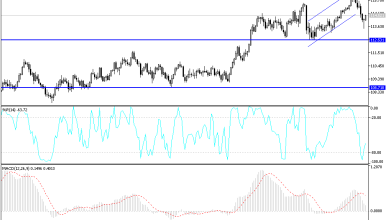

Double-Top Points to More Downside

There is a likelihood that the pair will continue retreating as bears target the next key support at 0.7170.

Bearish View

- Sell the AUD/USD pair and set a take-profit at 0.7170.

- Add a stop-loss at 0.7320.

- Timeline: 1 day.

Bullish View

- Set a buy-stop at 0.7270 and set a take-profit at 0.7330.

- Add a stop-loss at 0.7200.

The AUD/USD pair erased some of the gains it made on Tuesday after the latest interest rate decision by the Reserve Bank of Australia. The pair is trading at 0.7250, which is slightly below Tuesday’s high of 0.7290.

Geopolitics the Driving Factor

The AUD/USD pair rose on Tuesday after the Reserve Bank of Australia (RBA) delivered its interest rate decision. As was widely expected, the bank decided to leave interest rates unchanged at 0.1%, where they have been in the past few months.

The bank also warned about the impact of the current crisis in Ukraine on the Australian economy. Precisely, it warned that the country’s consumer prices will remain at elevated levels for a while because of the rising commodity prices. It expects that inflation will remain above 3.7% throughout the year and retreat in 2023.

As a result of the crisis, the bank now expects to maintain interest rates at the current level for a while. Before the meeting, analysts were expecting it to point towards a rate hike in May this year. The rate decision came a month after it scraped its its quantitative easing program.

Before the RBA decision, data by Markit and the Australian Industry Group pointed to a strong recovery of the manufacturing sector. The two PMIs remained above 50 as manufacturers cheered the growth of demand.

The focus on the pair will be on the crisis in Ukraine that has pushed oil prices to the highest level in years. The prices of other commodities like wheat and aluminum also jumped. To some extent, Australia will benefit because of its vast natural resources.

The pair will also react to the latest data by ADP on US employment. Economists expect the data to show that the economy added 350k jobs in February.

AUD/USD Forecast

The AUD/USD pair declined to a low of 0.7240, which was lower than this week’s high of 0.7290. On the four-hour chart, the pair has formed a double-top pattern. In price action analysis, a double-top is usually a bearish sign.

The pair has moved between the pivot point and the first resistance of the standard pivot points. It is also slightly above the 25-day and 50-day moving averages. Therefore, there is a likelihood that the pair will continue retreating as bears target the next key support at 0.7170.

Source link