Gave Up Early Gains on Friday

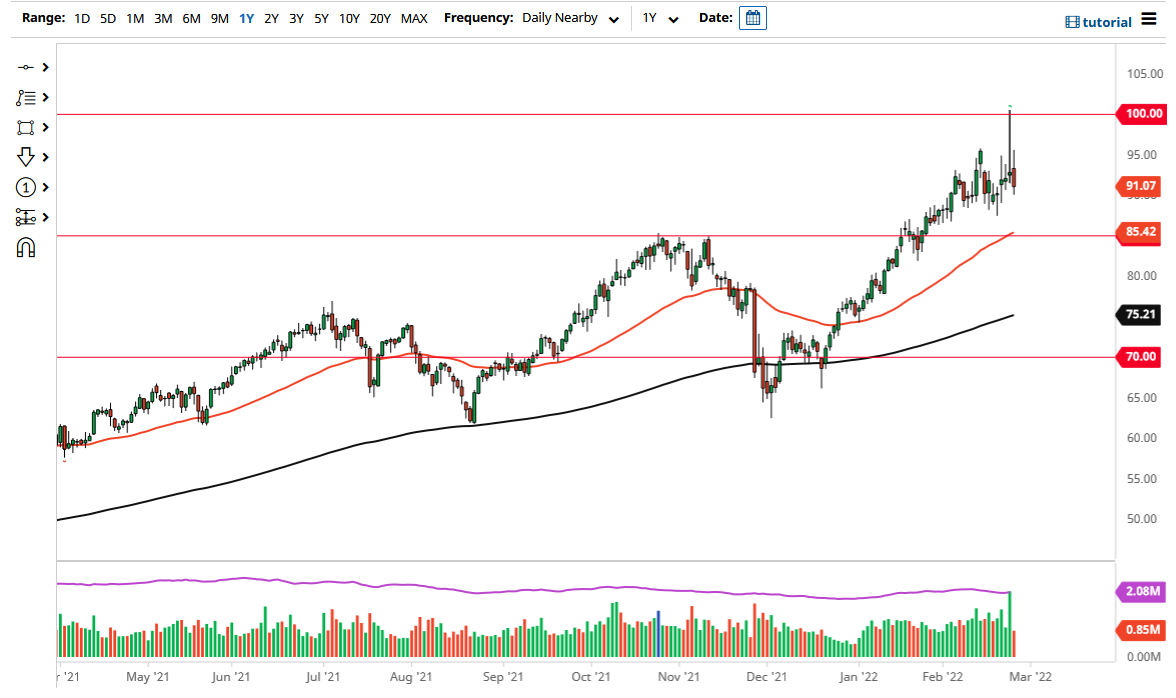

The West Texas Intermediate Crude Oil market initially tried to rally during the day on Friday in a way to continue the overall uptrend. Traders seem to be focusing more on the idea of the markets calming down and being less of a “risk off” type of shot across the bow when it comes to oil. After all, part of the spike that we had seen over the last couple of days has had a lot to do with the Russians invading Ukraine, making the possibility of a lack of oil flowing through the system.

We have not seen that happen so therefore the entire “panic bid” that caused the spike is complicit underwater at this point. The 50 day EMA sits underneath near the $85.40 level, and therefore I think that if we do break down, it is very likely that we will see buyers enter this market based upon value, because the fundamentals of oil have not changed despite the fact that we have seen quite a bit of selling pressure recently.

I believe at this point in time you are better off looking for value to buy, and it does make a certain amount of sense that perhaps traders do not want to carry a bunch of risk into the weekend, so maybe they are simply dumping those positions ahead of time. A little bit of a pullback could do a lot of good for this market, because quite frankly we can start working off some of the excess froth that we had seen. As long as the Russians do not escalate the combat with the Ukrainians into other countries, oil should continue to be relatively abundant.

By falling the way we have after forming a massive shooting star, it is a technical signal to go lower. The $85 level offers support, right along with the 50 day EMA, but if we do break down below there, it is likely that we go looking towards the $80 level next. To the upside, if we were to turn around a break above the top of the candlestick from the Thursday session, it could open up more or less a “panic bid” or possibly a “melt up” in this market.

Source link