NZD/USD Digesting Q4 Jobs Report as APAC Traders Eye RBA Chart Pack

New Zealand Dollar, NZD/USD, NZ Jobs Report, Lunar New Year, OPEC – Talking Points

- New Zealand Dollar nearly unchanged following NZ’s fourth-quarter jobs report

- RBA Chart Pack, Governor Philip Lowe Speech and upcoming OPEC meeting eyed

- NZD/USD testing the 9-day Exponential Moving Average after overnight strength

Wednesday’s Asia-Pacific Forecast

Asia-Pacific markets look primed to move higher on Wednesday after a rosy session on Wall Street overnight. The Dow Jones Industrial Average (DJIA) closed 0.78% higher. The risk-on trading pushed the safe-haven US Dollar broadly lower, with the DXY index down nearly half a percentage point. That benefited risk-sensitive currencies, including the New Zealand Dollar.

Kiwi Dollar traders are digesting fourth-quarter jobs data released earlier this morning, which showed a 0.1% quarter-over-quarter employment change. That missed the 0.4% q/q Bloomberg consensus forecast and was well under Q3’s 1.9% revised figure. However, the jobless rate fell to 3.2% from 3.3% (revised), beating expectations by 0.1%. The miss is largely attributable to the Omicron variant’s spread through the October to December months.

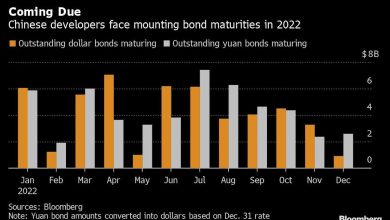

Today’s trading liquidity may be lighter than normal due to the Lunar New Year holiday closing many east Asian markets for the remainder of the week, including Chinese equity and bond markets. The Reserve Bank of Australia is set to release its chart pack, as usual, following policy decisions. AUD/USD initially dropped in reaction to yesterday’s policy decision, but the ailing USD helped reverse that move shortly after. RBA Governor Philip Lowe is due to speak today, which may generate some headlines.

Oil prices were largely unchanged overnight despite the market’s risk-on tone. WTI crude oil prices are trading near the highest levels since October. Given those price levels, OPEC — in its meeting this week — may opt to increase production in the coming months by more than 400k barrels per day, which has been the cartel’s default output bump in recent meetings. Elsewhere, gold and silver prices inched higher overnight on USD weakness.

NZD/USD Technical Forecast

NZD/USD is nearly unchanged in early trade, following an overnight gain of around 0.93%. The 9-day Exponential Moving Average (EMA) appeared to halt the pair’s advance, but breaking above the EMA could push prices near the 0.67 handle. Alternatively, a reversal lower would likely bring prices back to trendline support, which was seen underpinning prices last week.

NZD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link