US Dollar Surges as Nickel Leads Commodity Chaos and Stocks Drop. Will DXY Index Dip?

US Dollar, DXY Index, Crude Oil, AUD/USD, CAD, NZD, Russia, OPEC+ – Talking Points

- The USDollar marched higher today as uncertainty grips markets.

- Nickel put on a blistering rally along with the rest of industrial metals

- Equities are under the pump amongst the bedlam.Will USD see more haven flows?

The US Dollar has continued to gain favour as a haven amid commodity mayhem going into trading on Tuesday. Nickel on the London Metals Exchange (LME) was up over 130% at one stage overnight, before pulling back going into the London close.

Aluminium, copper, iron ore and steel prices all saw dramatic moves higher but have softened slightly in Asia today. Russia is a significant exporter of these industrial metals, as well as gold, which continues to trade near US$ 2,000 an ounce.

Although crude oil has backed away from Monday’s highs, it remains sought after as Russia threatens to cut gas supply to Europe.

OPEC+ Secretary General Mohammed Sanusi Barkindo said that there is no capacity to replace the 7 million barrels a day of Russian supply if the US goes ahead with banning Russian oil.

Stocks tumbled further with growing perceptions that higher input prices are going to be difficult to pass on to consumers.

Equity markets that have held up ok are commodity linked. Canadian, Australian, New Zealand and some Gulf indices are faring much better than places like France and Germany, which are exposed to Russian energy supply.

The Dow Jones, S&P 500 and Nasdaq 100 finished their cash session lower, down -2.37%, -2.95%, and -3.75% respectively. Futures markets are pricing in a weak start to their day.

All Asian bourses are down on the day but not to the same extent as Wall Street.

Bonds are down as yields tick up, the US 10-year note is up 13 basis points (bp) from Monday’s low, trading near 1.80%. Similarly, the Australian 10-year is yielding 2.22%, up 15 bp.

However, that hasn’t helped the Australian Dollar as it reversed Monday gains, trading under 73 cents after visiting 0.7441 yesterday.

CAD and NZD saw similar pull backs, but the Japanese Yen is the largest underperformer so far today. EUR and SEK saw some gains.

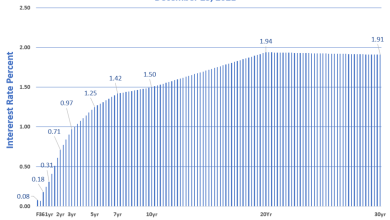

The US Dollar remains sought after in an environment of heightened uncertainty. The DXY Index is at its highest level since May 2020.

The DXY index is a US Dollar index that is weighted against EUR (57.6%), JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%) and CHF (3.6%).

After German industrial production and Euro zone GDP data today, the US will see trade and wholesale inventory numbers.

The full economic calendar can be viewed here.

US Dollar Index (DXY) Technical Analysis

After the breaking above the June 2020 peak of 97.802, the US Dollar has seen strong bullish momentum unfold.

97.802 might now provide pivot point support as well as 97.441 and 96.462.

The 10-day simple moving average (SMA) is currently lying between the latter two levels and could signal an end to bullish momentum should it be breached.

On the topside, the May 2020 peak of 100.556 and the April 2020 high of 100.931 may offer resistance.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link