Surge in Government Tax Receipts Papers Over Federal Spending Problem

With a surge in April tax receipts, the federal government ran a record budget surplus last month. This seems like good news. And the mainstream spun it as such. But record government revenue is papering over a spending problem that isn’t going away.

The surplus in April was $308.2 billion. This pushed the fiscal year budget deficit down to $360 billion with five months to go.

Record tax receipts of $863.6 billion flowed into the Treasury in April with the tax filing deadline falling within the month. For comparison, March government receipts totaled $315.2 billion. December was the second-highest revenue month of fiscal 2022 with receipts totaling $486.7 billion.

In other words, April’s record inflows into the Treasury were an anomaly that won’t likely be repeated.

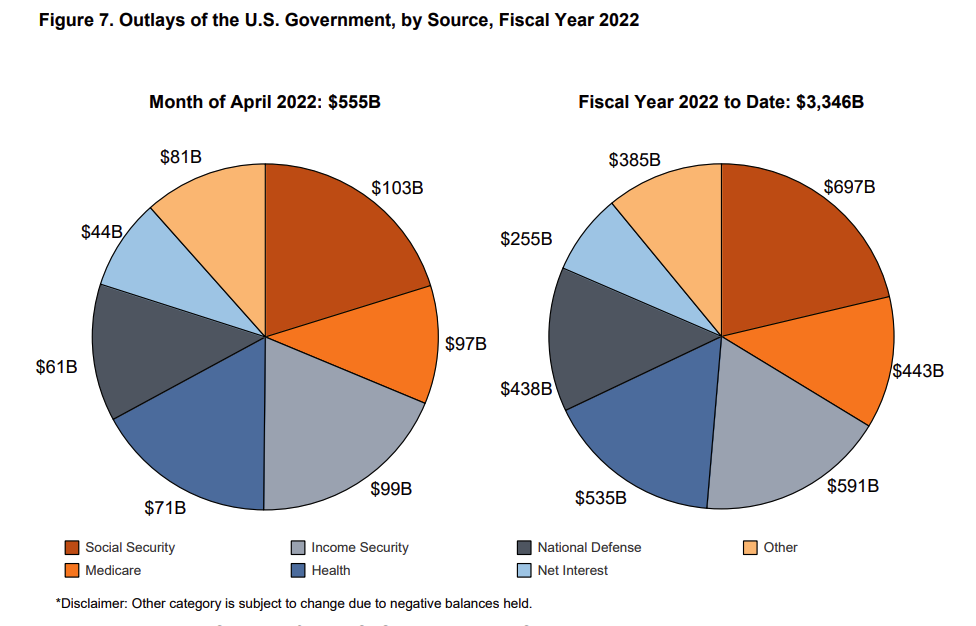

On the other hand, government spending has remained remarkably consistent throughout the year. Uncle Sam blows through about half a trillion dollars every month. In fact, the federal government spent more money in April than any previous month this fiscal year — $555.4 billion. That brings total spending this year to $3.35 trillion.

The mainstream keeps telling us that spending is dropping with the end of many pandemic-era programs. This is true. Stimulus and other programs ballooned spending over the last two years. But if you strip out the pandemic programs and look at baseline outlays, it’s clear that the federal government is nowhere near getting its spending problem under control.

Meanwhile, President Joe Biden wants to keep spending, and he wants to spend more. His budget raises spending on everything from domestic programs to the Pentagon.

The bottom line is the Treasury can’t depend on record revenues every month to push the deficit lower. Next month, tax receipts will almost certainly drop back closer to the yearly average of around $300 billion. That means you can expect a return to big deficits.

Mainstream pundits breathlessly reported that the 2022 deficit could come in under $1 trillion. This sounds like a great accomplishment until you put the numbers in context. Prior to the pandemic, the US government had only run deficits over $1 trillion four times — all in the aftermath of the 2008 financial crisis. Trump almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit prior to the pandemic. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked. Now it appears the government is settling back into the status-quo – running ’08 financial crisis-like deficits every year.

And if the economy spins into a recession as the Fed tightens monetary policy to fight raging inflation, you can expect revenue to tank, meaning even bigger budget shortfalls.

Simply put, the April Treasury report does not signal an end to borrowing and spending. It’s not “problem solved.” It’s just “problem papered over.”

The national debt currently stands at $30.38 trillion. That’s about $10 billion higher than this time last month, even with the big surplus.

According to the National Debt Clock, the debt to GDP ratio is 128.99%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $91,470 in order to pay off the national debt.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link