EUR/USD Technical Analysis: Bears’ Control Will Remain

With the beginning of the new week’s trading, the price of EUR/USD is still suffering from downward pressure. It recently pushed to the 1.1122 lowest support level for the currency pair since July 2020 and is settling around the 1.1165 level at the time of writing the analysis. The current trading week awaits the announcement of US jobs numbers and the monetary policy update of the European Central Bank. The US dollar is still stronger with economic performance and the future of the US Federal Reserve’s tightening policy.

Official figures showed that the German economy shrank by -0.7% in the fourth quarter of last year amid a resurgence of coronavirus infections and new restrictions. The quarterly decline reported by the Federal Statistics Office came after two quarters of solid gains, despite ongoing supply bottlenecks. Gross domestic product grew 2.8% over the whole of last year, the bureau said, rebounding from a 4.6% decline in 2020 when pandemic lockdowns were at their most extreme. That number was revised up slightly from the initial 2.7% that the bureau announced earlier this month.

The German government last week cut its growth forecast for this year to 3.6%, down from the 4.1% the previous German government had forecast in late October.

Germany is currently seeing another spike in COVID-19 infections fueled by the highly contagious omicron variant.

However, a closely watched survey showed that business confidence unexpectedly rebounded in January after a six-month slump. The increase came thanks to a marked improvement in managers’ expectations for the next six months, even as their assessment of the current situation worsened.

German exports to the United Kingdom fell another 2.5% last year, in the first full year of Britain’s exit from the European Union. This is after a significant drop in 2020 in the first phase of the coronavirus pandemic, according to official figures released on Friday. Exports from Germany, which has Europe’s largest economy, totaled 65.4 billion euros ($73.1 billion) in 2021, according to preliminary figures from the Federal Statistical Office. It said the drop, which followed a 15.3% drop in 2020, was the result of Britain’s exit from the European Union.

Britain withdrew from the EU’s single market and customs union on December 31, 2020, 11 months after it formally left the union’s political structures.

Between January and November, the period for which full figures are currently available – German exports to the UK were 2% lower than a year earlier, and imports were down 7.7%, the statistics office said. The United Kingdom was the eighth destination for exports in that period, falling from the fifth place in 2020. It fell from the 11th place to the 13th place in the list of sources of imports.

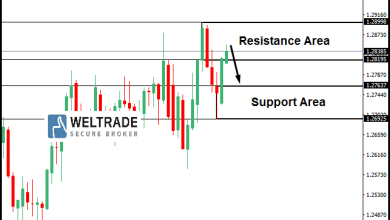

According to the technical analysis of the pair: On the daily chart below, the general trend of the EUR/USD currency pair is still bearish. The pressure factors on the pair are still present, and therefore any gains to rebound higher for the pair may be an opportunity to resell. The closest retracement levels are currently 1.1185, 1.1220 and 1.1300, respectively. On the downside, the stronger movement, the currency pair is set to move towards the psychological support level 1.1000 in case it moves towards the 1.1085 support. The euro will be affected today by the announcement of the GDP growth rate of the euro zone and German inflation figures.

Source link