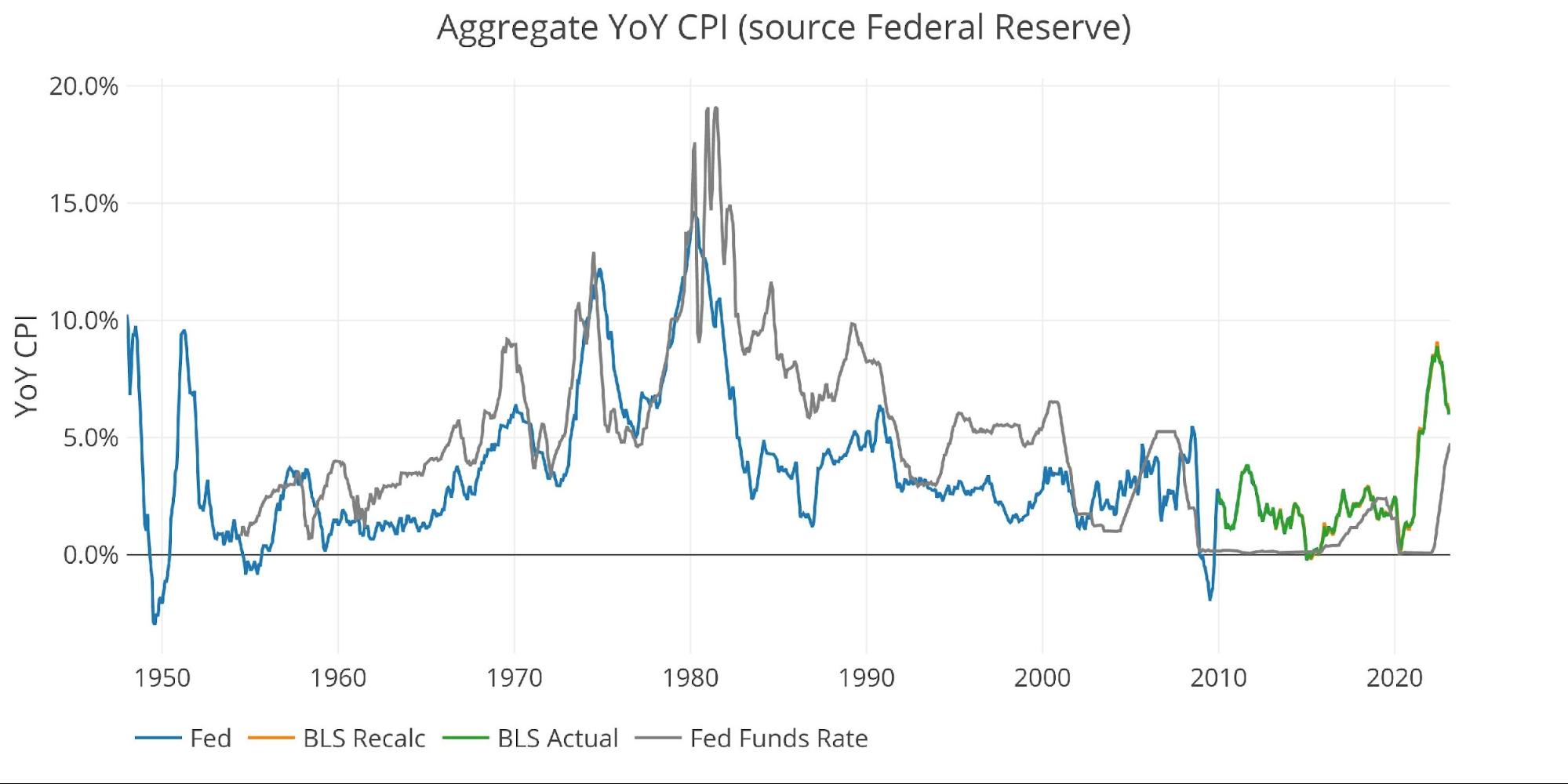

Fed Historical Perspective

Taking a longer look at the CPI produces the chart below. As can be seen, the mistake made by the Fed in the past has been to lower the Fed Funds rate (gray line) just as inflation started coming down. In the current period, the Fed has not yet gotten rates above the rate of inflation, something it has never really failed to do until now. Given the large CPI prints rolling off in the next few months, it’s likely to finally get there but it will have taken 3 years!

Figure: 6 Fed CPI

BLS Historical Perspective

The BLS weightings have only been scraped back to 2012, thus the chart below shows the past 10 years of annual inflation data, reported monthly. It cannot show the spikes of the 70’s and 80’s shown in the Fed data above.

As mentioned, big months will be coming off soon, but Shelter is still far too high to really get the CPI back down to anything remotely close to 2%. By itself, Shelter is contributing 2.65% of the 6% YoY figure.

Figure: 7 Historical CPI

Wrapping Up

Inflation is coming down some, but not fast enough. We have explained many times that raising rates will work up until the Fed actually breaks something. Well, it just did break something. The collapse of SVB has pushed the Fed to come back into the market with liquidity and balance sheet expansion. This was a move to shore up confidence in the banking system, but the Fed just showed that they are still the backstop to the entire financial system even if inflation is elevated. Can they tighten and loosen at the same time? That is a tricky game to play.

The Fed and Treasury averted a crisis over the weekend, but their resolve will be put to the test. As more things break, the Fed will have to throw more Band-Aids at the problem until they fold and finally start dropping rates. In fact, the market is already pricing in a higher probability of rates being lower by the end of this year. That means if the Fed raises rates next week to save face, they will likely be cutting them shortly after. Can confidence in the Fed continue with that type of whipsaw action?

The cracks are really starting to show. When the Fed comes in with a full rescue plan, expect to see the CPI start climbing again. This will be the end game for the Fed as they openly admit they are willing to let inflation run hot to save the financial system. This is when gold and silver start climbing at a very rapid clip.

Data Source: https://www.bls.gov/cpi/ and https://fred.stlouisfed.org/series/CPIAUCSL

Data Updated: Monthly within first 10 business days

Last Updated: Feb 2023

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link