GBP/USD Technical Analysis: Beginning the Selling Process

After several attempts to stand firm, the price of the GBP/USD currency pair fell to the support level 1.3485 at the time of writing the analysis. The move comes in light of news of expanding the scope of Russian military operations, ending the latest optimism. Yesterday, the GBP/USD settled around the 1.3620 level. At the time of this recovery, some analysts questioned the rally in light of the continuing risks associated with developments in Ukraine. Financial markets have come to grips with Russia’s official recognition of two separate Ukrainian provinces as independent republics and the potential effects of the international response.

But the GBP/USD pair rose strongly and was trying to regain the 1.36 resistance and some analysts were saying that there is likely to be little, if any, room to rise further in the short term. In this regard, analyst George Vessey of Western Union Business Solutions says: “The pound has regained a price of 1.36 against the US dollar and 1.20 against the euro,” and both levels of resistance have proven difficult to maintain in recent times.

“With GBP/USD now closing in New York between 1.3550-70 support and 1.3590-1.3610 resistance, we believe the market will adopt a more neutral tone,” said Eric Bregar, author of the FX Beat newsletter.

Overall, Moscow’s official recognition of the breakaway provinces and authorization of military deployments within its borders has alarmed markets and imposed a series of sanctions from the United Kingdom, members of the European Union and the United States. The British pound and other major reserve currencies were sold off during most of the previous session as international markets stabilized following losses incurred after Monday evening announcements from Moscow.

Western sanctions, with the surprising exception of Germany temporarily shutting down NordStream 2, were Milquetoast stuff. They will see the Russian oligarchs move the yachts, the money, but they won’t stop the Russian war machine from rolling in. They don’t hit SWIFT, major Russian banks, energy, grain, fertilizer, or metals — like most Russian exports. The European Union countries were harsh in the wake of London’s announcement of the response to the sanctions while Washington followed suit overnight, although the measures announced by each country so far are on the moderate side of what can be seen so far.

And there was no shortage of potential excuses for a hostile attitude toward Ukraine in President Vladimir Putin’s speech on Monday, which included a claim that the country could consider nuclear rearmament.

On the economic side, British inflation rose from 5.4% to 5.5% in January, and although this was the smallest increase since April 2021, the ongoing developments in Ukraine have raised global energy prices and could add to price pressures in the coming weeks and months. Much of the GBP-USD rate depends on any comments from BoE policy makers on how the additional energy price shock is likely to affect the BoE’s stance on monetary policy. The British Pound will be more responsive to any indications as to whether such developments will strengthen or undermine the case for higher interest rates given the risks they could pose to the economy.

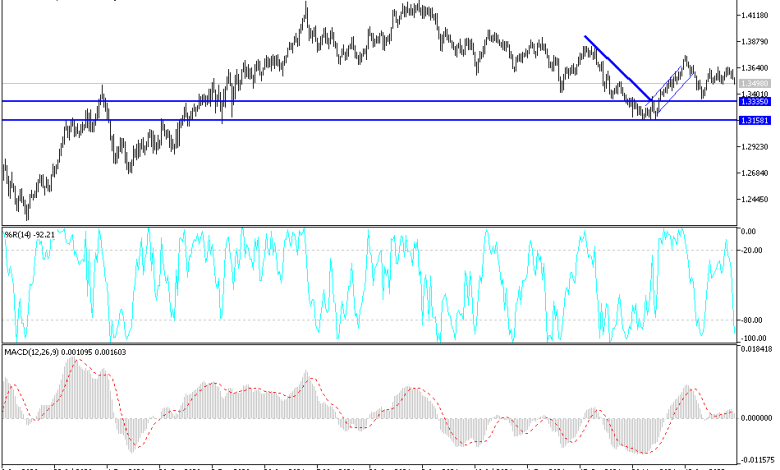

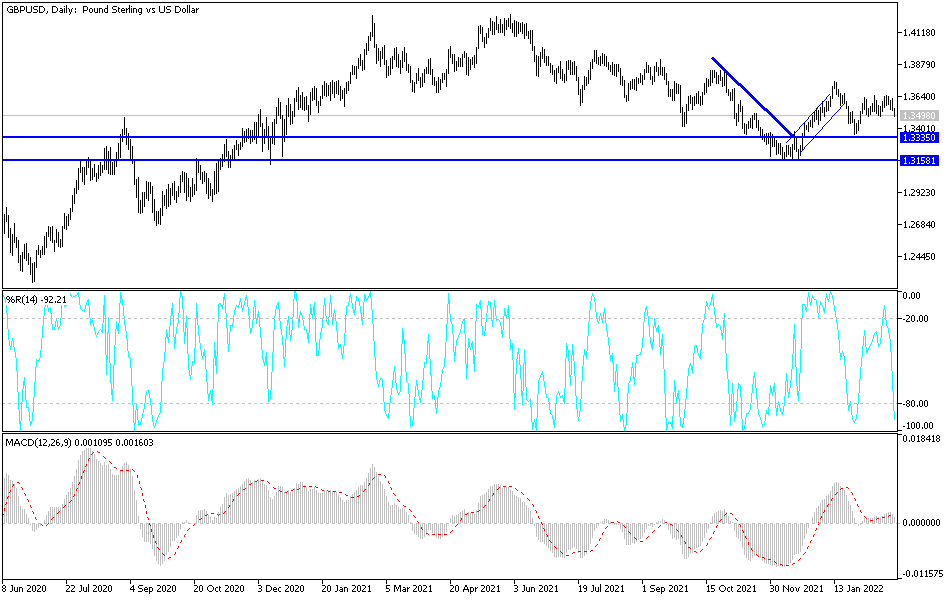

According to the technical analysis of the pair: On the daily chart, the decline in the price of the GBP/USD pair will be below the 1.3480 support, stimulating the bears to move strongly downwards. The pair may abandon the bullish outlook if it moves towards the 1.3420 and 1.3300 support levels, respectively. On the other hand, and over the same time period, the breach of the resistance 1.3660 will be important to move to the upside. Risk aversion will continue to motivate the bears.

The currency pair will be affected today by European developments along with the reaction from the release of US economic data, GDP growth rate, weekly jobless claims and US new home sales.

Source link