Air Continues to Seep Out of the Housing Bubble

Air continues to seep out of the housing bubble blown up with the Fed’s artificially low interest rates in the wake of the pandemic.

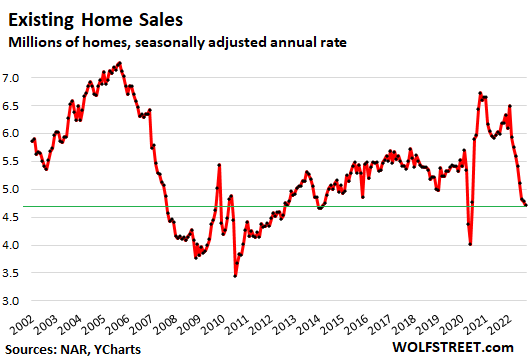

Sales of previously owned homes fell by 1.5% in September, according to a National Association of Realtors report. It was the eighth straight month of declining home sales.

Compared to the peak in October 2020, existing home sales are down 20%.

As you can see from the chart, the trend is beginning to look a lot like the plunge in sales we saw leading up to the financial crisis in 2008.

Compared to a year ago, the seasonally adjusted rate of sales dropped 23.8%. That was the 14th straight month of year-on-year declines.

On a year-over-year basis (yoy), sales plunged in all regions. On a month-over-month (mom) basis, only the West showed no declines in sales from the desperately low levels in August:

- Northeast: -1.6% mom; -18.7% yoy.

- Midwest: -1.7% mom; -19.7% yoy.

- South: -1.9% mom; -23.8% yoy.

- West: 0% mom; -31.3% yoy.

We’re also beginning to see a drop in home prices. The median price of home sales dropped for the third straight month in September. Sale prices are now down about 7% since the peak.

In terms of seasonality, the 7% decline was the largest for this period since the end of Housing Bust 1, and more than double the 3.2% decline during this period in 2021.

Nevertheless, prices still remain elevated. As WolfStreet pointed out, the housing market is basically at a standstill.

Potential buyers refused to even look at prices that sellers want. Sellers refused to cut their aspirational prices to where the buyers might be – though there is a lot more price cutting going now than a year ago. And other potential sellers waited for a Fed pivot that would lead to lower mortgage rates and higher prices before they put their homes on the market.”

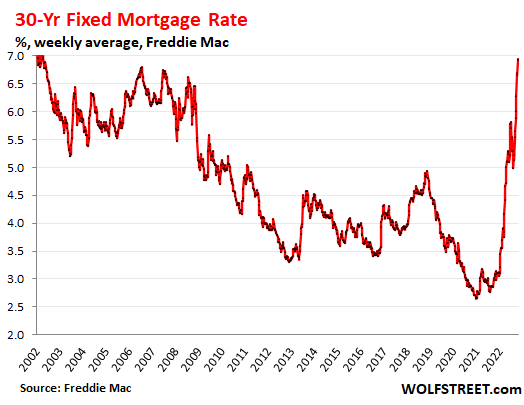

Price reductions have jumped from historic lows, a sign that expectations in the housing market are starting to come back to reality. During the boom, sellers were often getting multiple offers above the asking price on the first day of a listing. Those days are gone. Mortgage rates are pricing many people out of the market.

Mortgage rates continue to spike with the 30-year mortgage now hovering around 7%.

The last time we saw mortgage rates over 6% was right before the housing bubble popped leading to the 2008 financial crisis. Until mid-April, mortgage rates were in the 4% to 5% range.

With home prices no longer rising seemingly without limits, investors appear to be leaving the market. Investors and second-home buyers bought 15% of the homes in September, according to the National Association of Realtors. That was down from 16% in August, and from the 17%-22% range in the spring and winter.

As Reuters has noted, the housing market is “the sector most sensitive to interest rates,” and it’s losing speed.

This is just one of the many economic distortions caused by the government and the Federal Reserve’s response to the COVID-19 pandemic.

The Fed blew up a housing bubble when it artificially suppressed interest rates and bought billions of dollars in mortgage-backed securities. Now the central bank has pricked the bubble by pushing rates up.

What the Fed giveth, the Fed taketh away.

Mortgage rates began to fall in late 2018 as the economy tanked and the Federal Reserve ended its post-2008 rate hike cycle. Rates continued to fall as the Fed pivoted back to quantitative easing and then dropped through the floor with the rate cuts and QE infinity in response to the coronavirus. The big spike in mortgage rates we’re seeing today started as the Fed began talking up monetary tightening to tackle raging inflation.

We expect the housing bubble to continue to deflate as we move into 2023. Just how fast the air comes out and the impact on the broader economy remains to be seen.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link