Another Attempt At QE/Inflation – Alhambra Investments

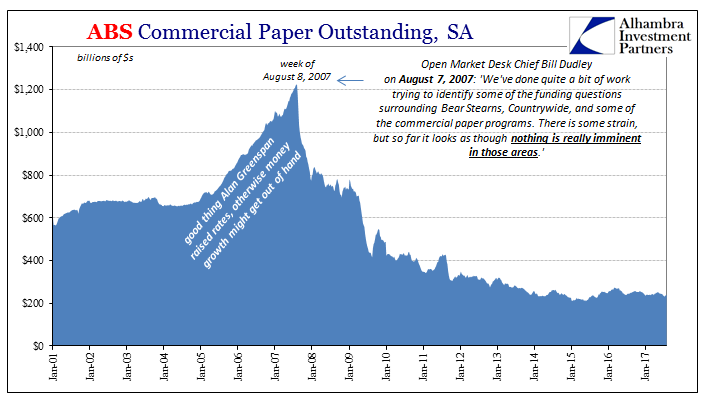

You have to hand it to Willian Dudley. Having committed one egregious error after another while in charge of the Fed’s New York-based Open Market Desk during the first Global Financial Crisis, Bill was kicked upstairs anyway to run that entire central bank branch following the debacle. He then continued on in the same spirit and with the same results.

In the middle of last year, Dudley returned to the pages of Bloomberg with an op-ed which begins with something he actually gets right, for once, a correlation everyone should easily be able to agree upon.

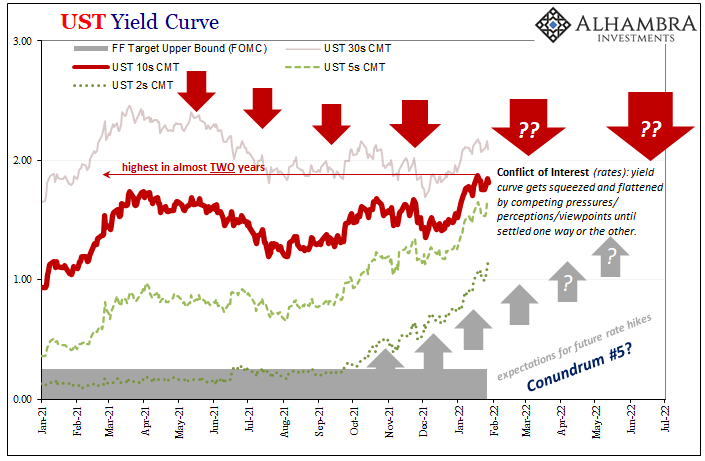

See if you can figure out which of these data points conflicts with the others: The U.S. economy grew at an annualized, inflation-adjusted rate of 6.5% last quarter; it added an estimated 850,000 jobs last month; consumer prices have risen 5% over the past year; and the 10-year Treasury note yield has recently fallen to 1.2%.

If you guessed the Treasury note yield, you’re right. Such a low long-term interest rate is totally inconsistent with rapid economic growth, strong job gains and high inflation. What gives?

Easy: no matter those temporal economic stats the Treasury market doesn’t buy the retired central banker’s central premise. Sure, growth looked spectacular and spectacularly inflationary during and after the helicopters (but suspiciously not during QE6 alone). But then what?

