Ended in Red at 1.34, a Busy Week Lies Ahead

- Amid the Russia-Ukraine conflict, GBP/USD bulls succumb to bearish forces.

- In the middle of the Russia-Ukraine conflict, broader market sentiment will continue to lead the way.

- Energy, taxes, and NHI contributions are projected to rise in the UK, putting pressure on consumers.

After a tough week, the GBP/USD weekly forecast ended red. Amid a geopolitical maelstrom in Ukraine, bulls eventually gave up their three-week-long hold on GBP/USD.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

Expectations for a hawkish Bank of England, fueled by hotter weather. The pound was supported by UK inflation in the first three weeks of February, but sellers reappeared at the end of the month when Russia declared war.

Pound got pounded

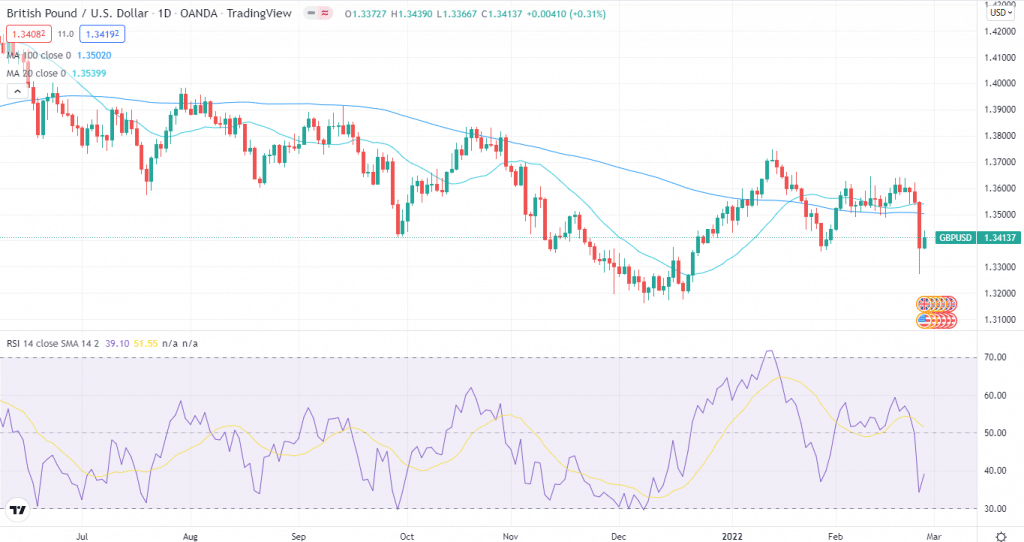

After hitting powerful resistance at the mid-1.3650s in the previous week, the pound eventually succumbed to bearish pressure.

After a small dip on Monday, sellers fought back into control is faced with a wide US dollar bounce and better UK Preliminary Markit Manufacturing and Services PMI surveys, and cable was hammered to the worst level in two months at 1.3271.

GBP/USD, a high-beta currency pair, has succumbed to gravity and relinquished the 1.3600 level. Following that, the US dollar rose in value as demand for safe-haven assets grew due to the threat of a Russian invasion.

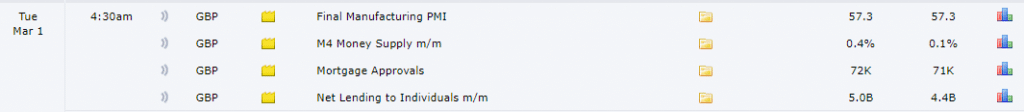

Key data/events for GBP/USD next week

![]()

As March begins, the focus may shift back to the market’s pricing of Fed rate hikes, as well as the ongoing Russia-Ukraine conflict, with Brexit worries taking a second seat.

Month-end flows may potentially play a role on the opening trading day of the week, as the data docket on both sides of the Atlantic remains modest.

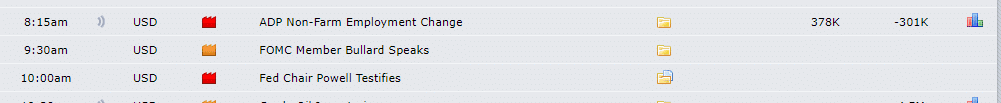

The final Manufacturing PMI from the United Kingdom and the ISM Manufacturing PMI from the United States will be released on Tuesday.

On Wednesday, the US ADP employment report and a speech from St. Louis Fed President James Bullard will be released ahead of Fed Chair Jerome Powell’s appearance before the House Financial Services Committee on the Semi-Annual Monetary Policy Report.

The US economy added 467K jobs in January, according to the NFP February report, which will be released on Friday.

In the middle of the Russia-Ukraine conflict, a broader market mood will continue to lead the way despite a busy week ahead.

GBP/USD Weekly Forecast: More on the bullish side?

With the RSI continuing below 40 on the daily chart, the technical outlook implies that the GBP/USD isn’t out of the woods yet. Furthermore, the pair is trading below the 100-day MA for the first time since early February, having broken below it.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

GBP/USD must retake the 1.3500 level to persuade bulls. However, the pair might extend its rebound to 1.3600 if it closes above that resistance area daily.

On the south, 1.3350 appears to have formed near-term support. If that level is breached, bearish objectives around 1.3300 and 1.3270 could be observed.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source link