USD/CAD Price Resists Losses at 1.25 Despite Oil Price Rally

- On Tuesday, rising oil prices supported the Canadian dollar and put the loonie defensive.

- US bond yields rose, giving the US dollar a boost and supporting major currencies.

- Be cautious before making directional bets in the light of a mixed fundamental background.

At the start of the European session, the USD/CAD price was trading near its psychological support level of 1.2500.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

Amidst bullish crude prices that tend to support the commodity-bound Canadian overnight, the pair has fallen for the second straight day on Tuesday. Due to rising geopolitical tensions in the Middle East, black gold has surged to a record high.

A Yemeni Houthi group claimed to have launched a drone attack on Abu Dhabi, the capital of the UAE, which killed three people. As global oil supplies dwindle, the bullish sentiment was boosted by fears of supply disruptions from third-largest producer OPEC.

However, the downside is limited, at least for now, thanks to a strengthening US dollar, supported by rising US Treasury yields. As bets suggested the Fed would raise rates in March 2022, 10-year Treasury yields rose to their highest level since January 2022.

Before the upcoming FOMC meeting on Jan 25-26, caution is warranted given the mixed fundamentals. Meanwhile, on Tuesday, traders will use the Empire State Industrial Production Index and oil price data for some near-term opportunities.

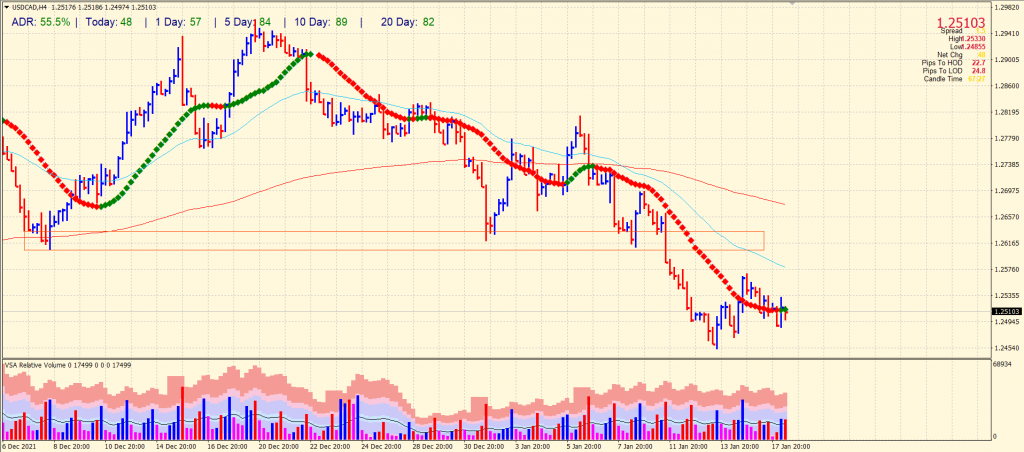

USD/CAD price technical analysis: Bulls aiming to ride

The USD/CAD price is consolidating above the 1.2500 handle. The price is wobbling around the 20-period SMA on the 4-hour chart. Meanwhile, the average daily range for the pair is at 55%, indicating a volatile day. The volume data is quite mixed, indicating no clear bias. However, the price structure shows that the bears face strong hurdles, and bulls may start dominating the market.

–Are you interested to learn more about forex brokers? Check our detailed guide-

As long as the price stays above 1.2450, we can expect the price to hit 1.2600 and 1.2700. Alternatively, if the price breaks below 1.2450, we may see support at 1.2400 ahead of 1.2350.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link