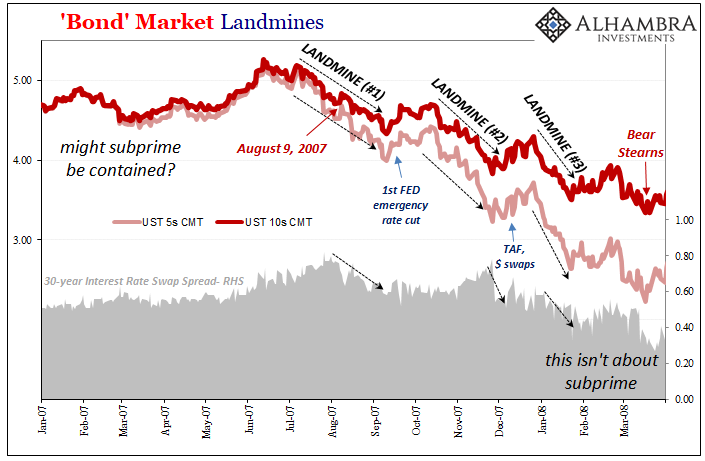

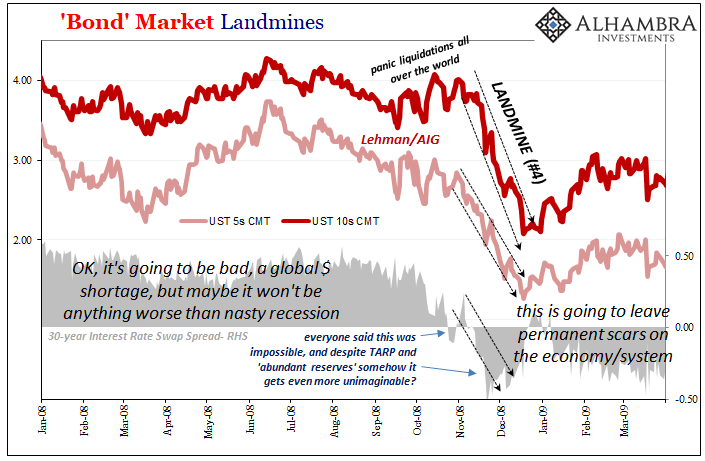

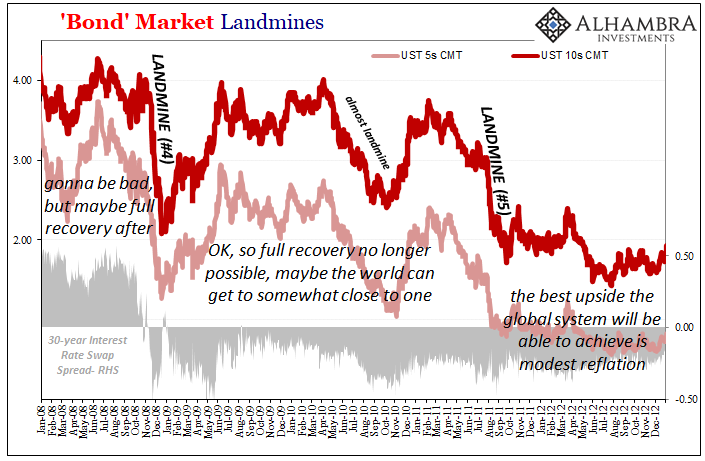

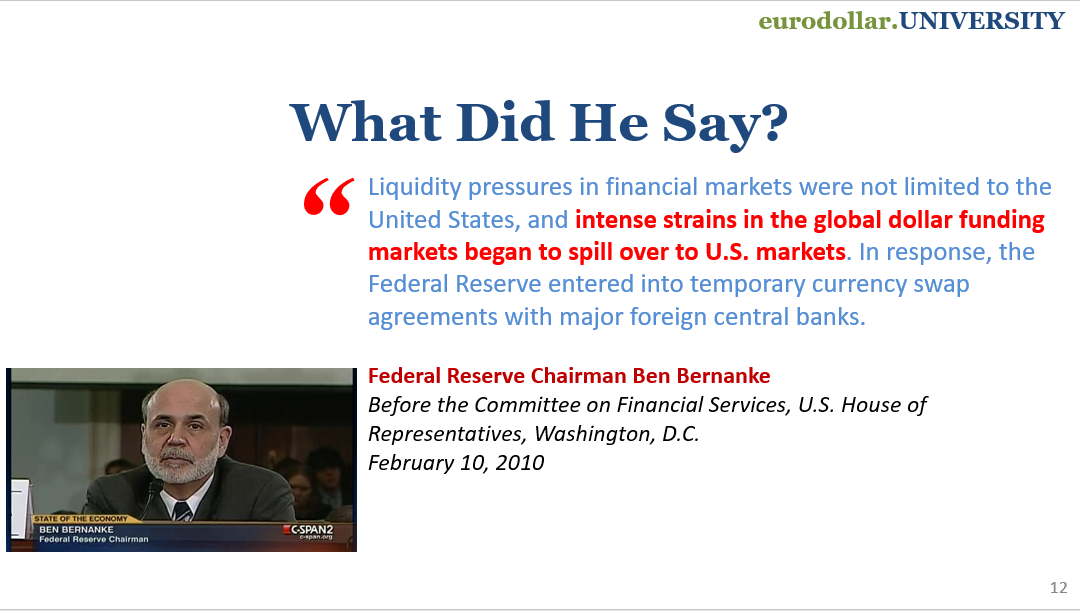

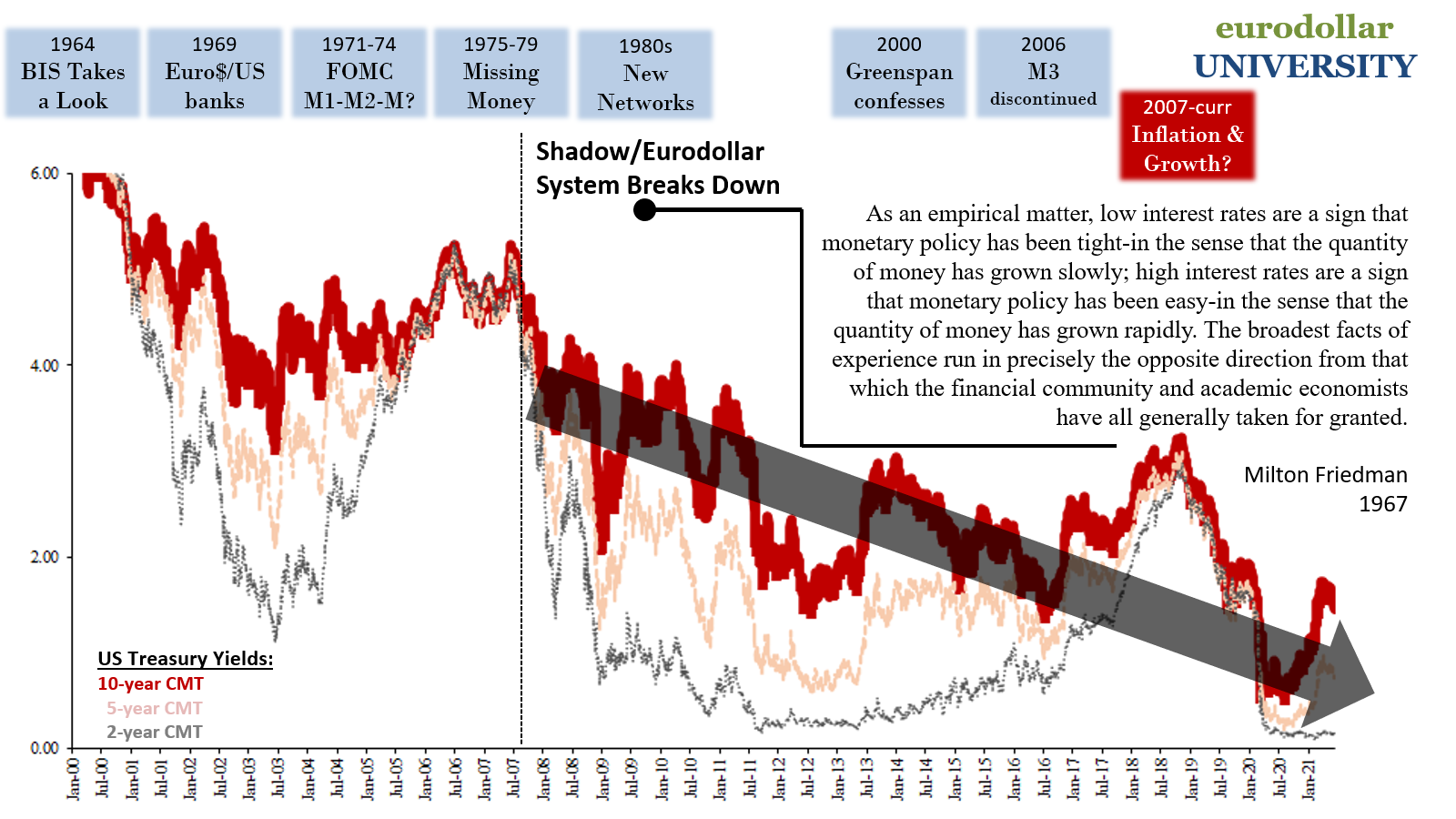

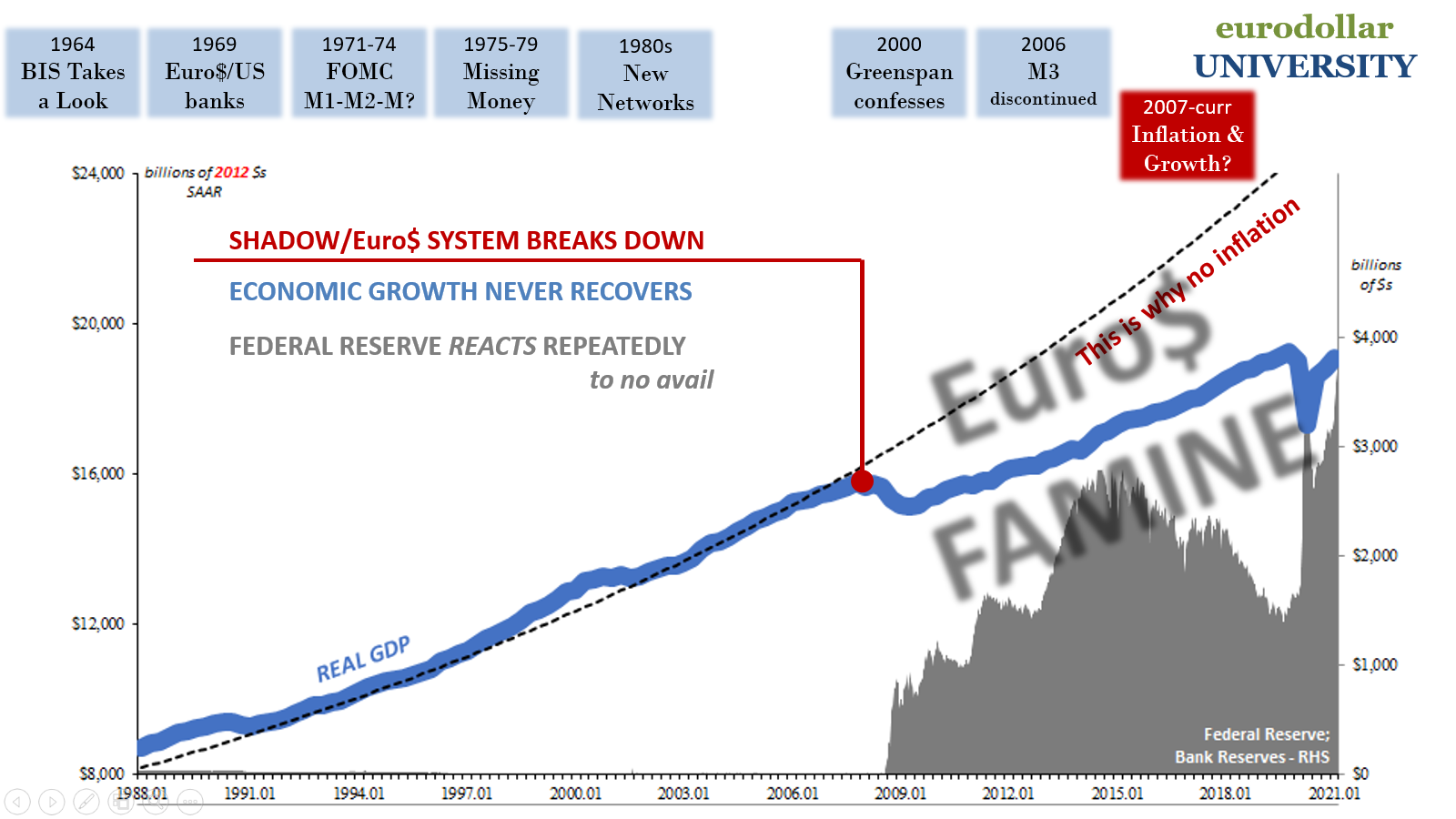

Such profound skepticism especially in the form of long-end Treasury yields is absolutely nothing new. It was, in fact, priced from all the way back following the successive 2007-08 landmines largely because of each of Dudley’s woeful explanations for what was pure monetary panic (leading to an utter lack of effective elasticity response from anywhere at the Fed, starting with the fact they have no idea where to find the monetary system).

