Challenges 1.36 Level Post BoE Rate Hike

- The GBP/USD pair could extend its growth if it takes out the immediate obstacles.

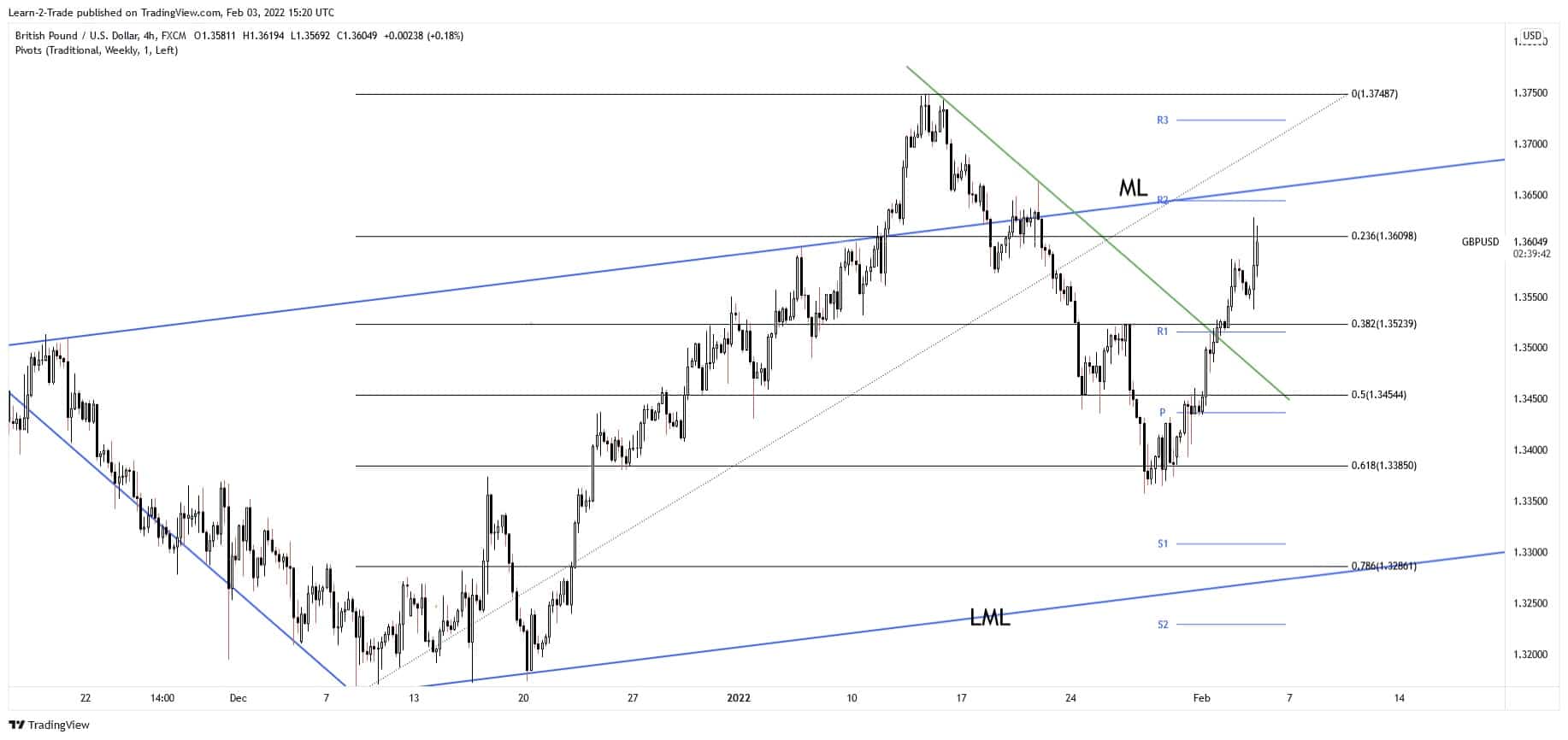

- A bearish pattern around the median line (ML) could signal a new sell-off.

- As long as the DXY drops, the currency pair could approach and reach new highs.

Our GBP/USD forecast sees the pair rally right after the BoE raised interest rates to 0.5%, reaching the 1.3627 level. Now, it’s traded lower at 1.3593 at the time of writing right below the 1.3600 psychological level.

In the short term, the DXY’s strong sell-off forced the USD to appreciate versus its rivals. The Dollar Index drops like a rock, it seems unstoppable, that’s why the USD could resume its short-term depreciation.

On the other hand, the British Pound remains bullish after the hawkish Bank of England.

3 Free Forex Every Week – Full Technical Analysis

As you already know, the Bank of England decided to raise its Official bank Rate from 0.25% to 0.50% as expected. Further rate hikes are expected in the coming monetary policy meeting, so this could be good for the GBP.

Speaking about the USD, the United States economic data came in mixed earlier today. The ISM Services PMI was reported at 59.9 points above 59.5 expected, but below the 62.0 in the previous reporting period, the Factory Orders dropped by 0.4% as expected, while the Unemployment Claims came in at 238K versus 245K expected.

In addition, the Final Services PMI jumped from 50.9 to 51.2, while the Prelim Nonfarm Productivity and Prelim Unit Labor Costs came in worse than expected.

If you want to try your hand at forex day trading then read our guide to getting started.

GBP/USD Price Technical Analysis: Swing Higher

After ignoring the downtrend line, the GBP/USD pair was somehow expected to resume its leg higher. The 1.36 psychological level and the 23.6% (1.3609) represent near-term upside obstacles. Technically, the price found support at the 61.8% signaling that the downside movement ended.

The ascending pitchfork’s median line (ML) is seen as a major target and obstacle. It remains to see how the pair will react around this dynamic resistance. The pair could extend its rally as long as the DXY drops deeper.

A valid breakout above the median line may confirm an upside continuation. On the contrary, a bearish pattern around this dynamic resistance could announce a potential leg down.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link