Jackson Hole looms | SchiffGold

Gold and silver rallied from the lows of last week in quiet Comex trade for gold, but more active trade in silver. In Europe this morning, gold was at $1916, up $27 from last Friday’s close, and silver was up $1.30 at $24.14.

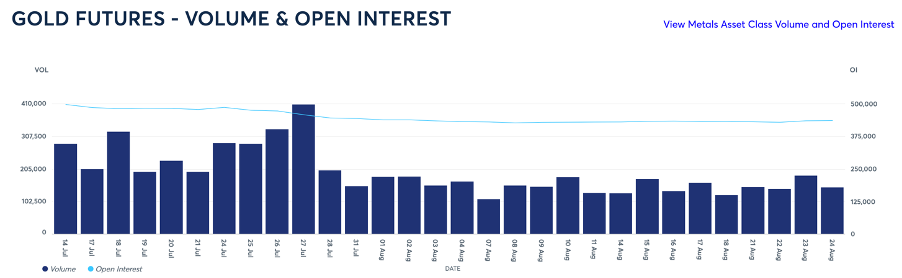

Gold has been remarkably quiet in all August, as the snapshot from the Comex web page below indicates.

It would appear that this low turnover is connected with the holiday season. And attempts by the shorts to drive the gold price even lower than last week’s lows have not transpired. The last day’s trading for September’s options is Monday. But open call interest below $1930, where there are 2,298 calls outstanding is not material (other than one large call position of 5,059 contracts at $1850).

We cannot rule out a bear raid later today after New York opens, perhaps even driving the price below $1850 to take out those call contracts. Perhaps the trigger will be Jay Powell’s speech at Jackson Hole if he is hawkish. There’s no doubt that ahead of this event, dollar and bond bears have been closing their short positions, as the next two charts indicate.

The yield on the 10-year US Treasury peaked on Monday at 4.365%, falling to under 4.2% yesterday (Thursday) before rallying slightly this morning. And the dollar’s trade-weighted index continued its recent rally, rising over 1% this week.

The closing of these bear positions indicates that after Jackson Hole the downtrends for both the dollar and US T-bond prices are likely to resume, assuming Powell says nothing out of the ordinary. But if his speech is read to be dovish, it should be very good for gold. And if it is hawkish, that markdown to make as many call options as possible worthless on Monday becomes likely.

This was also the week of the BRICS summit, when it was announced that in January it will be expanded to include Saudi Arabia, Iran, the UAE, Egypt, Ethiopia, and Argentina. Apart from a brief comment by President Lula about a new trade settlement currency, nothing else on the topic materialised. This is despite the clear steer towards a gold backed trade settlement currency from Russia. So, what drove it off the agenda?

One suspects it was China, which is suffering from a property and combined wealth management products crisis, combined with a downtrend in China’s exports. With these uncertainties, China would want to see trade settlement demand for the yuan to be sustained to counter capital outflows. Furthermore, China’s instinct is to see policy evolution, not revolution which is more in Russia’s psyche.

So, the world of fiat has been given a hospital pass. Meanwhile, silver has been in the throes of a bear squeeze, rising nearly $2 from its low point ten days ago. Incidentally, an observant reader of my market reports pointed out an error in last week’s chart of the net longs in Comex’s silver Non-Reported category. The error illustrates the hazards of excel spreadsheets. The corrected chart is below.

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link