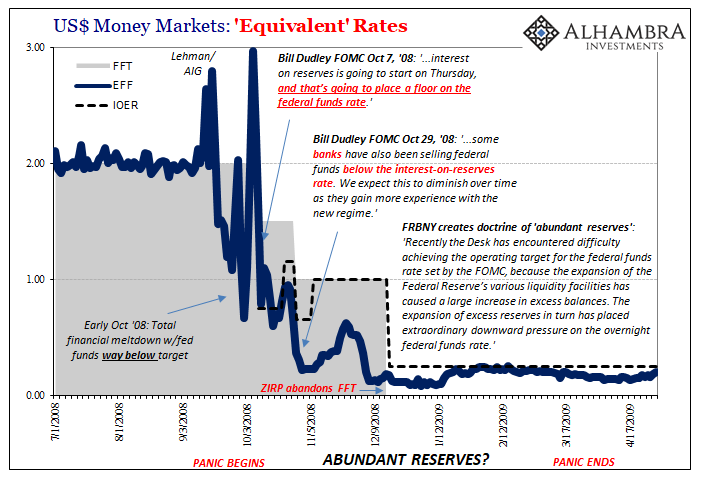

The big landmine right during his “abundant reserves” regime late in 2008 particularly damning as it has proved permanent by repeated (and global) inelasticity.

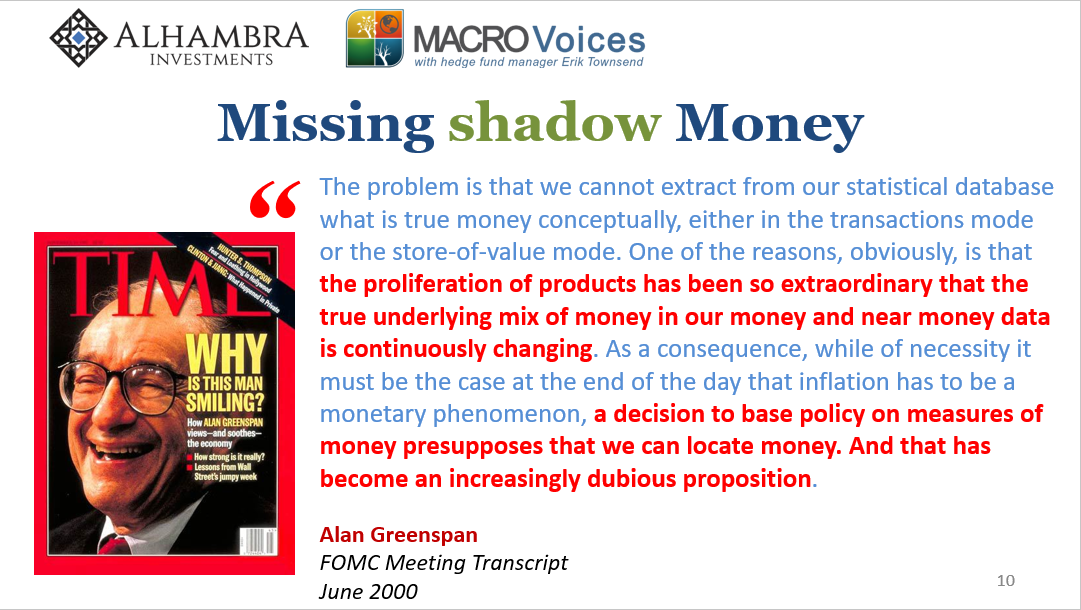

Mainstream Economics sees everything differently; it has to. Admitting the plainly evident interpretation of yields over the last decade plus would be tantamount to confessing how Economics has everything wrong when it comes to central banks and really money itself. This should be no surprise.

To account for this massive discrepancy, as Dudley and everyone in the mainstream sees it, in last year’s essay he first turned to, oh boy, a reincarnation of Ben Bernanke’s discredited global savings glut hypothesis. I won’t belabor his first point here since it isn’t worth the effort: mainly the contention that Baby Boomers are saving more than what gets invested in the real economy, ending up as UST purchases.

More to his and many others’ general point: the Fed and its QE’s are responsible for interest rates sticking to “artificially” low levels. Therefore, long-term yields are no longer reliable, though he craftily adds a nuanced wrinkle:

