New Vehicle Sales in 2021 at 1978 Level: 25 Years of Stagnation Interrupted by Plunges. But Prices Explode to WTF Level

GM and Ford sport 6 year declines of -28% and -27%. Toyota blows all away, but still -7% from 2015. Hyundai-Kia sets new record. Captured in charts.

By Wolf Richter for WOLF STREET.

New vehicle sales in 2021 were marked by supply-chain chaos and the semiconductor shortage. But there was sufficient demand, and consumers switched from astute car buyers to paying whatever, resulting in a collapse of price resistance among consumers, the likes of which I have never seen before, which led to a record spike in prices and obese gross profits per vehicle for dealers. Automakers, dogged by supply constraints, prioritized higher-end models. And the average transaction price exploded. GM, Ford, and others got battered by the chip shortages. Others emerged with their dignity intact. Toyota trounced GM and became Number 1 for the first time ever.

But in terms of sales volume, it was another crappy year. Total new vehicle sales – the number of vehicles delivered to ultimate retail and fleet customers – ticked up about 3.1% from the collapsed levels of 2020, to 14.93 million vehicles, about the same as in 1978, adding another year to the 25-year stagnation interrupted by plunges, where the only thing that’s booming is prices.

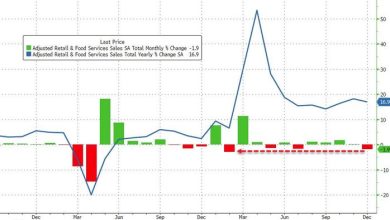

Prices exploded.

Automakers slashed incentives. The MSRP remains fixed for the model year. The way automakers adjust prices during the year is to increase or decrease the incentives to dealers and customers. In December, average incentives dropped to 3.5% of MSRP, according to J.D. Power estimates. In 2019, incentives ran over 10% of MSRP.

Dealers charged more for the vehicles, often advertising vehicles with addendum stickers, of $2,000 or even $20,000 over MSRP. And most astonishingly, there were enough people who paid those crazy prices. So the average gross profit per vehicle sold spiked by 165% year-over-year, to a record $5,258 per vehicle, according J.D. Power estimates.

Those dynamics have even shown up in the CPI for new vehicles, which, despite the notorious hedonic quality adjustments, spiked by 11% over the 12-month period through November, the third worst price spike on record, the other two having been in 1975.

Average Transaction Price exploded to WTF level.

In addition to these pricing dynamics – the cuts in incentives by automakers and the pricing at the dealer level – there was widespread prioritization of loaded higher-end models by automakers. Lacking components due to the chip shortage, they were building the models that would produce the most revenues and profits. And consumers – many of them having benefited from the Fed-triggered boom in asset prices – went for them.

As a result, the Average Transaction Price (ATP) spiked by 20% year-over-year to $45,743 in December, according to J.D. Power estimates. Over the two years, December 2019 through December 2021, the ATP exploded by $10,800, or by 31%. This is just nuts. Soon, dealers will advertise, “Buy One for the Price of Two”:

Sales volume by top automakers in the US.

During the 25 years of stagnation-interrupted-by-plunges, legacy automakers took an additional beating from the arrival of newcomers that ate into their slices of this already stagnating pie. Those newcomers include notably Hyundai and Kia, Mitsubishi, and more recently, Tesla.

Tesla doesn’t disclose US deliveries; it only discloses global deliveries. So it doesn’t have a spot in this lineup.

Toyota sales 2021: +10.4% from 2020, -7% since 2015. Toyota too got slammed during 2020, but in 2021, it navigated the chip shortages a lot better than its US counterparts, in part by having made special deals with its key suppliers a decade ago following the collapse of its supply chains due to the earthquake and tsunami in Japan. In 2021, it won the production war and had more vehicles to sell:

GM sales 2021: -12.9% from 2020, -28% since 2015, a six-year collapse in volume that is hard to grasp. After the multi-year process of declining sales, GM then got slammed by the pandemic in 2020 and by the semiconductor shortage in 2021. With total sales of all its brands at 2.218 million vehicles, GM got kicked into the Number 2 position, behind Toyota:

Ford sales 2021: -6.8% from 2020, -27% since 2015. With sales down to 1.905 million vehicles, after a six-year decline that sharply accelerated in 2020 and 2021, Ford, the perennial Number 2, got knocked into the Number 3 slot.

Fiat Chrysler sales 2021: -2.4% from 2020, -22% from 2015. With sales down to 1.777 million vehicles, the automaker, now in the Stellantis group, remained in the Number 4 slot, with Honda and Hyundai-Kia moving in on it.

Honda sales 2021: +8.9% from 2020, -10.6% from 2017. With 1.467 million sales, Honda remained in the Number 5 slot, but now just a hair above the combined Hyundai-Kia:

Hyundai-Kia sales 2021: +19.1% from 2020, +1% from 2016, to a new record of 1.439 million vehicles. Hyundai owns a big portion of Kia, and there are numerous cross-shareholding deals between Kia and entities in the Hyundai chaebol. The vehicles share many components. So here, I look at them as two brands of the same automaker.

After two very rough years following the peak in 2016, sales began to recover in 2019. The pandemic slapped them down again in 2020, but in 2021, sales spiked to a new record of 1.439 million vehicles, just a tad behind Honda:

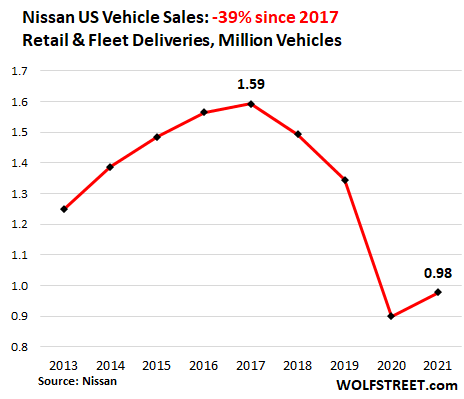

Nissan sales 2021: +8.7% from 2020, -39% since 2017. Of the major automakers, Nissan’s sales collapsed the most. In 2020, sales were down 43% from the peak in 2017. In 2021, sales rose from that catastrophically low level, to 978,000 vehicles, but still below 1 million for the second year in a row.

Where are the German automakers? Despite the hoopla around them, they’re relatively small in the US. BMW, Mercedes Benz, and Volkswagen (the company hasn’t released sales figures yet) sell below 400,000 vehicles each in the US, and don’t fit into the top automakers in the US.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Classic Metal Roofing Systems, our sponsor, manufactures beautiful metal shingles:

- A variety of resin-based finishes & colors

- Deep grooves for a high-end natural look

- Maintenance free – will not rust, crack, or rot

- Resists streaking and staining

To reach the Classic Metal Roofing folks, click here or call 1-800-543-8938

Source link