BOJ Acts to Put Lid on Bond Yields and Affirm Dovish Stance

(Bloomberg) — The Bank of Japan finally acted to keep a lid on bond yields and reaffirm its commitment to its stimulus framework after a tense week of upward market pressure.

Most Read from Bloomberg

With most bond traders in Tokyo already well on their way home to start a long weekend, the central bank offered to buy an unlimited amount of bonds at a fixed rate, pushing back against weeks of trader speculation about policy normalization.

The central bank will buy 10-year bonds at 0.25% on Feb. 14, according to a statement on its website that sparked a weakening of the yen. This is the first such operation since July 2018 as yields creep closer to the limit of tolerated levels under the BOJ’s yield curve control framework.

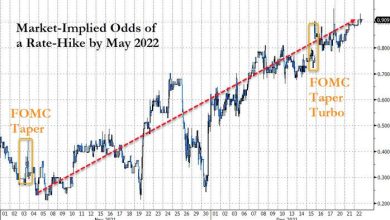

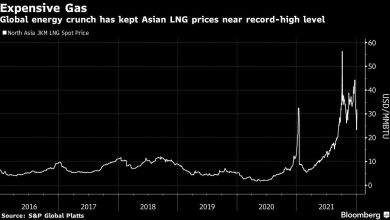

Policy normalization bets have gathered pace across the world in recent months as soaring inflation spurs central banks to unwind pandemic-era stimulus and raise rates. The BOJ has remained an outlier, with Governor Haruhiko Kuroda repeatedly stating the need to keep easing.

“The BOJ is trying to restore the credibility of its YCC policy framework which has come under pressure recently following the Treasuries selloff on the back of surging global inflation,” said Valentin Marinov, strategist at Credit Agricole. “The BOJ is clearly not worried about runaway inflation in Japan and instead seems to try to maintain favorable financial conditions.”

Treasuries have led a global bond selloff with the Federal Reserve indicating it will start raising rates from March. With the European Central Bank not ruling out a rate hike this year after a surge in inflation, yields on 10-year German bunds have climbed above zero.

Benchmark 10-year yields in Japan rose to 0.225% on Thursday before the operation was announced. That was approaching the BOJ’s ceiling of around 0.25% with a three-day weekend ahead and the possibility of another hot inflation figure out of the U.S. that could fuel the global yield surge.

With the operation the BOJ is now setting 0.25% as a clearer line in the sand for market participants and doubling down on its commitment to continue with its stimulus program for now.

Kuroda remains the last staunch dove at the world’s biggest central banks outside of China, after ECB chief Christine Lagarde last week swiveled in the direction of tightening policy.

“Market players have been thinking that as the Fed pivoted and then the ECB, the next in line must be the BOJ,” said Kyohei Morita, chief Japan economist at Credit Agricole Securities Asia. “The BOJ didn’t want to take the risk of fueling speculation by refraining from action before U.S. CPI data and the long weekend.”

Following the announcement the yen weakened to briefly hit 115.88 against the dollar from 115.54 immediately beforehand, in an indication that investors initially saw the move as a reaffirmation of Kuroda’s continued commitment to easing.

What Bloomberg Economics Says…

“The Bank of Japan’s move on Thursday to defend its yield curve control policy demonstrates a willingness to keep borrowing costs low in an effort to stimulate the economy.”

— Yuki Masujima, economist

For the full report, click here

Traders have increasingly turned their focus on the Asian nation, even though its core inflation was only 0.5% in December, well below the central bank’s target.

The BOJ’s latest projection shows inflation just slightly above the halfway point to its 2% target in the two years through March 2024, a forecast that suggests it’s unlikely Kuroda will start unwinding stimulus before his term ends in April next year.

Still Smoking

Still, the speculation is likely to smolder on.

In 2018, market chatter about possible policy adjustments rocketed during a previous Fed tightening cycle. The BOJ defended its yield target range at that time right up to an announcement of adjustments.

Also, some of Japan’s top forecasters now see the possibility of inflation staying near the BOJ’s price target through the end of this year after jumping in the spring.

“The bond market is already starting to set sight on policy prospects after Kuroda,”said Eiichiro Miura, general manager of the fixed-income department at Nissay Asset Management Corp., said before the announcement.

(Adds analyst comments and market moves)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link