Jobs Report: Be Careful What You Wish For

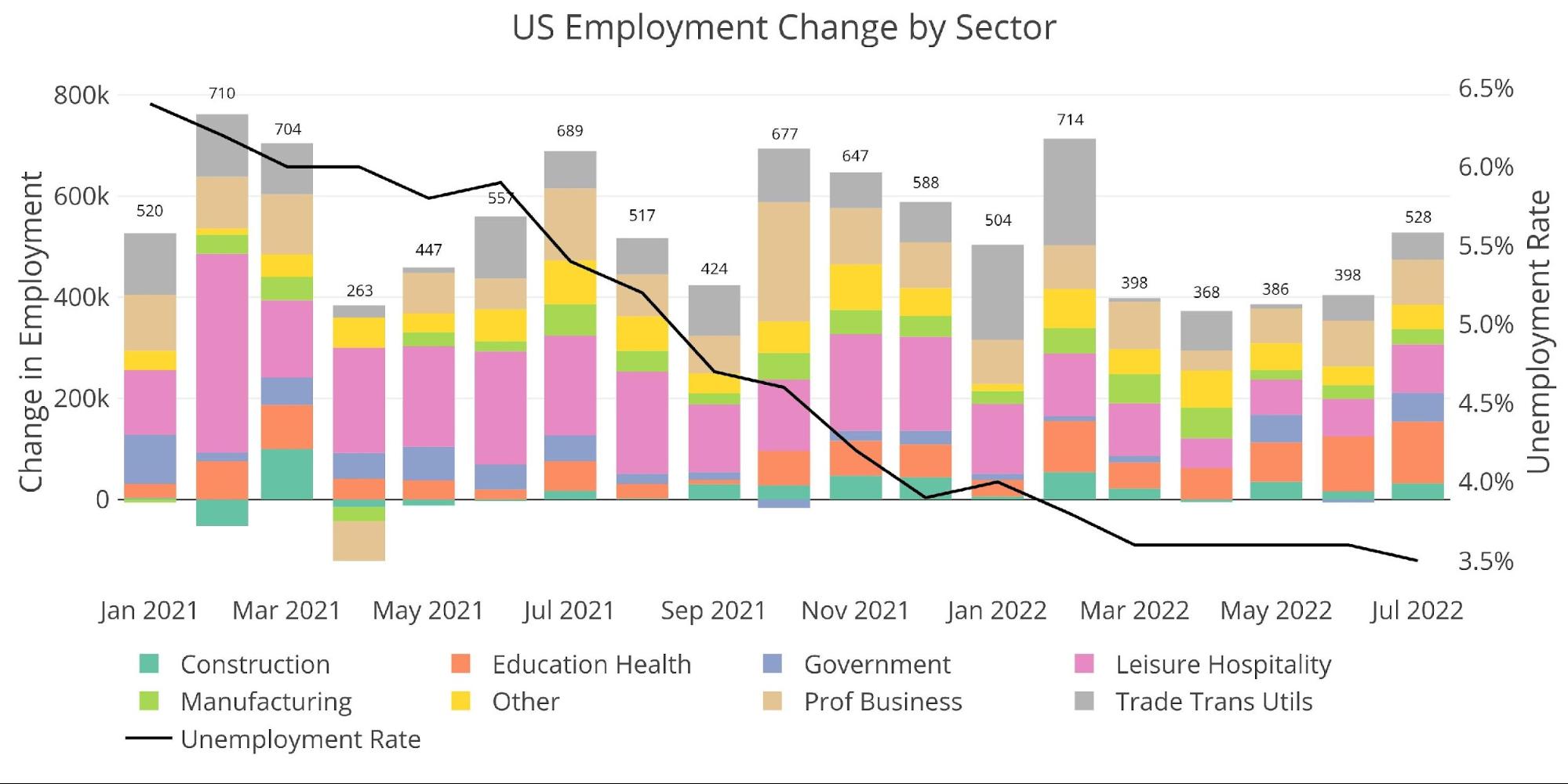

According to the BLS, the economy added 528k jobs in July, blasting past analyst estimates of 250k. The strong report comes on the heels of a Fed meeting last week that made a point to state they are hyper-focused on the job market as a sign of a weakening economy. The White House and Fed are now in lock step ignoring negative GDP growth and hanging their hat on the job market. For now, that message fits their narrative.

