Gold Higher Despite Fed Hike Expectations

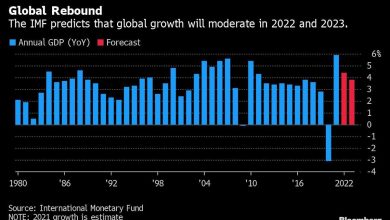

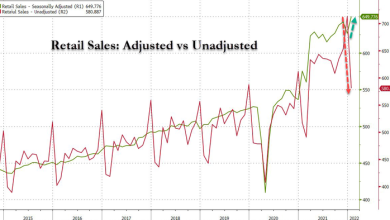

Omicron is looking more like a short-term disruption to the economic outlook and not a destructive headwind that knocks the economy off its course. A wrath of US economic data, which was mostly pre-Omicron painted a picture that showed the economic was moderating, but and remained strong. continue to head into the right direction, higher prices dragged down both incomes and spending, and the Fed’s preferred inflation measure came in much hotter-than-expected.

If the US was not battling the Omicron variant, US stocks would be dancing higher as the Santa Clause rally would have kept the climb going into uncharted territory. It is too early to say for sure if we will get a Santa Claus rally, but given all the short-term risks of Fed tightening, Chinese weakness, fiscal support uncertainty and COVID, Wall Street is not complaining as the is less than a percentage point from record highs.

Just before the open, the FDA authorized Merck’s (NYSE:) COVID antiviral treatment molnupiravir for certain adults. The US economic recovery in 2022 still looks very strong despite fiscal and tightening uncertainty as it now carries an arsenal of vaccines and treatments to win the fight against COVID. Novavax (NASDAQ:) shares went on a ride after reporting its COVID vaccine demonstrated a strong immune response against Omicron, but was lower when compared to other strains.

When you look at all the COVID vaccine/treatment updates over the past 24 hours the news was mostly positive: the Novavax COVID vaccine is effective and will be likely be used, Merck COVID pill will start helping Americans in the New Year, and AstraZeneca (NASDAQ:) COVID booster increases antibody levels against Omicron. The one major setback came from a Hong Kong study that showed that three doses of Sinovac (NASDAQ:) gave inadequate antibodies when fighting Omicron.

US Data

Initial jobless claims edged lower to 205,000, still near the lowest level in more than half a century. The labor market remains tight despite some concerns the Omicron variant could lead to a tentative stall with new hiring. Continuing claims dame in higher than forecasts at 1.859 million.

The industrial sector continues to impress after durable goods delivered a better-than-expected rebound. Commercial aircraft orders drove the 2.5% durable goods jump from a year ago, which was the best increase in six months. The industrial sector outlook going into the New Year remains very upbeat.

The Fed’s preferred inflation gauge, PCE Core Deflator increased 0.5% from a month earlier and surged 4.7% from November 2020. Fed rate hike expectations continue to heat up as the chances of March 16th hike grow. The consensus on Wall Street is that inflation is still not at its peak, so by the time we get to the end of January, a March rate hike may fully be priced in.

The November report was rather confusing. The hot housing market showed new home sales were drastically reduced in October and November’s reading came in softer-than-expected. Still the pressure for higher house prices remains and demand may cool during the holiday season.

The final December reading for showed Americans became more optimistic and inflation expectations edged lower.

FX

President Erdogan’s FX intervention is looking like a genius move given he took advantage of thin trading conditions that gave much more bang for his shorted buck. Turkey’s central bank reported a weekly $5.8 billion decrease in FX reserves in the week to December 17th. In early December Erdogan noted that the CBRT reserves (during that week Turkey used $2 billion in reserves) show no need to worry. The has now rebounded almost 40% since the currency crash at the start of the week.

The key test for the lira will be once normal trading conditions return, volatility should remain elevated.

Energy

Gasoline prices rallied after the fourth largest refinery in the US had a major industrial accident. The fire at the Exxon Mobil (NYSE:) plant in Baytown, Texas was extinguished safely and gasoline prices gave back almost half their daily gains.

stabilized after a wrath of mostly positive COVID vaccine/treatment headlines in the fight against Omicron. It seems all the major catalysts that await oil in the New Year lean towards higher prices. This week, supply disruptions from Libya and Nigeria and a bullish EIA report have WTI crude trading comfortably above the $70 level. The US is a net exporter again, diesel demand roared back, and stockpiles are dropping.

WTI crude will likely consolidate around the low-to-mid-$70s until OPEC+ gives a hint on what they will do at the January 4th meeting on output or if a major development happens with Europe’s energy crisis.

Gold

prices are holding up nicely despite another round of US data that mostly supported the case for the Fed to raise rates in March. Fed rate hike expectations have been constantly swinging over every data point and assessment over how Omicron will delay parts of the economic recovery and potentially fuel more inflation.

Gold should have a strong 2022 as the risks to the outlook remain elevated and that will likely lead to more easing from Beijing, dovish Fed rate hikes in the summer, and a weakening dollar as investors bet on Europe’s growth potential.

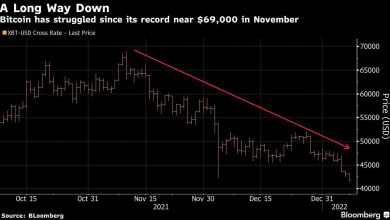

Bitcoin

For a market that trades 24/7, appears like it doesn’t want to move despite a modest risk appetite mood on Wall Street. Bitcoin and have benefited the most this year on risk-on rally days, so today’s weakness suggests market participation is very low and entry orders are rather distant.

Source link