Gold gains on concerns over Ukraine crisis, inflation

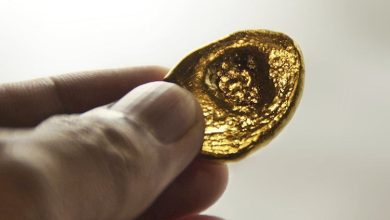

A one kilo Swiss gold bar and US dollars gold coins are pictured in Paris on February 20, 2020.

JOEL SAGET | AFP | Getty Images

Gold rose on Wednesday as unruly inflation and the intensifying Ukraine crisis fed demand for the safe-haven metal, although a firmer dollar and high bond yields put a lid on gains.

Spot gold rose 0.8% to $1,937.52 per ounce by 2:05 p.m. ET. U.S. gold futures settled up 0.8% at $1,937.30.

“You’re seeing a little bit of safe-haven demand and a little perceived bargain hunting at lower price levels in the gold market,” said Jim Wyckoff, senior analyst at Kitco Metals.

The yellow metal had scaled record highs earlier in March but retreated sharply from those levels in the run-up to last week’s Federal Reserve meeting.

Prices have since moved into a more steady range as the market digested a more hawkish outlook from Fed policymakers.

High inflation is in favor of precious metals and it is “not going to go away anytime soon,” Wyckoff said. He added that rising bond yields were limiting the gains in gold and could force the metal to trade “sideways and choppy.”

Yields on the benchmark U.S. 10-year Treasury hit their highest in nearly three years, yet eased to 2.357%, increasing the opportunity cost of holding zero-yield bullion.

The dollar was also higher on the day, making gold expensive for holders of other currencies.

Adding to gold’s appeal, U.S. stock indexes fell on Wednesday as oil prices climbed over $121 per barrel.

Holdings of the world’s largest gold-backed ETF, SPDR Gold Trust, hit their highest since March 2021 this week.

“What’s phenomenal at the moment and a good indicator of a beginning of a gold bull market is ETF (exchange traded fund) demand remains remarkably strong,” independent analyst Ross Norman said.

Spot silver rose 1.2% to $25.05 per ounce, platinum fell 0.6% to $1,017.15, and palladium rose 1.4% to $2,518.30.

Source link