U.S. Has More Credit Cards Than Ever as Issuance Surged in 2021

(Bloomberg) — U.S. lenders issued more credit cards than ever last year, with a growing share of them going to consumers with lower credit scores.

Most Read from Bloomberg

A record 196 million Americans held cards at the end of 2021, according to a report by credit-data agency TransUnion. In the third quarter, the latest for which detailed numbers are available, the number of new cards issued hit an all-time high of 20.1 million, it said. Some 9 million of them went to so-called non-prime borrowers — those with poor or fair credit.

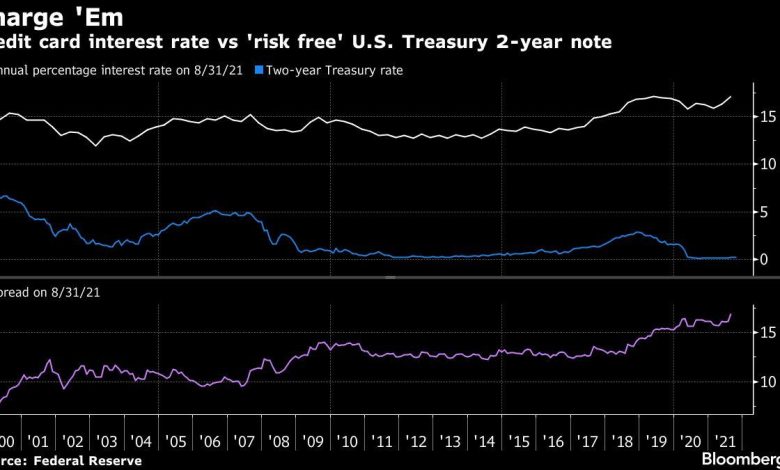

The surge shows how lenders seeking growth are eager to tap into consumers who’ve largely been able to meet their obligations even after pandemic stimulus programs ended last year. Credit-card issuers have been ramping up marketing campaigns and competing to lure customers. Interest rates charged on cards were at longtime highs last year relative to risk-free rates on Treasury debt.

Capitol One Financial Corp., primarily a card lender, spent almost $1 billion on marketing in the October-December period, double the sum it spent in the first quarter.

“I am struck by how the consumer is in a very good place right now,” Capitol One Chief Executive Officer Richard Fairbank said on a Jan. 25 earnings call. “We’ve got a strong consumer,” he said, with “everybody sort of roaring out of the pandemic.”

Consumers are still relatively cautious with their new cards. The average balance per borrower was little changed from a year earlier in the fourth quarter, at $5,127, and remained well below pre-pandemic levels, TransUnion said.

One unknown risk for issuers is that unless student loan repayments are forgiven or paused once again, millions of Americans will have to meet those loan obligations in May when the forbearance period ends.

Student loan payments, typically in the hundreds of dollars per month, will force many households to make budget decisions.

“For a portion of those consumers, that will mean less disposable income available for discretionary purchases, that could result in lower amounts being added to card balances each month,” Charlie Wise, senior vice president of research and consulting at TransUnion, said by email.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link