Russia-Ukraine war puts Fed further behind inflation curve, former insider warns

Former Kansas City Federal Reserve President Thomas Hoenig argues that the war between Russia and Ukraine ‘does complicate the Fed’s life even more.’

Former Kansas City Federal Reserve President Thomas Hoenig warned on Monday that the world is in an “economic war” amid the conflict between Russia and Ukraine and that the United States and the West face “major challenges.”

Hoenig argued that higher prices for basic resources, including metals and food, should be expected and warned that “rough months” are ahead.

He also said that the war presents further challenges for the Federal Reserve, which he argued is “so far behind the curve” of inflation.

Hoenig stressed that the war between Russia and Ukraine “does complicate the Fed’s life even more.”

GAS PRICES ABOVE $4 PER GALLON AS RUSSIA-UKRAINE WAR IMPACTS SUPPLY, DISRUPTING GLOBAL MARKET

He provided the analysis on “Mornings with Maria” on Monday, three days before the Labor Department releases its latest inflation report for February.

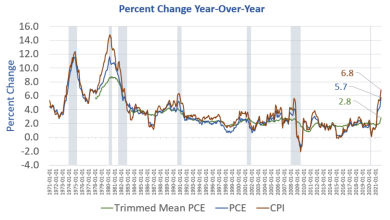

Last month it was revealed that inflation surged more than expected in January, notching another four-decade high.

The consumer price index rose 7.5% in January from a year ago, according to a Labor Department report released last month, marking the fastest increase since February 1982, when inflation hit 7.6%. The CPI – which measures a bevy of goods ranging from gasoline and health care to groceries and rents – jumped 0.6% in the one-month period from December.

Price increases were widespread: Although energy prices rose just 0.9% in January from the previous month, they’re still up 27% from last year. Gasoline, on average, costs 40% more than it did last year. Food prices have also climbed 7% higher over the year.

George Cipolloni, portfolio manager at Penn Mutual Asset Management, discusses what he believes the Fed will do this year to try and curb inflation.

On Wednesday, Federal Reserve Chairman Jerome Powell told Congress that he plans on proposing a 25 basis point interest rate hike at the central bank’s upcoming March meeting, as the U.S. economy battles soaring inflation.

“With inflation well above 2% and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month,” Powell testified before the House Financial Services Committee, saying that he is “inclined to propose and support a 25 basis point rate hike” at the Fed’s March 15-16 gathering.

Powell added that the central bank is “prepared to move more aggressively by raising the federal funds rate by more than 25 basis points” at future meetings.

Federal Reserve officials have signaled for months that interest rate increases were coming, and Powell said last week that before Russia invaded Ukraine he would have expected a series of increases in the near future but that the war could now have an impact on the central bank’s actions.

WHEAT, CORN PRICES SURGE AS RUSSIA INVADES UKRAINE

“The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain,” Powell said in his prepared remarks. “Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook.”

Senate holds hearing on Monetary Policy Report with Fed Chair Powell

On Monday, host Maria Bartiromo asked Hoenig what he expects from the Fed in the coming months and how soon he believes it would take before the central bank could reach a 1% increase in terms of rate hikes.

“I think the Fed will attempt to get close to 1% because even with all this going on, they know how far behind they are on the curve of inflation,” Hoenig argued. “They have to move this stuff up.”

He added that if the Fed sees “the unemployment rate start to rise in May or June, I think they will slow that down even more and that’s what gives me some pause, but it’s something they have to deal with, something they brought on themselves because they are so far behind the curve.”

“That’s the challenge they’ve got to weave themselves through,” he continued.

He provided the insight referring to the Fed’s dual mandate of maximum employment and price stability, identified as the central bank’s inflation goal of 2%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND L.P. | 81.33 | +1.90 | +2.39% |

| BNO | UNITED STS BRENT OIL FD LP UNIT | 34.02 | +1.24 | +3.78% |

Hoenig warned on Monday that the war overseas further accelerates global economic challenges and presents “an enormous supply shock as you’re witnessing today with oil.”

He went on to warn that “other commodities are also under pressure right now in terms of higher prices.”

Former Kansas City Federal Reserve President Thomas Hoenig warns the U.S. and the West face ‘major challenges’ ahead and argues that higher prices for basic resources, including metals and food, should be expected.

“So that does complicate the Fed’s challenge, but I think, at this point, they know they’re far enough behind and the U.S. economy by now, with its very low unemployment rate of 3.8%, will continue to move its rate up at this next meeting as Chairman Powell has indicated and I think they will continue that,” Hoenig said.

He went on to say that he believes the Fed will pay close attention to the unemployment rate in the months ahead.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“If we go down this path and this economic war continues and unemployment starts to rise, then I think the Fed will hesitate [to continue to raise rates],” the former Fed president argued. “That’s been their pattern in the past for some time now and I think that will be a major challenge for them to try and balance the need to get this inflation, which is almost four times higher than their target, under control while not also seeing the economy suffer large increases in unemployment.”

He stressed that the Fed “will be very sensitive to unemployment in my opinion.”

Prochain Capital President David Tawil discusses how high oil prices impacts the economy and weighs in on the cryptocurrency market.

Hoenig, a senior fellow at the Mercatus Center at George Mason University, also told Bartiromo on Monday that he believes that “even with the economic war underway, I think we’re months away from a recession” in the U.S. “based on the momentum that we currently have.”

He added that the potential for a U.S. recession “will depend on some of the decisions that the administration and the Fed make.”

“For example, if the administration were to drop some of the restrictions on energy discovery and supply means, then you could mitigate some of the effects of this supply shock,” Hoenig said, acknowledging that “that will take a little bit of time.”

“The sooner they act in addressing the supply shocks, where they [the administration] can, the less likelihood there will be a major recession,” he continued, acknowledging that the risk is always there “given the extent of this global economic conflict.”

He then stressed that the Biden administration and the Fed “have some major challenges” ahead.

CLICK HERE TO READ MORE ON FOX BUSINESS

FOX Business’ Megan Henney and Breck Dumas contributed to this report.

Source link