Bulls Lack Conviction amid Low Activity on Christmas Eve

- Despite rising close to a weekly high, gold prices remain dormant.

- Risk sentiment and softer dollars favored gold buyers, despite higher returns.

- In the short term, Omicron, US stimulus, and China are important catalysts.

The gold price forecast is bullish despite the fact that the metal is lacking any strong conviction as the market activity is low around the year end. After updating the weekly high to $1810 the previous day, gold prices balance around $1809. However, the yellow metal shows a typical lack of activity in the market on Christmas Eve.

–Are you interested to learn more about STP brokers? Check our detailed guide-

However, a South African covid variant dubbed Omicron has recently led to a reduced risk of hospitalization for bulls. Positive news for gold was the FDA’s approval of Merck’s Covid-19 pill a day after Pfizer approved the Omicron pill. In addition, the US military announced earlier this week that it had developed a single covid drug and its variants.

Despite this, the cancellation of French orders for Merck tablets, citing a smaller effect than was anticipated, joins a steady increase in Omicron cases to challenge market optimism and gold prices.

Stronger US data supported higher US government interest rates, which reached a monthly high of around 1.50%. Recent economic indicators have favored bond bears, such as the rise in the Fed’s preferred inflation measure, the core PCE price index, durable goods orders, and Michigan’s consumer sentiment index.

Also challenging the risk mood and gold buyers are US President Joe Biden’s Build Back Better (BBB) plan and China’s disgust with a US bill that highlights the concerns of the Uighur minority.

Additionally, the last words of a Fed spokesman, Christopher Waller, were hawkish and indicated an upcoming hike in interest rates, which again dampens the outlook for the metal.

Due to reduced market activity during the holidays and the downturn in several western stock exchanges, traders may face challenges.

–Are you interested to learn more about Forex apps? Check our detailed guide-

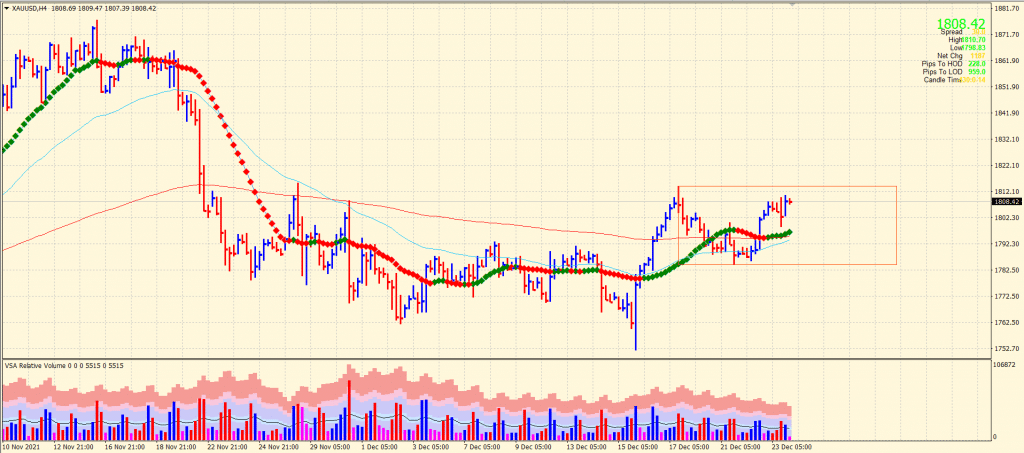

Gold price technical forecast: Bulls facing resistance

The gold price is consolidating in a tight range above $1,800. Although the price is above key SMAs, the $1,815 will remain a barrier for the bulls. However, the volume gives no clue for any directional bias. Therefore, the price is likely to stay within $1,780 to $1,815, and a clear breakout is required to find a directional bias.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link