Despite Record Receipts Uncle Sam Still Ran a Budget Deficit in December

Despite a monthly record in receipts to the US Treasury, the federal government still managed to run a deficit in December. That’s because the federal government also broke a monthly spending record.

The December budget deficit was $21.30 billion, according to the Monthly Treasury Statement.

Through the first three months of fiscal 2022, the deficit stands at $377.69 billion.

The mainstream breathlessly reported this as good news. It was, after all, the smallest budget deficit in two years. But December is typically a small deficit month. The deficit in December 2019, before the pandemic, was $13 billion.

With more people working, government receipts rose sharply in December, helping to close the budget gap. The Treasury took in $486.7 billion. According to Reuters, it was the highest December income for the US Treasury in history. It was also higher than the total monthly receipts for any month last year.

There was a 44% increase in individual income and payroll taxes withheld, while other individual tax payments rose 13% for the month.

All of this revenue helped hide Uncle Sam’s continued spending problem.

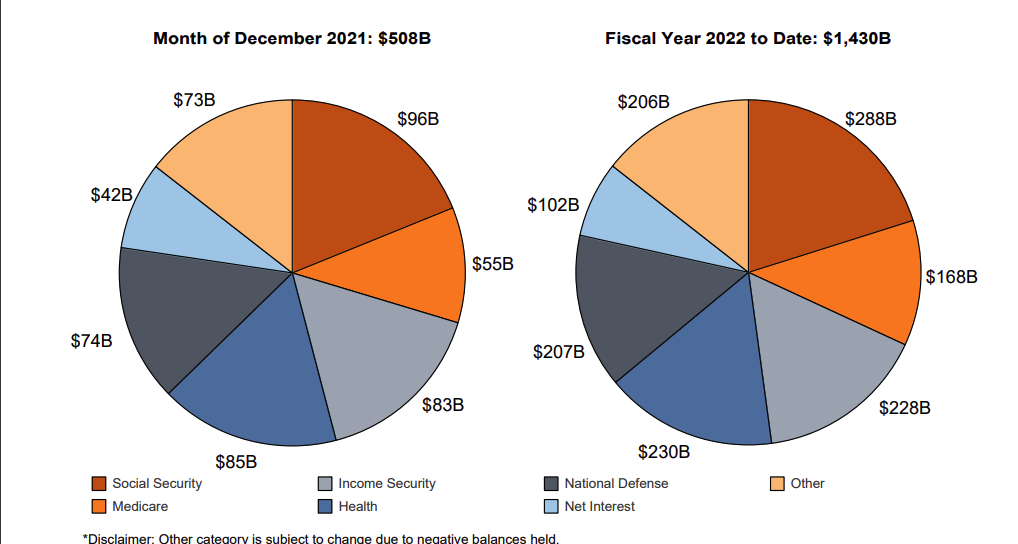

In December alone, the federal government spent $508 billion. The was the highest December spending level ever. Through the first three months of fiscal 2022, the federal government has already spent $1.43 trillion. That’s a record for the first quarter of any fiscal year, according to Reuters.

An easing in coronavirus has done nothing to ease the pandemic of federal government spending.

As of Jan. 11, the national debt stood at $29.8 trillion. Just one month ago, the debt was still below $29 trillion. It quietly crossed that threshold on Dec. 16, not long after Congress raised the debt ceiling. Uncle Sam is now on the fast-track to $30 trillion in debt.

And there is no end in sight to the spending. Congress has already passed a massive infrastructure bill. For the time being, the “Build Back Better” bill has stalled. But there is no doubt the Democrats will come up with another plan or they’ll strong-arm Joe Mancin (D-WV.) into getting onboard with the plan. Supporters of these big spending plans promise tax increases and government savings will “pay for” the spending. But it’s almost certain tax receipts will fall short of projections and spending will be even higher than budgeted.

That’s how government always works.

According to the National Debt Clock, the debt to GDP ratio is 127.36%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

Every American citizen would have to write a check for $89,641 in order to pay off the national debt. That’s $2,514 more than last month.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link