The Fed will likely stick to its aggressive path; however, this only brings the Fed closer to breaking something. A weak report would have given the Fed an excuse to pause and assess the impact of their hikes. A more aggressive Fed will mean it will be far too late to calmly dial back the hawkishness when the rate hikes really start to bite. The Fed will likely have to pivot to an even more dovish stance than during Covid once the carnage of their rate hikes fully materializes.

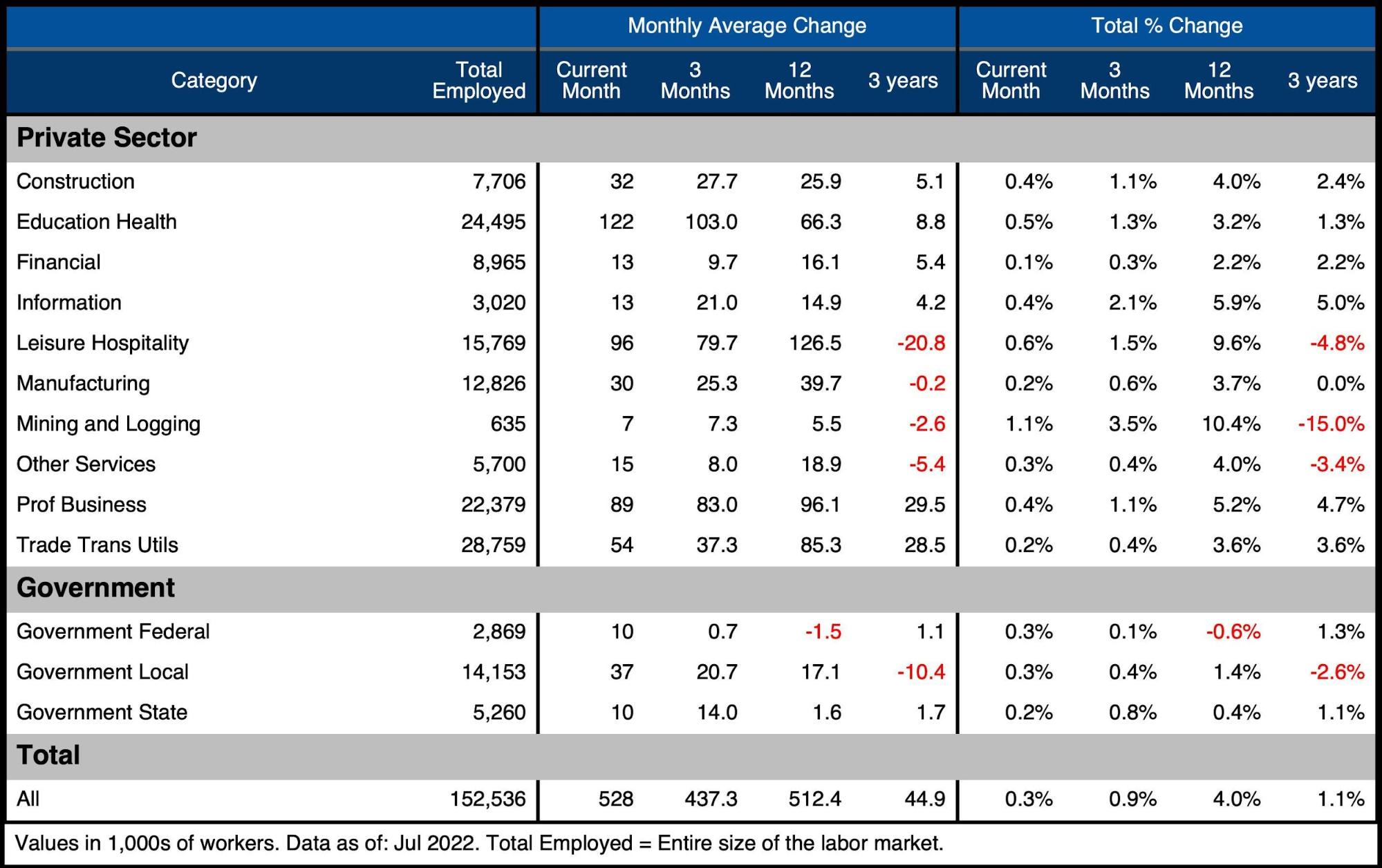

Figure: 1 Change by sector

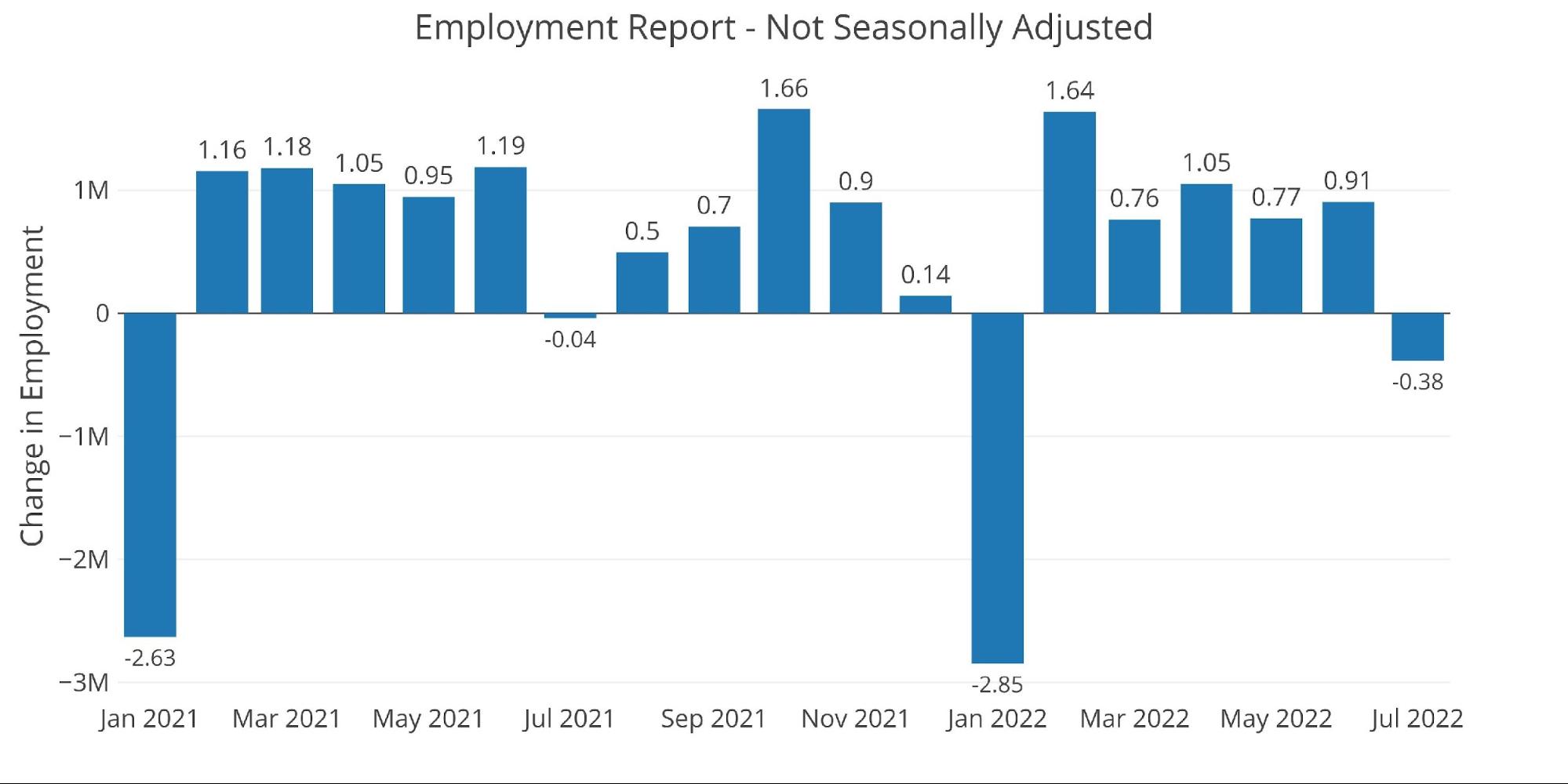

The unadjusted numbers actually show that this July was much weaker than last July and only January has been a worse month (by a wide margin).

