Euro Spikes After Christine Largarde

The market has been negative for so long that is going to be difficult to simply break out.

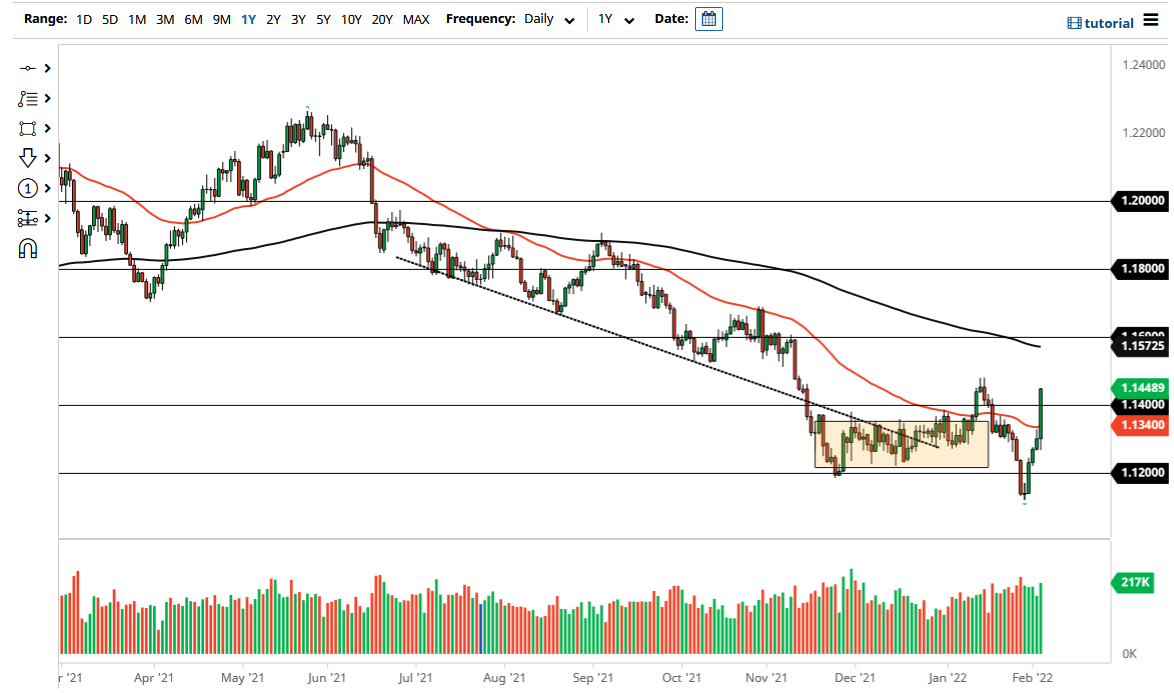

The Euro has broken higher during the course of the trading session on Thursday to break above the 50 day EMA. That being said, the market is looking very bullish overall, as we have also broken above the 1.14 handle. By breaking above the 1.14 handle, we are threatening the recent spike near the 1.1475 handle. With Christine Largarde sounding a little bit more hawkish during the central bank meeting on Thursday, and therefore it suggests that the Euro could go higher. That being said, the market has broken to the upside quite violently, so if you do want to buy the Euro, you may look for some type of pullback.

Looking at the size of this candlestick, it certainly suggests that we should go higher. However, you also have to worry about a significantly overbought condition, and with the jobs number coming out on Friday, the very likely that we will get some volatility. In fact, that might provide an opportunity to get long of the Euro on a significant pullback. Whether or not we get that is probably going to be a different question, but we have a situation where the Euro is trying to change things.

On the other hand, if we were to close below the 50 day EMA on Friday, then it would be a very negative turn of events, and probably continue the overall long-term downtrend. That being said, the market has been negative for so long that is going to be difficult to simply break out. If we are trying to change the trend, it makes a certain amount of sense that this market could be very noisy. Trend changes are almost always a choppy situation, and therefore you need to be very patient. Furthermore, you need to keep your position size reasonable, as the volatility can cause a lot of problems and could cause a lot of losses if you are cautious. However, we make a “higher high”, then we can start to add to a longer-term position because the trend change could be a longer-term situation. That being said, keep in mind that there is the risk appetite aspects of the currency pair as well, as the US dollar is considered to be a safety currency. In other words, if we get a sudden shift in the attitude, that could cause some problems.

Source link