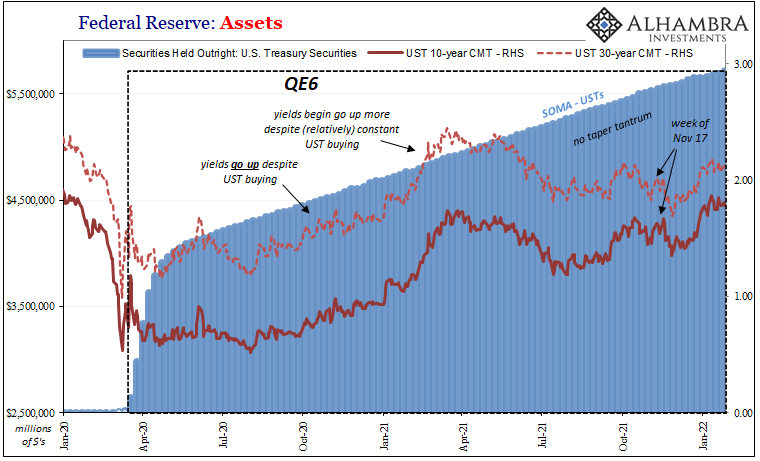

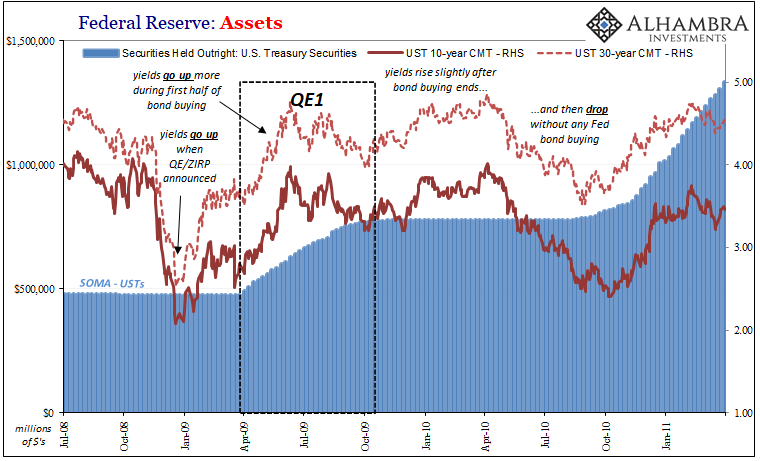

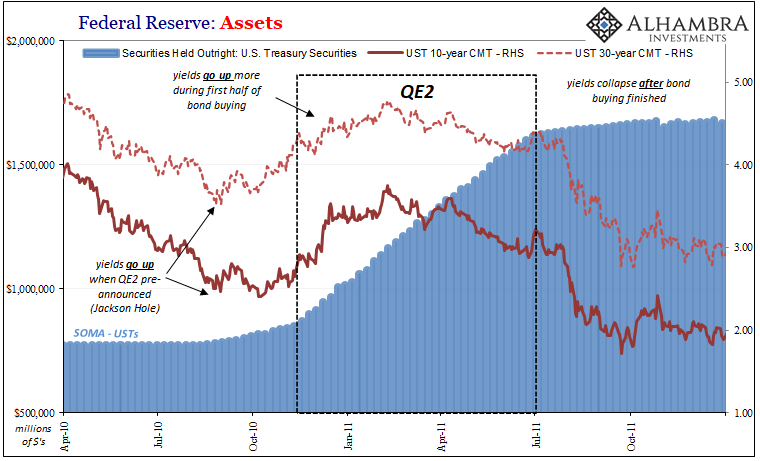

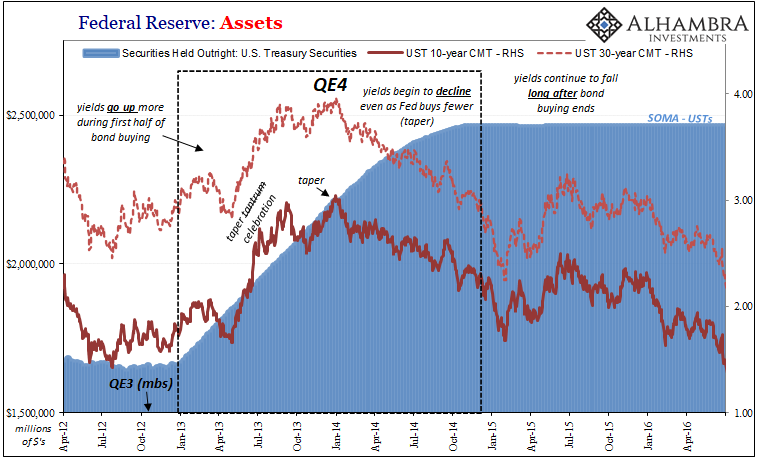

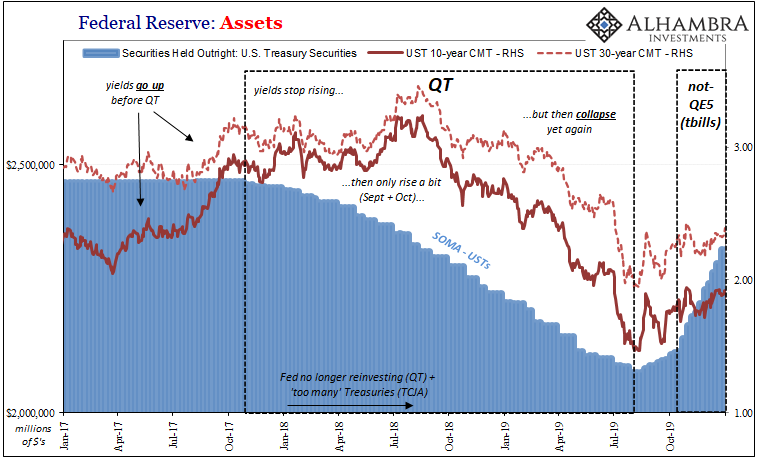

Second, the Fed is buying a lot of longer-term Treasury securities. The effect of such quantitative easing has been evident in real yields since the time the Fed began its asset purchases in 2008: They typically decline whenever the central bank ramps up its purchases. This happens because the Fed takes long-dated securities out of circulation and replaces them with bank deposits and reserves. Investors respond by seeking to replenish their holdings of long-term securities, pushing yields down. But the cash they spend to buy the bonds becomes someone else’s near-zero-yielding deposits, perpetuating the broader impetus to keep buying slightly higher-yielding securities. And the Fed adds to the demand by buying even more. This is why QE may be considerably more powerful than generally appreciated.

Notice the subtle change to the official QE narrative. It used to be: buy bonds, yields fall. No longer – because every bit of mainstream scholarship likewise shows little or no direct link between the theory and outcome. So, for Economists, they have to find some other way to reconcile QE’s otherwise obvious futility.

It is a variation of the “stock argument” if only with an added bit of reverse-engineered theoretical plumbing. They’ve all finally realized that banks have done all the Treasury buying necessary to keep rates down, when this is a common feature of every QE everywhere, but hadn’t been able to come up with a plausible (sounding) explanation for why or how to place it in the context of QE.