Figure: 2 Monthly Non-Seasonally Adjusted

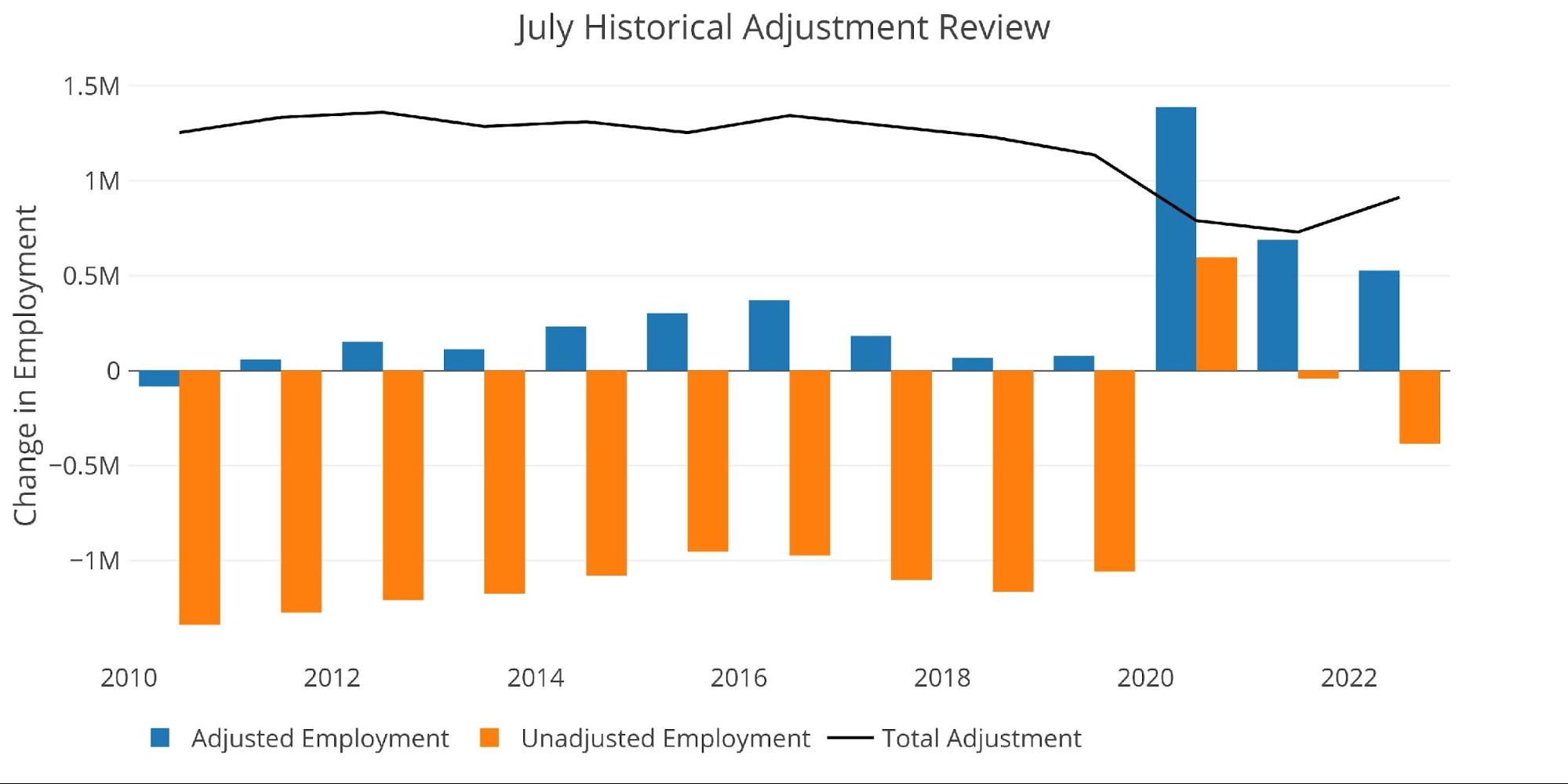

The BLS adjusts the data to account for seasonality in the hiring market. Typically, July unadjusted is a massive negative number, but that has changed post-Covid. As shown below, the adjustment upward this month was actually smaller than July typically sees historically, but larger than the last two years.

Figure: 3 YoY Adjusted vs Non-Adjusted

Breaking Down the Adjusted Numbers

Looking at the raw numbers is interesting and shows how much the BLS models modify the final output. That being said, the market at large and this analysis will focus primarily on the officially published numbers.

