Bulls Aiming for 0.74 Despite Risk Aversion, Firm USD

- With the AUD/USD pair retreating from its 2022 high, it ended a two-day winning streak.

- Radiation levels increased after Russian troops attacked Ukraine’s nuclear power plant, reviving fears of Chernobyl.

- No major events are scheduled ahead of the US NFP, but risk catalysts will provide fresh impetus.

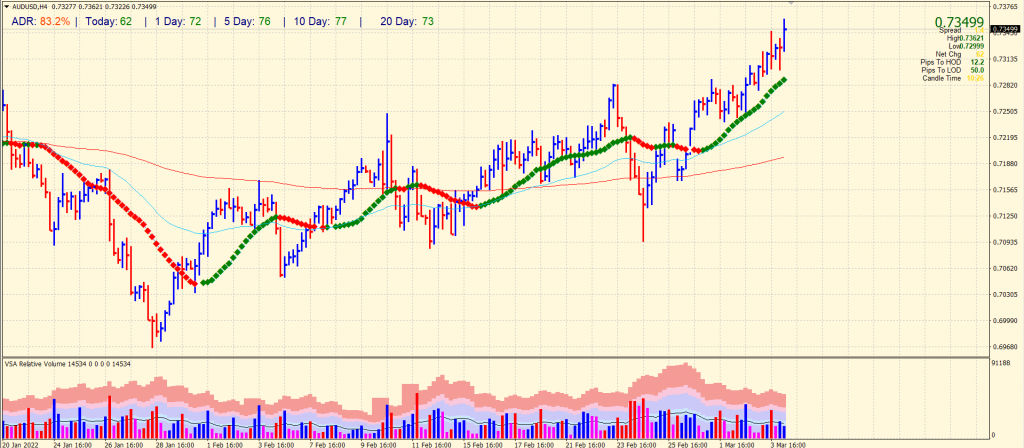

The AUD/USD price outlook is still positive as the pair leads among the major currency pairs amid a rise in commodity prices. However, risk aversion is back in full force, supporting the AUD/USD sellers early on Friday. Meanwhile, the Australian pair is playing around mid-0.7300 with a daily gain of 0.33% after updating the daily low at 0.7299. Today, the risk barometer pair reached a new yearly high of 0.7362.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

The shelling of Europe’s largest nuclear reactor by Russia has sparked a fresh wave of risk aversion as it confirms market doubts over Russia-Ukraine peace talks, which concluded in Kyiv the day before on safe passage for civilians. Senator Marco Rubio reported an anonymous second Ukrainian diplomat trying to calm the concerns after a Ukrainian power plant was attacked. There were concerns about higher radiation levels and renewed concerns about Chernobyl.

The senator tweeted: “A second Ukrainian official just confirmed that the plant is not running on fuel, but the administration building is on fire.” “He has no information about increased radiation, says a meltdown is unlikely, but a leak is possible,” he added.

Concerns over a 50-basis Fed rate hike in March have weighed on riskier assets such as AUD/USD. During the second round of testimony the day before, Chair Powell reiterated his support for a rate hike of 0.25%, effectively indicating readiness for a 0.50% rate increase at the March meeting. FedWatch, the CME’s rate hike forecasting tool, predicts an 89% chance of a similar hike at the next Fed meeting. Powell’s comments have encouraged investors to anticipate a similar hike next month.

On Thursday, the latest US ISM Services PMI fell for the third straight month, but the data on second-tier employment and factory orders showed signs of improvement. As for domestically, Australia’s trade balance was positive, but building permits fell sharply in January.

The S&P 500 futures are down about 1.0% on the day, while the US 10-year Treasury yield is down almost six points to 1.78% at press time, which is in line with the sentiment.

The US February jobs report and developments in Ukraine and Russia will be important for the AUD/USD.

AUD/USD price technical outlook: Bulls eying 0.7400

The AUD/USD price remains strong near the yearly highs. Despite posting the buying climax pattern, the pair gives no respite to the sellers. Staying above the mid-0.7300 area may add more fuel to the bulls. We can expect the price to test the 0.7400 handle if the momentum persists.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

Alternatively, profit taking or trend reversal may trigger sell-off. The immediate support for the pair lies at 0.7300 ahead of 0.7250 and then 0.7200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source link