BTC/USD Forex Signal: Bitcoin Stabilizes, Downward Pressure

There is a likelihood that the pair will resume the bearish trend today as bears target the next key support level at 40,000.

Bearish View

- Sell the BTC/USD pair and set a take-profit at 40,000.

- Add a stop-loss at 44,000.

- Timeline: 1-2 days.

Bullish View

- Buy the BTC/USD and set a take-profit at 44,000.

- Add a stop-loss at 40,000.

The BTC/USD stabilized during the weekend as concerns about a Russian invasion of Ukraine eased. The pair is trading at 42,352, which is about 7.53% below last week’s high. Other cryptocurrency prices also held steady, with the total market cap of all cryptocurrencies being at about $2 trillion.

Bitcoin Stabilizes

Bitcoin joined other assets like stocks in falling sharply on Friday as investors continued worrying about the ongoing tensions on Ukraine. In a statement, the US government announced that Russia had managed to mobilize the necessary troops needed to invade Ukraine.

The country has placed thousands of troops near its Ukrainian border. It has also allocated other troops in Belarus and the Baltic sea. The main concerns are that Russia fears that Ukraine will become a member of NATO, which it sees as a major threat.

However, there was no invasion during the weekend, which explains why the prices of Bitcoin and stocks have made some improvements. On Friday, the BTC sell-off coincided with the sell-off of the Nasdaq 100 index. On Monday, the BTC and the tech-heavy index have made some gains.

The BTC/USD pair is also stabilizing as investors continue watching the ongoing inflation worries. Last week, data by the American statistics agency showed that the headline consumer inflation to 7% in January. That was the highest level that inflation has been in more than 40 years.

Therefore, considering that the unemployment rate has moved to the lowest level since the pandemic started and inflation has risen, there is a likelihood that the Fed will become more hawkish this year. Historically, risky assets tend to lag in a period of Fed tightening.

Inflation will likely remain at elevated levels as commodity prices rise. For example, the price of crude oil has risen while other industrial metals have also moved higher.

BTC/USD Forecast

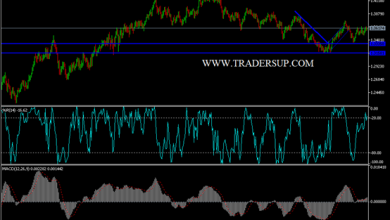

The BTC/USD pair was moving sideways on Monday morning. The pair is trading at 42,705, which was lower than last week’s high of 45,952. On the four-hour chart, it is at the 50% Fibonacci retracement level. It has also moved below the 50-day and 20-day volume-weighted moving average (VWAP) and formed a bearish flag pattern. The MACD has moved below the neutral level.

Therefore, there is a likelihood that the pair will resume the bearish trend today as bears target the next key support level at 40,000.

Source link