EUR/USD Technical Analysis: Advantage of USD Decline

The EUR/USD exchange rate moved towards the top of its December-January range at 1.1370 following another broader dollar turnaround after the Federal Reserve Chairman said there was no rush to reverse the quantitative easing program. Following the announcement of US inflation figures, and despite the positive results, better than expected, the price of the Euro-dollar completed the correction upwards. It reached the resistance level of 1.1452 at the time of writing the analysis, and the highest for the currency pair in two months. This week, Jerome Powell told US lawmakers that the US central bank would not rush to reverse its quantitative easing program, a process known as quantitative tightening.

The reaction of the FX and stock markets to Powell’s appearance before the Senate Banking Committee indicates that investors fully appreciate that the Fed is ready to raise interest rates and embrace quantitative tightening. The dollar’s continued reluctance to rise recently – despite a steady stream of hawkish comments from the Federal Reserve – has surprised some dollar bulls in the analyst community who are now questioning the assumption that 2022 will start with a stronger dollar.

Accordingly, US bond yields pared their recent gains, and the dollar lost its rally and recorded its weakest level since November in the wake of Powell’s appearance, as the dollar index – a broad measure of the currency’s value – fell to 95.53 in the middle of the week’s trading. Market volatility increased last week after the Federal Reserve released the minutes of its December policy meeting, revealing that policy makers have become very concerned about inflation and may raise interest rates as early as March.

The Fed also said it would need to start reversing the quantitative easing program in a process called quantitative tightening. Three to four rate hikes in 2022 are now priced in by money markets, much more than in mid-2021. The rise in interest rate hike expectations has been a major component of the dollar’s strength in the second half of 2021.

The question now for the forex currency markets is whether this topic can be extended, or whether it has run its course. If it is the latter, the euro against the dollar may recover from its recent lows.

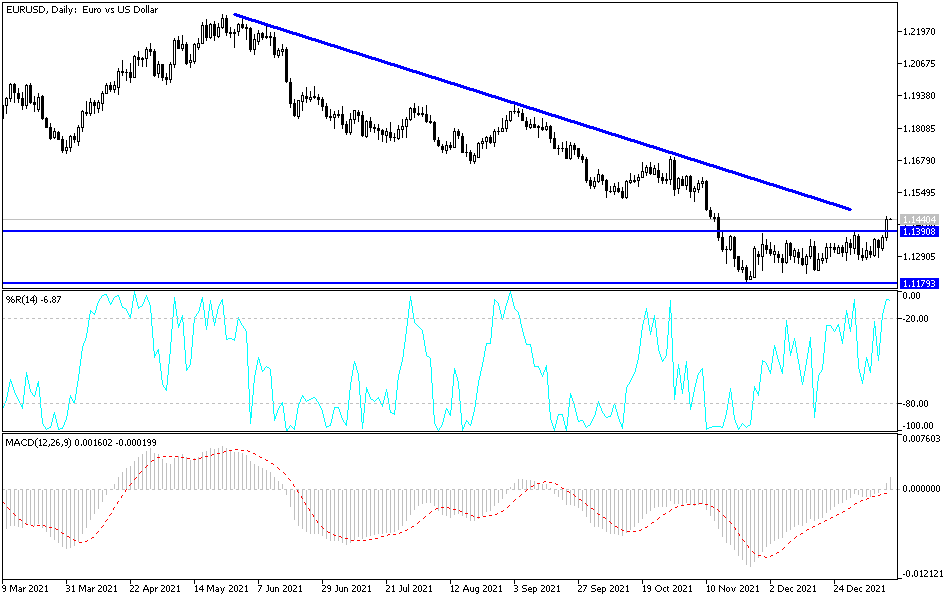

According to the technical analysis of the pair: Undoubtedly, the recent gains of the EUR/USD currency pair are good for the bulls’ stronger control of the performance. This is due to the price of the most popular currency pair in the forex market coming out of a neutral zone in which it continued amid downward pressure for a long time. On the daily chart below, the bulls need to move towards the next most important resistance that has always been mentioned in the technical analysis of the pair, which is 1.1660. To confirm the change in the general trend to the upside.

On the other hand, the currency pair may abandon the new path if it returns to the 1.1345 support area again. Eurodollar gains may collide at any time with the markets balancing the economic performance and the future of monetary policy between the Eurozone and the United States of America. Today, the currency pair will interact with the announcement of the other component of US inflation, the Producer Price Index and the number of weekly jobless claims.

Source link