Euro Downward Pressure to Continue

There is a likelihood that it will continue falling as bears target the next key support level at 1.0900.

Bearish View

- Sell the EUR/USD pair and set a take-profit at 1.0900.

- Add a stop-loss at 1.1120.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.1070 and add a take-profit at 1.1150.

- Add a stop-loss at 1.100.

The EUR/USD pair remained in a tight range in the overnight session even as Jerome Powell reiterated his hawkish stance. It is trading at 1.0987, where it has been in the past few days. It is about 1%% below the highest point last week.

Ukraine Crisis in Focus

The EUR/USD pair was unchanged as investors continued focusing on the ongoing crisis in Ukraine. After signs of progress emerged last week, the situation has dramatically changed in the past few days. Russia has continued to bombard major cities like Kyiv and Mariupol.

In a statement, Russia said that it will continue its “special military operation” even as reports said that over 10 million people have been displaced in the past few weeks. Therefore, it is unlikely that we will see an end to this crisis any time soon.

This trend could lead to more demand for the US dollar as investors move to its safety. Indeed, data published by the CFTC last week showed that positioning by large hedge funds and other speculators had shifted to the US dollar.

There will be no major economic data from the United States and the European Union today. Instead, investors will focus on speeches by ECB Chair Christine Lagarde and Vice-Chair Luis De Guindos. Their statements will also have minimal impact on the EUR/USD since they made their decision almost two weeks ago.

In a statement on Sunday, Guindos reiterated that inflation continues to pose substantial risks to the European economy. He also warned that the situation will continue because of the crisis in Ukraine.

Therefore, with the Fed and Bank of England raising rates, analysts expect that the ECB will not be left behind for too long.

EUR/USD Forecast

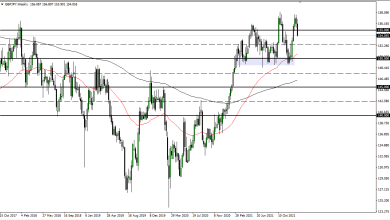

The four-hour chart shows that the EUR/USD pair has been under pressure in the past few days. It has moved slightly below the middle line of the Bollinger Bands. Further, the pair has managed to move below the 23.6% Fibonacci retracement level while the MACD indicator has made a bearish crossover.

The pair also seems like it has formed a double-top pattern and has moved below the ascending trendline. Therefore, there is a likelihood that it will continue falling as bears target the next key support level at 1.0900. On the flip side, a move above the key resistance level at 1.1100 will invalidate this view.

Source link