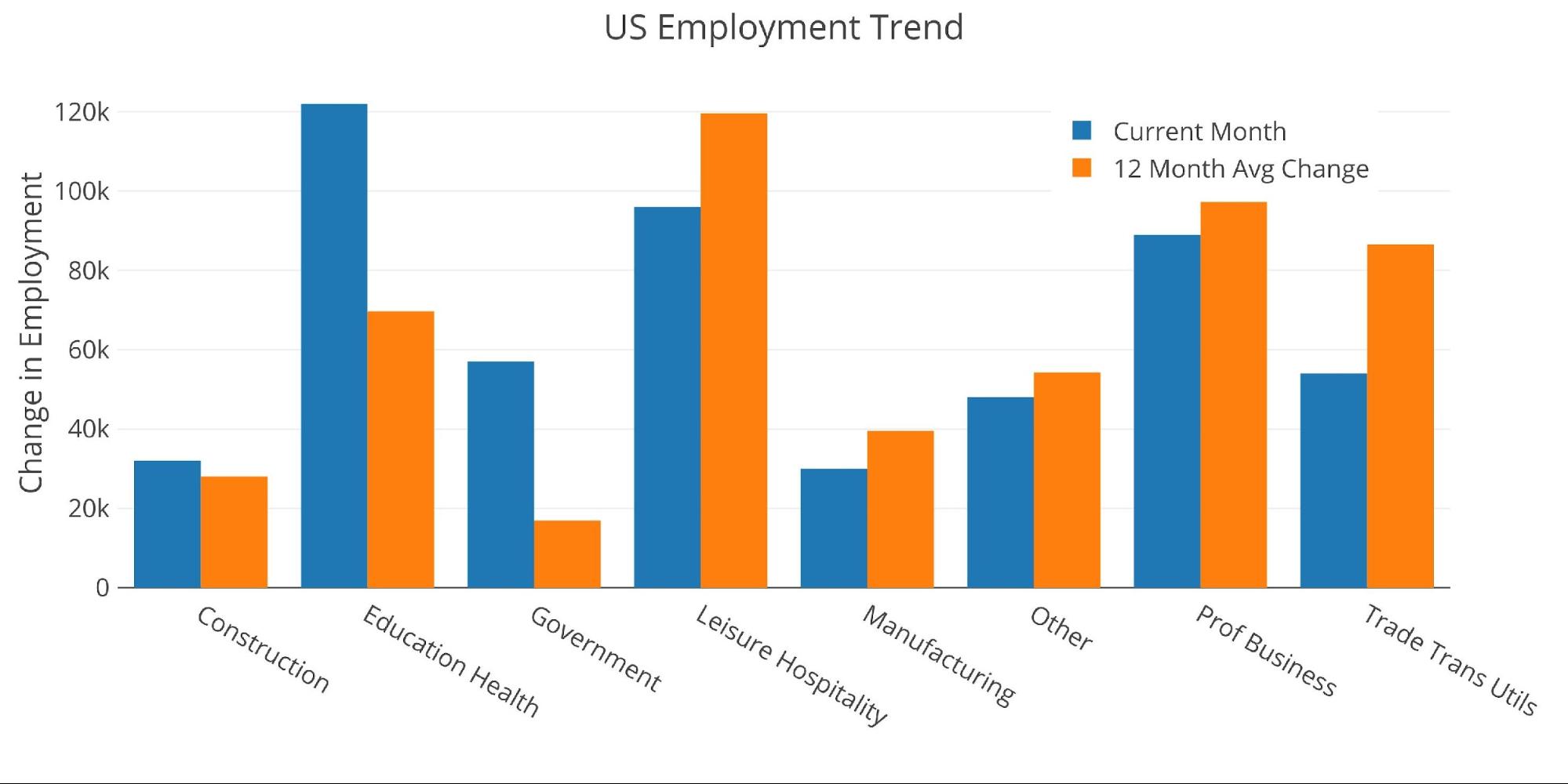

Despite the strong headline report, this month actually saw 5 of the 8 categories trailing the TTM average. Construction, Education/Health, and Government are the three categories that exceeded the 12-month average. Government was particularly strong, beating the 12-month average by 3.5x. Government jobs weigh on the economy though, so this should not be celebrated.

Figure: 4 Current vs TTM

The table below shows a detailed breakdown of the numbers. The aggregate 12-month average is 512k, which was beaten this month.

Key takeaways:

-

- Leisure and Hospitality beat the 3-month average but was 30k below the 12-month

- Government sector added jobs at all three levels (Federal, State, and Local)

-

- All three exceeded the 12-month average by a wide margin

-

- Factoring in Covid, over the last three years, the economy has only added 45k jobs per month on average

