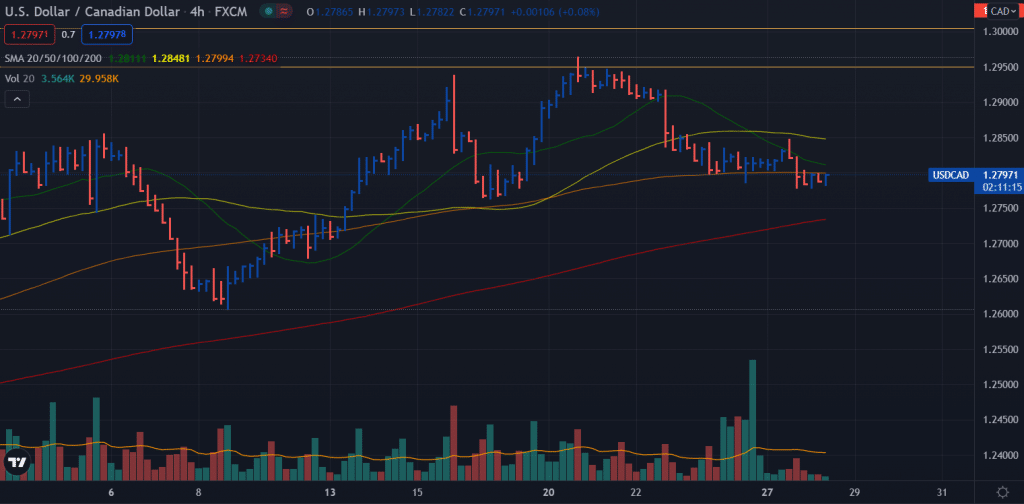

USD/CAD Price Struggling Below 1.28, Remains Flat as Year Ends

- The USD/CAD struggled to recover from more than a week’s lows.

- Despite sluggish dollar price movements, higher oil prices supported the Canadian dollar.

- The break below the bullish channel’s support will result in further short-term losses.

The USD/CAD price lost modest intraday gains, the last trading around 1.2785 neutral before the European session.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

The USD/CAD pair gained positive momentum early in Tuesday trading after reversing sharply from the 1.2845-50 area the previous day. Despite bouncing back from a week and a half low, the price ended at around 1.2800.

As the Omicron variant of the Coronavirus is expected to have a limited impact on fuel demand, WTI crude prices held steady near a one-month high of just under $76 per barrel. Since the US dollar’s price movements have been sluggish, the commodity-pegged Canadian dollar has been supported, limiting USD/CAD gains.

According to reports, the new exposure may be less severe than the previous Delta variant, sustaining the prevailing risk environment. Additionally, Omicron infections are less likely to result in hospital admissions, further boosting investor confidence and impacting the safe dollar.

Further, the softer tone in US Treasury bond yields pushed the dollar bulls into a defensive position and acted as headwinds for the USD/CAD pair. Although the Fed’s forecast of at least three rate hikes over the next year is restrictive, it should help contain the dollar’s decline and provide some support for the dollar/Canadian dollar pair.

Traders can also be discouraged from taking aggressive directional bets when poor year-end liquidity. Likewise, the USD/CAD pair has so far managed to hold the support marked by the lower bound of the two-month-old uptrend channel, which is now an important turning point.

Caution is also warranted following the Canadian banking weekend and the relatively weak US economy, including the Richmond Manufacturing Index. In any event, broader risk sentiment will add some momentum to the USD/CAD pair. Going forward, traders will consider oil price dynamics to take advantage of some short-term opportunities.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

USD/CAD price technical analysis: Weak below 1.2800

The USD/CAD price is consolidating losses below 1.2800 mark. The pair is moving in a tight range with volume below average. It looks like the pair lacks directional bias and may not provide any trading opportunity for now.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link