United States Annualized Inflation Falls to 6%

The Bureau of Labor Statistics (BLS) has confirmed that annualized inflation in the United States has fallen for the eighth successive month in February down to 6%.

US inflation data released yesterday showed a fall to an annualized rate of 6%, as had been widely expected. However, month-on-month prices did rise by 0.4%, slightly below the 0.5% rise recorded from December to January.

The 6% increase in the year to the end of February was the lowest annualized inflation recorded since September 2021.

However, core inflation, which excludes food and energy, remained high year-on-year at 5.5%, having increased by 0.5% for February.

This data will be in firmly in the thoughts of the Federal Open Market Committee which meets on 21st and 22nd of March, to discuss its next move on interest rates.

The Cleveland Federal Reserve anticipated that annualized inflation would be set at 6.2%, but did expect a 0.5% monthly increase in prices.

As for next month’s inflation data, it currently is forecasting that monthly inflation will fall by just under 0.3%, while year-on-year inflation will decline meaningfully again to slightly below 5.4%.

The Federal Reserve faces a difficult two days before coming to a decision on interest rates, especially in the aftermath of the failure of the Silicon Valley Bank.

Fears of contagion and significantly increased instability in the financial system may prompt the Fed to hike rates by no more than 0.25%, or pass on a hike entirely.

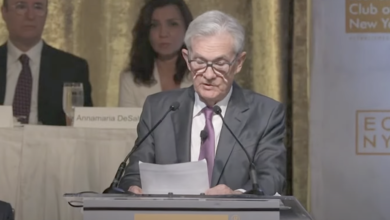

Recently Federal Reserve Chairman Jerome Powell said that rates might be called higher than expected, due to stronger economic data in the early part of this year than what was predicted.

Higher demand in the economy could lead to faster monetary policy tightening to stabilize prices.

However, some economists have said that as there has been increased stress in the banking system partly due to the rate-rising cycle, further borrowing cost increases might even be paused.

The CME FedWatch Tool overwhelmingly believes that there will be another 0.25% rate rise next week, with 82.7% of its respondents saying that this will happen.

Nigel Green, CEO of the deVere Group reflected: “The 6% headline figure is positive, and together with the collapse of Silicon Valley Bank and Signature Bank, the second and third biggest bank failures in United States history, will certainly give the Fed cause to reconsider their rate hiking agenda.”

“However, against a backdrop of a robust labor market, we still expect the central bank will raise interest rates by 0.25% at their next meeting on 22nd March.

Should the Fed pause the rate hike agenda now, it puts them at risk of exposing themselves to inflation speeding up again.

But due to the time-lag associated with CPI data, we would champion a move by the Fed not to raise rates at all later this month.”

Shoppers are still having to deal with stubbornly high food prices as they increased by 0.4% in February, year-on-year food prices have now risen by 9.5%.

The food at home index grew by 0.3% for February, while there was a bigger jump in food away from home prices which rose by 0.6%.

Over the year up to February prices for food that is consumed at home has increased by 10.2%, highlighting the leap in prices found at grocery stores.

There was better news for energy prices overall, as they fell 0.6% month-on-month.

Gasoline prices have now fallen 0.2% over the year up to February.

Yet energy services prices which include electricity and utility gas costs, have risen by a huge 13.3% year-on-year.

Electricity prices increased by 0.5% in February, and by 12.9% annually.

Utility gas prices dropped by 0.8% for last month, but over the year it has still climbed upwards by 14.3%.

The shelter index was the biggest contributor to the price growth for February and accounted for over 70% of the 0.4% increase.

In the aftermath of the CPI announcement, the United States 2-Year Treasury yield increased by 0.35% up to 4.35%.

The increase can be seen as a reflection of the banking headwinds, despite the inflation reduction which usually would prompt slower rate rises.

The United States Dollar made gains against other major currencies, but the Forex market has been relatively muted.

Overall, the greenback appreciated most against the Yen by 1.03% in the USD/JPY currency pair, with $1 buying ¥134.40.

There were also increases against the Euro and the UK Pound by 0.07% and 0.05% respectively.

Stock markets gained following the CPI data release, with the S&P 500 Index ending the day up by more than 1.65%. However, many banking shares continued to decline.

Source link