-

- This shows how Covid has still weighed significantly on the job market

-

Figure: 5 Labor Market Detail

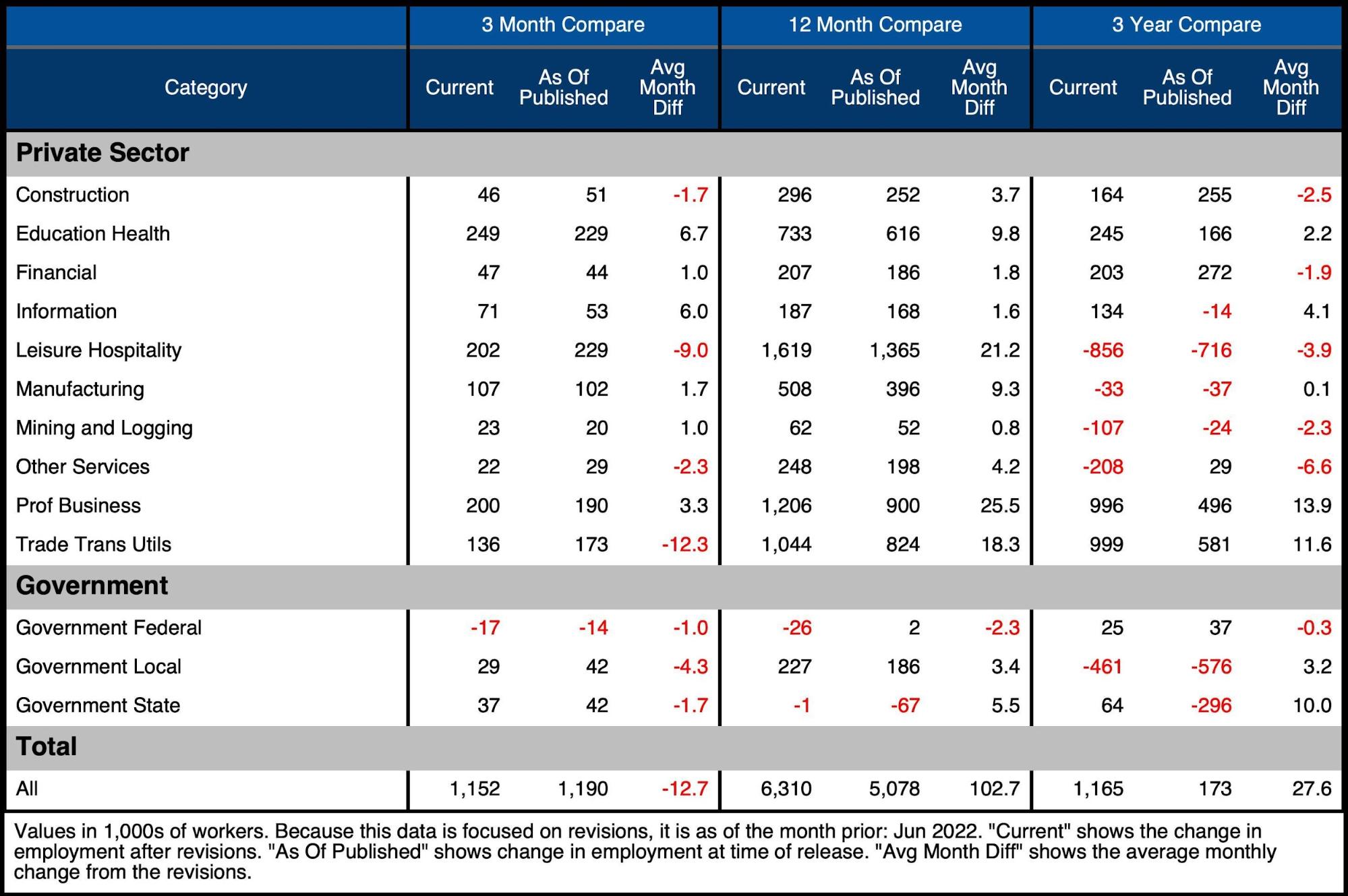

Revisions

While the headline number gets all the attention, the number is typically revised several times. Revisions over the last three months were net negative again for a second month. This is a big change from a few months ago. The 12-month average revision is +102.7k vs a 3-month average revision of -12.7k.

