Fed’s Favorite Inflation Indicator Spikes To Almost 40-Year-Highs, Real Spending Flat

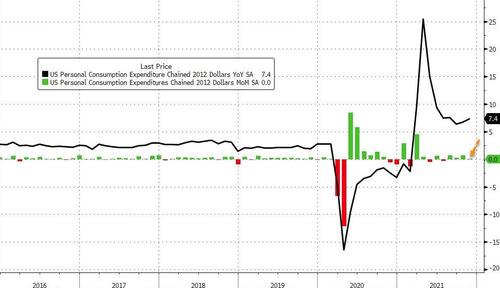

The growth is Americans’ personal spending was expected to decelerate in November, as income growth also slowed. Analysts narrated October’s surprise spending gain as being driven by pull-forward on supply-chain availability fears. Analysts nailed it for once with both income and spending coming in as expected (+0.4% MoM and +0.6% MoM respectively)

Source: Bloomberg

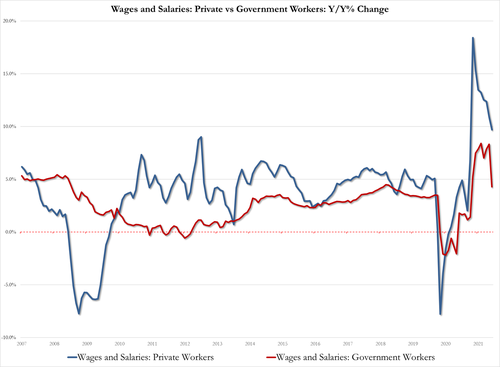

Wage growth for private and government workers slowed dramatically last month…

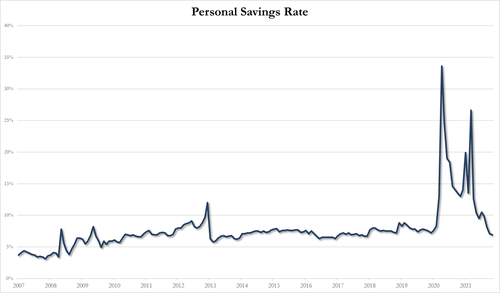

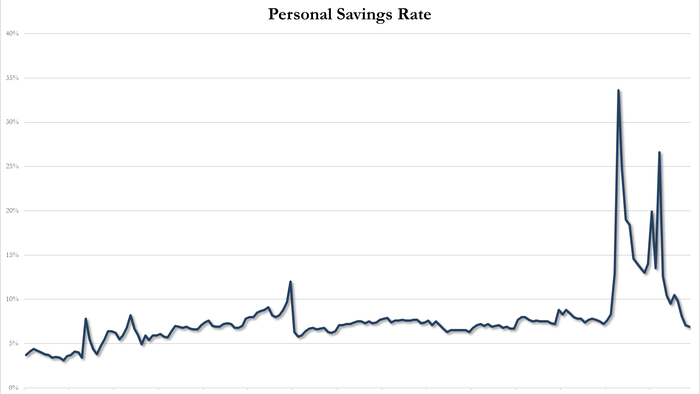

This is the 9th straight month of spending increases, and notably far higher than the income growth. Obviously that means the savings rate is tumbling… and it just plunged to its lowest since Dec 2017!

Finally, and perhaps most importantly, The Fed’s favorite inflation indicator – the core PCE deflator – soared in the last month. The headline PCE deflator hit 5.7% YoY, the highest since June 1982…

Source: Bloomberg

Which left real personal spending unchanged MoM, worse than the +0.2% MoM expected and well down from the +0.7% MoM in October…

Source: Bloomberg

Get back to work Mr.Powell

Source link