Selling Still a Trading Strategy

The price of the USD/JPY currency pair is still subjected to selling operations that pushed it recently towards the 114.49 support level, before settling around the 115.20 level, after announcing the rise in US consumer confidence. The selling was primarily due to investors’ flight from risk in light of the Russian-European crisis which may hinder the future of the global economic recovery, which has not yet recovered from the effects of the epidemic.

The yen is a popular asset during turbulent times.

As it was announced. US consumer confidence has fallen slightly this month but remains high, even as prices for almost everything continue to rise. The Conference Board, a trade research group, said that the US Consumer Confidence Index – which takes into account consumers’ assessment of current conditions and their expectations for the future – fell to a reading of 110.5 in February from a reading of 111.1 in January. The Conference Board’s Current Situation Index, which measures consumers’ assessment of current business and business conditions, rose slightly this month to 145.1 from 144.5 in January. The expectations index, which is based on consumers’ six-month expectations of income, business and the labor market, fell to 87.5 in February from 88.8 in January.

Inflation concerns increased in February after the previous two months’ decline and the proportion of people planning to buy homes, cars and major appliances fell over the next six months, however, consumer confidence remains high in the US, even though prices for nearly everything are up. Earlier this month, the Labor Department reported that during the 12 months ending in January, inflation was 7.5% – the fastest annual pace since 1982.

Prices for cars, gas, food and furniture have all risen sharply, but so far they haven’t deterred US consumers, who ramped up their spending at retail stores last month. The government reported last week that US retail sales jumped 3.8% from December to January, a much larger increase than economists had expected. Although inflation helped drive the figure, most of January’s gain reflected more buying, not a price hike.

The Fed is expected to start raising US interest rates in March for the first time in three years, the main anti-inflation mechanism. Many economists say the Fed is ahead of it too late.

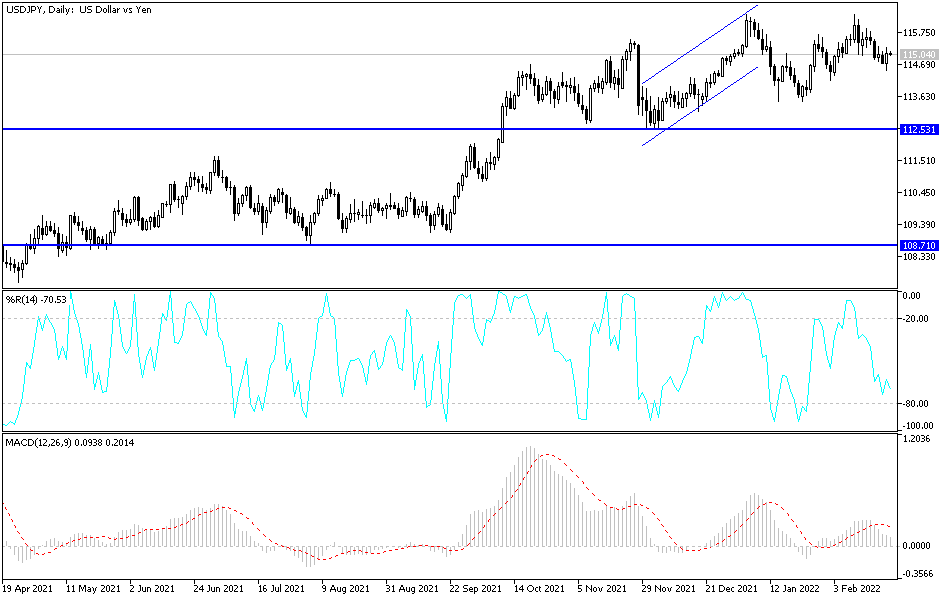

According to the technical analysis of the pair: The price will remain below the 115.00 level. It is important to push the bears of the USD/JPY currency pair towards stronger bearish levels, and the closest ones are currently 114.30, 113.75 and 112.90, respectively. These are important areas for changing the general trend to a downtrend.

On the other hand, the bulls are trying to hold on, but if the escape from risk increases, it may quickly run down. On the other hand, the bulls should move to breach the resistance levels 115.45 and 116.30 to confirm the strength of control. The currency pair will be affected today by risk appetite, in the absence of influential US economic data.

Source link