Market Outlook

The Fed Should Pick ‘Boomflation’ Over a Recession

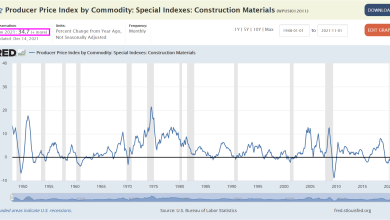

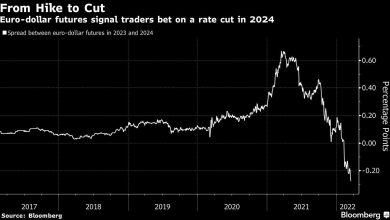

Coming into this year, the hope was that supply chain improvements and modest interest-rate increases from the Federal Reserve would return the U.S. economy to the healthy expansion mode it enjoyed in 2019. Accelerating inflation and anecdotes from companies suggest that’s much less likely to happen than it seemed a few months ago.

The Fed is in a tight corner: Is it better to aggressively jack up interest rates to lower inflation, even if that risks throwing the economy into recession? Or should it tolerate a somewhat higher level of inflation than its 2% rough target to keep the economy growing while cooling off prices? Given these two imperfect choices, the latter is clearly preferable.

Source link