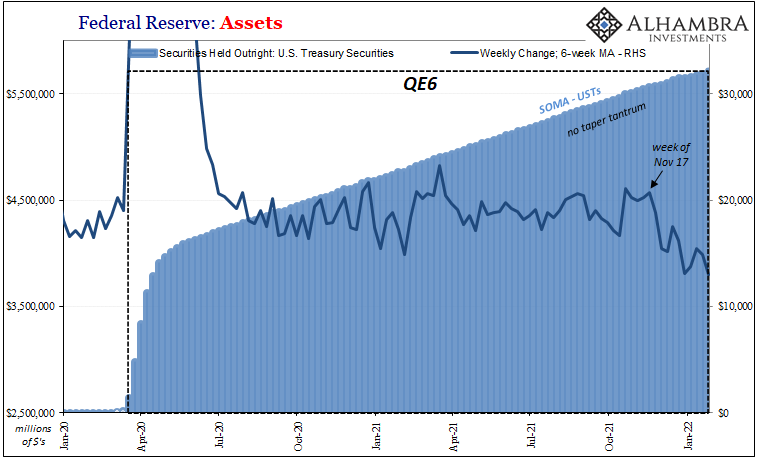

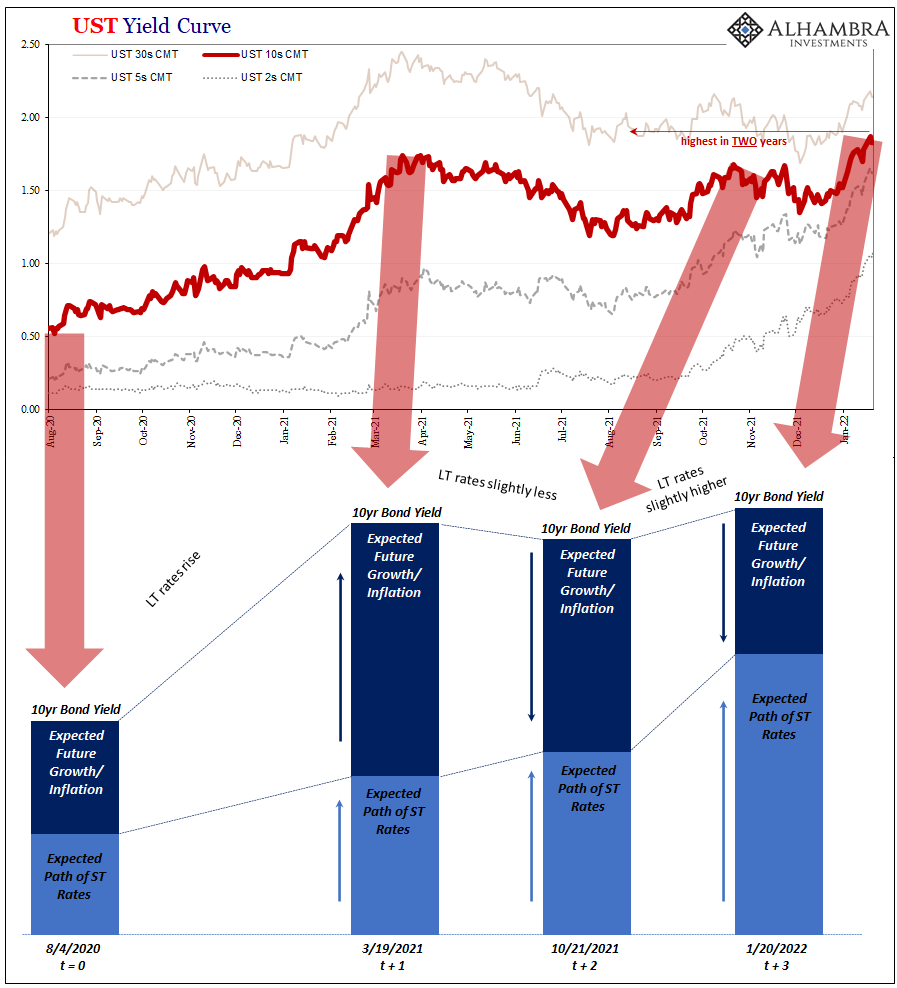

Still no real-world evidence for this wrinkle, however. This is a point – and my main point – we’re witnessing in action right now. The benchmark 10-year Treasury yield is, after today’s trading, only a few bps higher than it had been almost a year ago in mid-March 2021. Even compared to when the above was written in early August, very near the mid-year lows, the 10s have increased by only 45 bps.

This despite now QE having been tapered during the last six weeks (see: above) along with imminent rate hikes and “everyone” including the FOMC onboard with blistering inflationary pressures. What gives?

Not coincidentally, the behavior Mr. Dudley describes in the quoted passage above can also be explained (much better and more historically consistent) by banks who won’t take any risks. In fact, if you really think about what he’s saying, he’s describing that very condition if coming at it from a predetermined perspective to make it sound plausible.

It’s not. Had QE worked at all in any one of its surmised channels (including portfolio effects), then banks wouldn’t want low yielding safe securities, whether Treasuries, bank reserves, or deposits. On the contrary, they’d be moving out of them by the boatload to invest in high nominal returns offered by a normal and healthy economic environment.

Even if you accept what he says, what he says is not consistent with that – at all.

On the contrary, if you look at the behavior of interest rates, especially long-end yields, they are entirely consistent with what Irving Fisher popularized in 1907: growth and inflation expectations. This includes 2013’s taper tantrum which, as Emil Kalinowski has correctly pointed out, was a celebration in how the market was selling safe and liquid even though QE was right at that time being “considerably more powerful than generally appreciated.”

Interest rates haven’t much changed, remaining historically low, despite another taper simply because QE doesn’t work. Nor does it ever explain bond yields and the yield curve.

What did create the appearance of recovery, Uncle Sam, only possessed the power to do so for a short while. This has led to enormous confusion in full part given the stubborn adherence to the idea the Federal Reserve is somehow an all-powerful central bank no matter how much evidence piles up conclusively proving otherwise (more than twenty years and every place QE has been tried).

The Fed isn’t even a central bank; though it does buy a lot of bonds from time to time. This sounds terrifying and conclusive. But how it sounds is really the whole thing and always has been. You may try to twist reality to fit the noise, as Dudley did and others will continue to, it’ll still just be noise.

Source link