Is 4% the “Magic Number” for Mortgage Rates to Prick the Housing Market (and Stocks)?

The Magic Number in 2018 was around 4.8%. In 2006, it was around 6%. But with today’s super-inflated home prices? Here are the signs.

By Wolf Richter for WOLF STREET.

The average weekly contract interest rate for 30-year fixed-rate mortgages with conforming loan balances rose to 4.06 percent for the week ended February 18, the second week in a row above 4%, and the highest since July 2019, according to the Mortgage Bankers Association today. The average rate for FHA-backed 30-year fixed-rate mortgages increased to 4.09%.

So where is the magic number beyond which this super-inflated housing market starts to feel the pressure of higher mortgage rates?

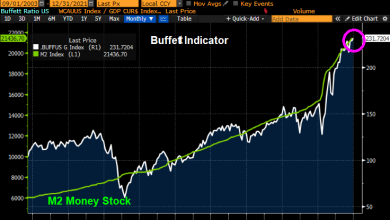

But mortgage rates remain ridiculously low, in face of CPI inflation that has shot to 7.5% and is still being fueled by the Fed’s ongoing interest rate repression and QE – which makes this the most reckless Fed ever.

The “Magic Number” in 2018.

In the fall of 2018, as mortgage rates headed toward 5%, the housing market was beginning to wheeze, and stocks were spiraling down. The magic number at the time appears to have been about 4.8%, and when mortgage rates moved above it in September, all heck started breaking loose.

After the S&P 500 had dropped about 20% by December 24, 2018, and with the housing market weakening, Fed Chair Powell caved under Trump’s daily hammering and did the now infamous U-Turn.

However, back then in early 2019, inflation was below the Fed’s target, as measured by its yard stick “core PCE,” at 1.6%, and that provided Powell a fig leaf.

Now inflation is the worst in 40 years and spiraling higher, and “core PCE” inflation is 2.5 times the Fed’s target. It’s now inflation that is hammering Powell on a daily basis – him who’d made a fool of himself calling this monster he’d unleashed “temporary” when everyone already knew that it would spiral higher.

So where is the magic number this time beyond which the housing market starts to feel the pressure?

Mortgage applications to purchase a home have dropped sharply for three weeks in a row, coinciding with the surge in mortgage rates, and in the week ended February 18 reached lows briefly kissed in August 2021, and then during the lockdown, to enter the lower part of the range in 2019. The MBA’s index for purchase mortgage applications has now dropped by 28% from the January 2021 pandemic highs (data via Investing.com):

The “Magic Number” in 2006.

Not shown in the chart: Back during the peak of Housing Bubble 1, in January 2005, the MBA’s Purchase Mortgage Index had maxed out at 500 – twice today’s level – before it collapsed.

At that time, the Fed was in the middle of its rate-hike cycle, taking the federal funds rate from 1.0% in June 2004 to ultimately 5.25% by July 2006, which pushed the average 30-year fixed mortgage rate to 6.4%, at which time the housing market ever so slowly began to collapse.

The Nasdaq started heading lower in the summer of 2007, and little by little all heck broke loose in a global manner, punctuated by the collapse of Lehman in September 2008.

Higher mortgage rates, when home prices are already sky-high, are very tough on housing markets. And higher interest rates in general are tough on stocks.

So where was the magic number back then? Obviously 6.4% for the 30-year fixed mortgage rate, at those Housing Bubble 1 prices, was beyond the magic number.

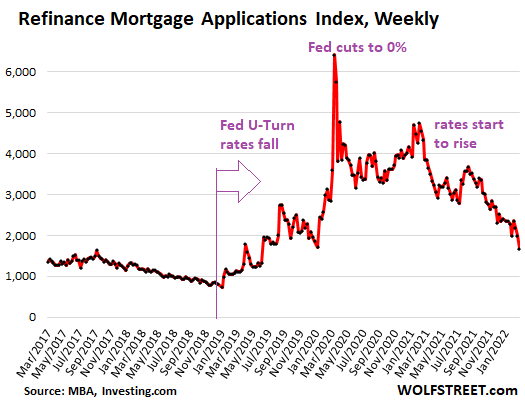

Refi mortgage applications plunge.

Rising mortgage rates means that households are putting refinancing their mortgages on the back burner. This happens despite the historic explosion of home prices that brings with it a lot of home equity that could be drawn out via cash-out refis.

The MBA’s Refinance Mortgage Applications Index has now plunged to the lowest level since June 2019 and is down by 74% from the pandemic highs – and mortgage rates have just started rising and are still ridiculously low, given that CPI inflation has surged to 7.5% (data via Investing.com):

The Magic Number now.

First-time home buyers, facing these higher mortgage rates and sky-high prices, have already pulled back from this ridiculous Fed-inflated market, as investors and cash buyers have piled into the market.

In January, first-time buyers dropped to just 27% of total home purchases, down from 30% in December, and down from 34% in all of 2021, according the National Association of Realtors.

Going forward, “some moderate-income buyers who barely qualified for a mortgage when interest rates were lower will now be unable to afford a mortgage,” the NAR said.

With each increase in home prices, and with each increase in mortgage rates, more layers of potential buyers get wiped off the table. At first no one notices, but then the layers are starting to accumulate, and at some point, the regular buyers – such as first-time buyers – are starting to thin out. And that’s what we’re now seeing.

At first, cash buyers and investors may be able to make up the difference. And that’s what happened during Housing Bubble 1, which was in part driven by investors, who then become the core of the mortgage crisis when they walked away from multiple properties at once.

Individual investors or second-home buyers piled into the market, accounting for 22% of home purchases in January, up from 17% in December and up from 15% in January last year, according to the NAR.

All-cash purchases jumped to 27% of home purchases in January, up from 23% in December and up from 19% in January 2021, according to the NAR.

But in January, mortgage rates were still in the 3.5% to 3.7% range, well below the 4% line. And already, visible layers of first-time buyers started to get pushed out of the market that has been artificially inflated by the Fed’s reckless monetary policies, and that now faces rising but still artificially low mortgage rates.

So it looks like the Magic Number now for the average 30-year fixed mortgage rate is a little north of 4%, a level when the layers of potential buyers, such as first time buyers, are disappearing from the market. This is already happening.

For now, as last time, over-enthusiastic investors are making up the difference, but if we’ve learned anything from the debacle 15 years ago, it’s that this investor enthusiasm too will fade in these ridiculously over-inflated markets when interest rates rise in face of spiking home prices as in the Most Splendid Housing Bubbles In America:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Source link