Right, Said Fed – Deflation Ahead

The Fed knows it must deflate but seems reluctant to do so.

This week’s press conference by Federal Reserve Chairman, Jerome Powell, proved to be quite interesting. The main topic was, of course, the fact that consumer price inflation is running at annualized clip of around 7% in the U.S. (it is rampant in Europe too) and yet the Fed is still printing money via its asset purchase program. The Fed is “tapering” this money printing (slowing it down) but it is still minting new digital Fed tokens in order to purchase Treasury bonds, corporate debt and mortgage-backed securities. Check out this chart of the Monetary Base in the U.S. to see just how historic this money printing is. In the 13 years since 2008, it has inflated by 760%. That level of inflation had previously taken 33 years, between 1975 and 2008.

Powell made a point of stressing time and again that the Fed sees its main tool as the Federal Funds interest rate, which the market has already priced to increase by almost 1.25% this year. The Fed’s balance sheet, which has inflated enormously as a result of it underwriting the bond markets, seems to be relegated in importance, with the Fed setting out “principles” which it intends to follow before embarking on deflating its assets. For the cynics among us (what? moi?) these are blatant delaying tactics.

Some commentators are suggesting that the Fed doesn’t care about the stock market right now and so won’t be concerned if the market continues to decline. This is nonsense. This Fed, as it has been since Alan “The Maestro” Greenspan’s day, wants to be friends with the financial community, politicians, and the country at large, and will try with all its might to prevent a bear market in stocks. Powell might talk tough, but he ain’t no cigar-chomping Volcker.

The Fed is scared of deflating its balance sheet because it knows that this flood of printed money has been a pillar on which the stock market stands. There’s not a direct causal link. A bull market in stocks is driven by a positive social mood and a bear market by a negative mood. Nevertheless, the more money and liquidity there is in the system, the easier it is for a positive social mood to propel the stock market higher.

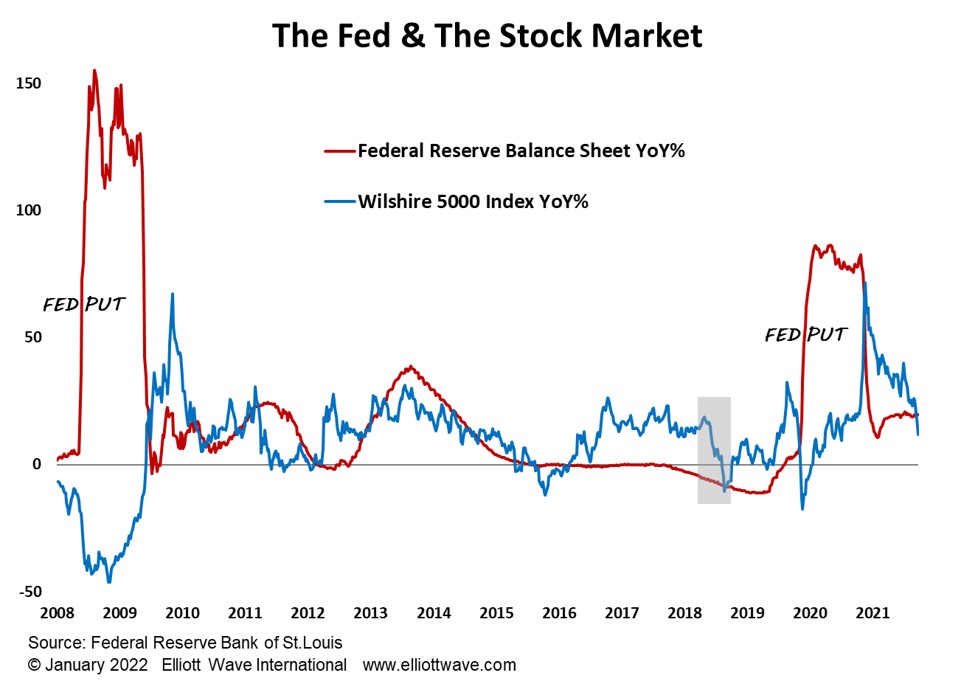

The chart below shows the annualized rate-of-change in both the Fed’s balance sheet and the U.S. stock market. The “Fed put,” when it (apparently) comes to the rescue of the stock market by an explosion of money printing, is clearly seen in 2008 and 2020. As the rate of growth in the creation of new Fed tokens was decelerating (disinflation) from the end of 2013 to 2016, the positive rate-of-change in the stock market was also decelerating. A similar dynamic exists from March of 2021.

What the Fed is afraid of is a repeat of 2018, when its balance sheet was actually contracting (deflation) and the stock market declined, with the Wilshire 5000 falling by 20% from a September high into December.

The Fed is very wary of shrinking its ill-gotten assets this time around.

Source link