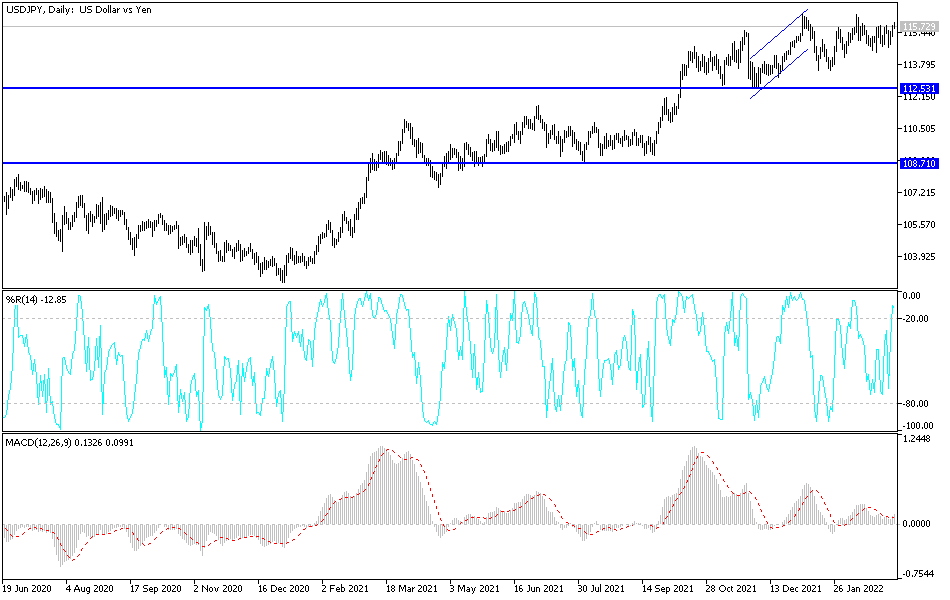

USD/JPY Technical Analysis: Appropriate Selling Levels

For three trading sessions in a row, the exchange rate of the US dollar against the Japanese yen is moving in an upward correction range with gains that reached the resistance level 115.92. That is the target of our sell recommendation as it settles around the level of 115.70 at the time of writing the analysis. It is waiting for more stimuli to complete the rebound path upwards . There is no doubt that the US dollar has benefited greatly from the dual factors of expectations of a US interest rate hike this month and expectations of a stronger tightening path throughout 2022, as well as the demand for it as a haven since the outbreak of the Russian-Ukrainian war.

The US dollar pared some of the gains later after oil prices retreated from their highest levels in almost 14 years. Crude oil prices have jumped to their highest levels since 2008 on concerns about global supplies amid fears that the United States and its Western allies will impose an embargo on Russian oil, denouncing Ukraine’s invasion of Ukraine.

In a letter to lawmakers on Sunday, House Speaker Nancy Pelosi said the chamber was considering a bill that would ban the import of oil and energy products from Russia amid the intense fighting in Ukraine. For his part, Foreign Minister Anthony Blinken said that the United States is discussing with its allies in Europe to consider the possibility of banning the import of Russian oil in a coordinated manner.

Data from the Commerce Department showed that the US trade deficit widened to $89.7 billion in January from $82.0 billion in December. Economists had expected the deficit to rise to $87.1 billion from originally $80.7 billion from the previous month. With the larger-than-expected increase, the trade deficit reached a new record high. The broader trade deficit came as the value of imports jumped 1.2% to $314.1 billion, while the value of exports fell 1.7% to $224.4 billion.

According to the technical analysis of the pair: The recent gains of the USD/JPY pair moved some indicators towards overbought levels, and since the Japanese yen is one of the most important safe havens, the currency pair is more a candidate for profit-taking operations instead of penetrating stronger ascending levels, the closest of which are currently 116.35 and 117.00 on straight. Selling operations, if they occur, might push the currency pair towards the 115.20 and 114.00 support levels. I still prefer selling the dollar yen from each ascending level.

After the announcement of the growth rate of the Japanese economy, the dollar-yen will be affected by the announcement of the number of US job opportunities and the extent to which investors take risks or not.

Source link