Omicron could prompt looser Fed policy: Analyst

Persistent issues surrounding the coronavirus have proven to be an annoying thorn in an otherwise hot economy’s side. The Omicron variant has spread rapidly throughout the U.S. the past four weeks, with at least 41% (and possibly much more) of U.S. cases being the Omicron strain.

“Perversely, bad news around Omicron might be good news for the markets because it gives the Fed the impetus to continue with these very loose monetary policies,” said Octavio Marenzi, co-founder and CEO of Opimas, in a recent interview with Yahoo Finance Live. “Too much good news for the real economy might actually be quite bad for the markets.”

Opimas is a capital markets consultancy offering clients insight and craft strategies on financial matters. Marenzi co-founded the organization in 2015 along with managing director Medi Agami.

Markets have faltered, recovered, then faltered slightly again in a series of up-and-down cycles since the first case was announced in early December. The increased transmissibility of Omicron has given rise to fears of lowered demand and potential shutdowns or closures. However, potential economic hazards could prove fruitful for economic growth in the near-term, he said, as they could prevent more tight monetary policy from occurring.

“Obviously, if we have really hard shutdowns and the economy comes to a crashing halt as a result of Omicron, which I don’t think will happen but let’s assume it did, that, of course, would be very bad for markets,” Marenzi said. “But if it’s sort of just in the middle … for the economy as a whole, [if] it’s just an irritation, but it allows the Fed to continue these monetary policies, it’s going to be very good for the markets.”

For those affected directly, the virus is much worse than just an irritation, Marenzi added, but the macroeconomic implications could be net positive.

“The primary thing the markets are concerned about right now is the Fed’s policy and what is the Fed going to do,” he said. If Omicron threatens to threaten businesses already struggling with a labor shortage and rising material and labor costs, the Fed may be less inclined to pursue a tight monetary policy.

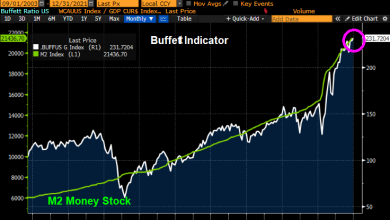

Faced with historically high inflation rates (November’s CPI report noted that the 6.8% increase in inflation was the highest mark since the late 1970s), the Fed announced in mid-December that they would begin tapering off asset-buying COVID-relief programs several months ahead of schedule.

The 10-year U.S. Treasury yield (TNX) traded at 1.48% on Tuesday afternoon. Earlier this month, yields rose around 2 basis points after the announcement evidenced a more proactive Fed approach to curtailing high inflation.

Marenzi noted that, should inflation grow out-of-control next year, the Federal Reserve may be forced to raise rates aggressively. This would spell bad news for markets, especially if they were still suffering from the effects of the Omicron variant.

“I think what we’ll see then is… there’ll be a severe market reaction,” he said. “It will come tumbling down. The markets, equities markets and bond markets, will be a very bad place to be. The smart money will then be in absolute cash in very, very short-term money market instruments or actually just bank deposits or something like that.

No asset class would really be safe in this event, Marenzi said, including crypto assets and real estate because most asset classes are “basically dependent on Fed largesse.”

Ihsaan Fanusie is a writer at Yahoo Finance. Follow him on Twitter @IFanusie.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link