Another Big Budget Deficit in June; This Is Supposed to Be Good News?

The federal government ran an $88.8 billion budget deficit in June. That was up nearly $22 billion from the previous month, according to the latest Monthly Treasury Statement.

And this is supposed to be good news.

After running a budget surplus in April thanks to an influx of tax-day tax receipts, the federal government reverted back to running a deficit in May and widened the budget gap last month. With three months left in fiscal 2022, the budget deficit stands at just over $515 billion.

So, how is this good news?

Well, it’s not as bad as last year.

Reuters reported that the June deficit was “roughly half the gap in the same month last year, as pandemic-related outlays fell and revenues edged higher.” Of course, as the Reuters report later points out, “the prior-year figure bloated by COVID-19 aid payments and benefits associated with President Joe Biden’s $1.9 trillion American Rescue Plan Act.”

The fact of the matter is a big increase in tax receipts has papered over the federal government’s continuing spending problem.

This is not good news.

The federal government took in $460.8 billion in June. This was far below the big influx of $864 billion the Treasury reported in April as Americans paid their 2021 income tax bills. But June still ranked as the fourth-largest revenue month of fiscal 2022. Government receipts of $3.8 trillion for the fiscal year are up 26% compared to the same period in 2021.

Unfortunately for Uncle Sam, the CBO expects this revenue surge to wane.

Individual income tax receipts are projected to decline as a share of GDP over the next few years because of the expected dissipation of some of the factors that caused their recent surge. For example, realizations of capital gains (profits from selling assets that have appreciated) are projected to decline from the high levels of the past two years to a more typical level relative to GDP. Subsequently, from 2025 to 2027, individual income tax receipts are projected to rise sharply because of changes to tax rules set to occur at the end of calendar year 2025. After 2027, those receipts remain at or slightly below the 2027 level relative to GDP.”

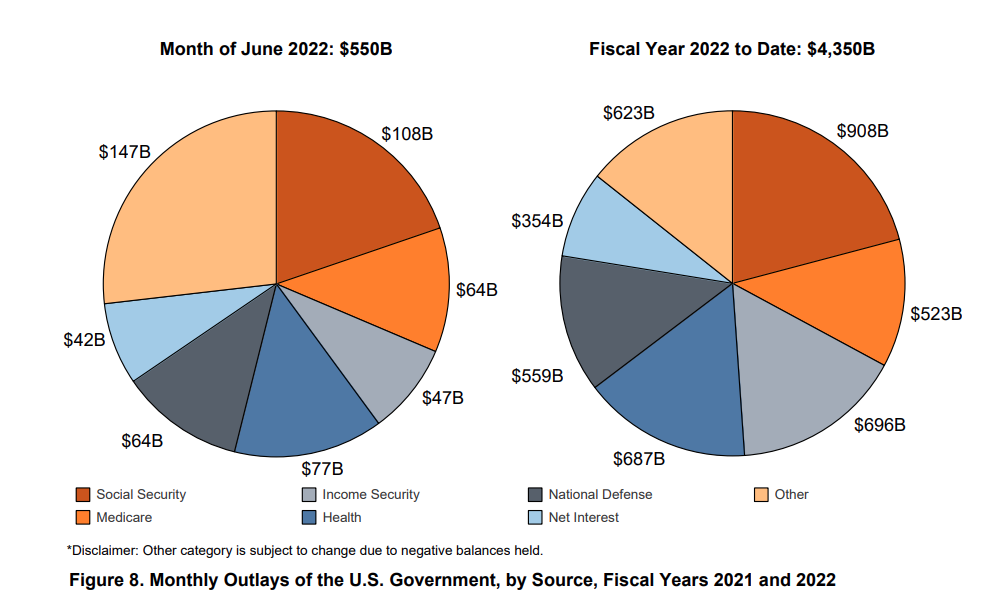

Meanwhile, the federal government continues to spend money as if it has a printing press. The Biden administration blew through over half-a-trillion dollars last month. This brought total spending for fiscal 2022 to just over $4.4 trillion.

As Reuters points out, stimulus and other programs did in fact balloon spending over the last two years. As those programs wind down, we’re seeing a drop in outlays. But if you strip out the pandemic programs and look at baseline spending, it’s clear that the federal government is nowhere near getting its spending problem under control. For comparison, spending for the entirety of fiscal 2018 came in at $3.15 trillion. Uncle Sam has already blown past that by over $1 trillion in FY2022 with three months remaining.

There is no sign that the Biden administration has any plan to get spending under control. In fact, the president wants to spend more. The Democrats are trying to breathe life back into the “Build Back Better” plan.

The CBO projects a $1 trillion deficit in fiscal 2022. At the current trajectory, it could fall just below $1 trillion. That would be down significantly from the massive deficits the government ran in 2020 and 2021. This sounds like a great accomplishment until you put the numbers in context.

Prior to the pandemic, the US government had only run deficits over $1 trillion four times — all in the aftermath of the 2008 financial crisis. Trump almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit prior to the pandemic. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked. Now it appears the government is settling back into the status-quo – running ’08 financial crisis-like deficits every year.

As the economy spins into a recession as the Fed tightens monetary policy to fight raging inflation, you can expect revenue to tank, meaning even bigger budget shortfalls.

The national debt currently stands at $30.5 trillion.

According to the National Debt Clock, the debt to GDP ratio is 129.8%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $91,764 in order to pay off the national debt.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link