Argentina’s Central Bank Hikes Rate for First Time in a Year

(Bloomberg) — Argentina raised its benchmark interest rate for the first time in over a year as it faces calls from the International Monetary Fund to tighten its monetary policy.

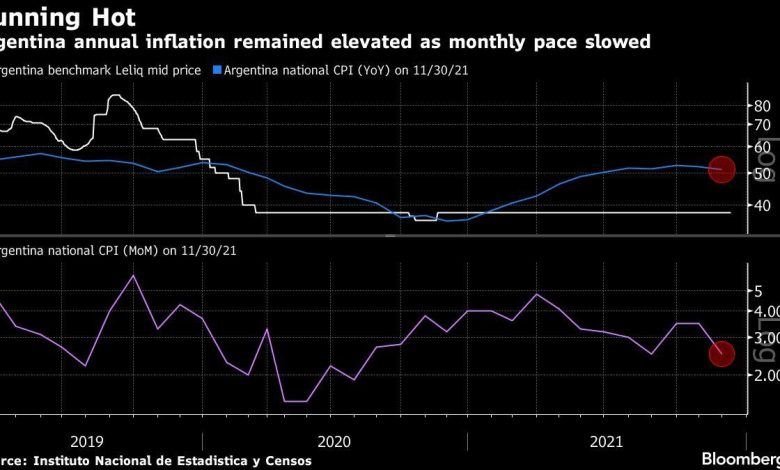

The central bank lifted the key Leliq rate to 40% from 38%, the level it had stood for over a year even with annual inflation running at around 50%. The bank’s unorthodox approach until now had contrasted with a wave of rate hikes by central banks across the globe, seeking to battle accelerating inflation.

IMF officials urged Argentina in December to implement an “appropriate” monetary policy as part of talks for a new program to reschedule payments on about $40 billion owed to the lender. They specifically called for interest rates to exceed inflation.

Read More: Argentina Government Rhetoric Suggests IMF Deal Far Off

“The rate hike is a step in the right direction, but too timid to matter,” said Adriana Dupita, an economist with Bloomberg Economics. “The central bank will need to raise the rate further if it intends to use monetary policy to tackle inflation — with or without a deal with the Fund.”

Bloomberg News reported last month that central bank authorities were considering a rate hike.

Read More: Argentina Bonds Slump as Economy Chief Criticizes IMF Proposals

The bank, which isn’t independent from the executive branch, has printed money to finance government spending throughout the pandemic, raising concerns about future inflation. Economists surveyed by the monetary authority expect prices to rise 52% this year.

The central bank also announced a series of technical measures Thursday:

-

The rate on 28-day Leliq note will continue to serve as the benchmark

-

Central bank to participate in secondary market for public bonds

-

It will create a new, 180-day Leliq note with a fixed annual rate of 44%

-

It will progressively eliminate 7-day repo notes

-

For individuals, the annual rate on fixed time deposits of 30 days will rise to 39%

-

For other depositors, rates on fixed time deposits will be 37%

-

Central bank expects price pressures to ease and expectations for the exchange rate to improve in 2022

(Adds economist quote in fourth paragraph.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2022 Bloomberg L.P.

Source link