Figure: 6 Revisions

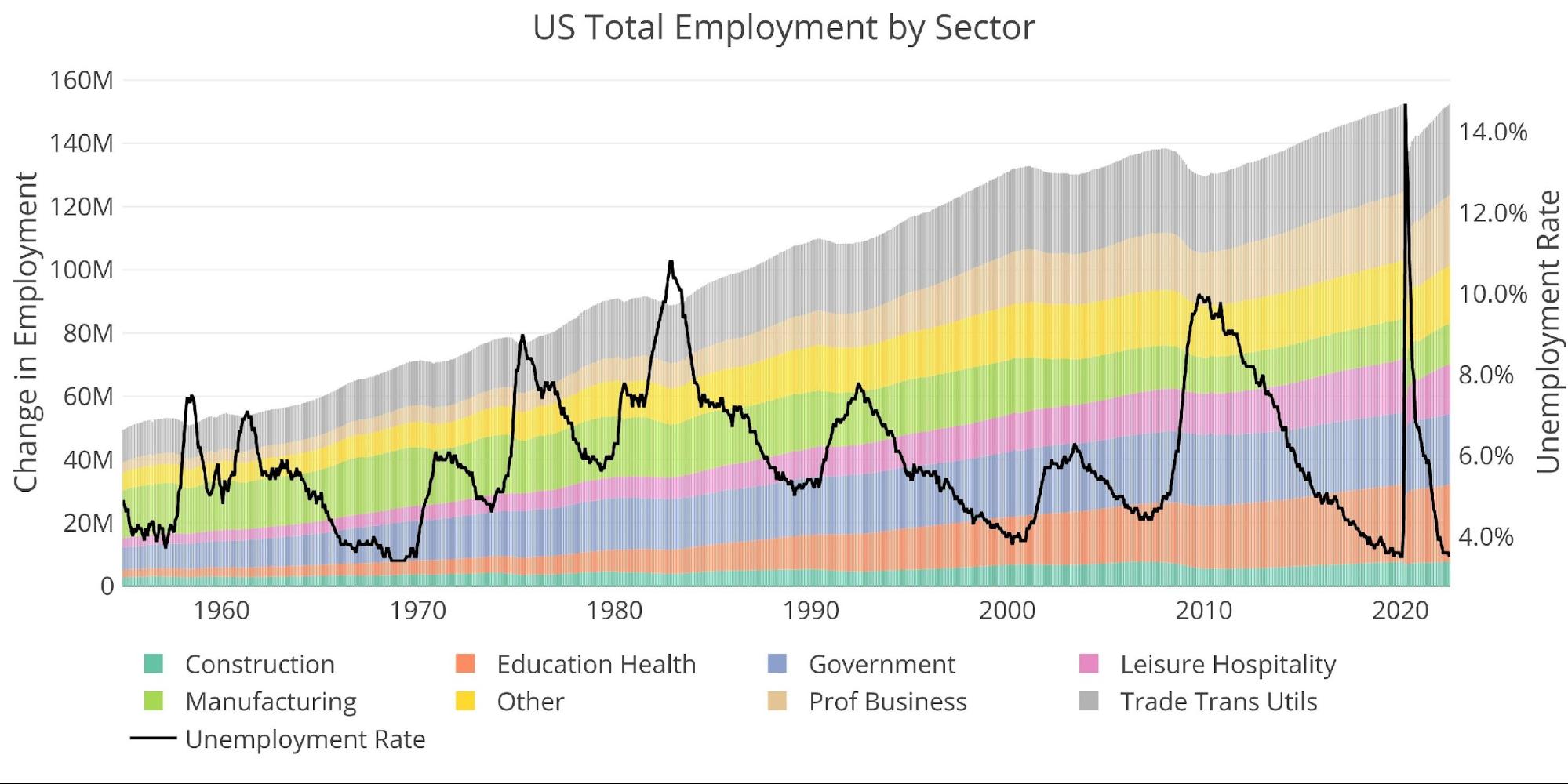

Historical Perspective

The chart below shows data going back to 1955. As the labor force has grown in total aggregate numbers, the recessions along the way have caused dips in the general trend. But the trend is still clearly upward.

The Covid recession can be seen as the greatest job market loss ever. The chart also shows how the rebound has been quite strong. The unemployment rate has returned to the Covid low of 3.5%. It should be noted that labor force participation has fallen from 63.4% to 62.1% over the same time.

Figure: 7 Historical Labor Market

What it means for Gold and Silver

The strong jobs report will most likely push the Fed to consider another large rate hike in September as predicted by the CME Fed Watch tool. It also probably means the Fed will not pivot as soon as the market was anticipating.

That being said, interest rates have not moved up this quickly in such a short time for decades. With all the debt built up in the system, it will take time for the interest rate hikes to begin breaking things. It’s very likely that by the time the Fed acknowledges the weakness in the economy and slows their rate hikes, it will be too late to save the economy with a simple slow down or pause in rate hikes. Instead, the Fed would have to likely pursue extremely aggressive monetary easing, possibly even more so than during Covid.

The strong jobs number does not change anything fundamentally. The rate hikes are still going to cripple the economy and cause interest payments to explode for the Treasury. If anything, the report will push the Fed to be more aggressive and potentially create even more chaos in the months and years ahead. That will be when the Fed is fighting a battle on two fronts (high inflation and a spiraling economy). Gold and silver are the best insurance policy against such a scenario.

Data Source: https://fred.stlouisfed.org/series/PAYEMS and also series CIVPART

Data Updated: Monthly on first Friday of the month

Last Updated: Jul 2022

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link