NZD/USD Eyes RBNZ Next Week as Prices Rise for Third Week on Easing FOMC Bets

New Zealand Dollar, NZD/USD, Fed, Ukraine, Oil, Iran, JPY – Talking Points

- Asia-Pacific trade set for mixed open after Russia tensions sink US stocks

- New Zealand Dollar gained vs USD after Fed rate hike bets ease further

- NZD/USD bulls probe the 23.6% Fibonacci level as oscillators point higher

Friday’s Asia-Pacific Outlook

Asia-Pacific markets may come under pressure today after escalating geopolitical tensions sent US stocks lower overnight. The Luhansk People’s Republic (LPR) – a quasi-breakaway state within Ukraine – came under sustained mortar fire yesterday. The Organization for Security and Cooperation in Europe (OSCE) stated that tensions seem to be easing in the region, according to its staff. The New Zealand Dollar appeared relatively immune to the risk aversion, with NZD/USD higher through overnight trading.

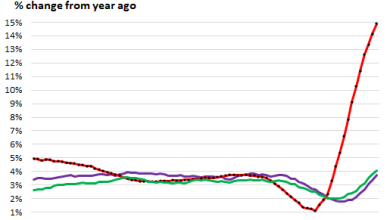

A pullback in Federal Reserve rate hike bets for the March policy meeting dragged the Greenback lower overnight despite the broader risk-off move. The chance for a 50-basis point rate hike – per market pricing — has fallen sharply over the last week, with a 25 bps hike now seen as the most likely outcome. That sparked a bid across the Treasury market, dragging US rates lower and increasing the NZD’s yield premium.

NZD/USD vs 10-year US/NZ Yield Spread – Daily Chart

Chart created with TradingView

WTI crude and Brent crude oil futures fell overnight as energy traders weighed escalations in Ukraine against talks in Vienna between Iran and the United States. Those negotiations are in the final stages, according to US State Department spokesperson Ned Price. An agreement would see the countries return to the nuclear deal abandoned in 2018, likely removing sanctions on Iran, allowing over 1 million barrels per day to return to the global market.

New Zealand reported fourth-quarter producer price data this morning. The producer price index (PPI) for inputs fell to 1.1% from 1.6% on a q/q basis. The PPI for outputs fell to 1.4% from 1.8% q/q. A drop in producer prices may help ease some inflationary pressures in New Zealand, currently at a 30-year high, but the data is unlikely to dissuade the Reserve Bank of New Zealand (RBNZ) from its expected 25 bps hike next week.

Japan’s national inflation rate on a y/y basis fell from 0.8% to 0.5%, below the 0.6% Bloomberg consensus forecast. A measure excluding food and energy prices fell to -1.1% from -0.7%. The Yen is slightly stronger against the US Dollar after haven flows pushed USD/JPY to a weekly low. The Nikkei 225 index was one of Asia’s biggest losers on Thursday, likely due to JPY strength, which disadvantages the country’s exports.

NZD/USD Technical Forecast

NZD/USD is probing the 23.6% Fibonacci retracement level, which has held bulls back on several intraday moves over the past week. A break higher would open the door for a test of the 50-day Simple Moving Average (SMA). Alternatively, if prices shift lower, bears may start to chip away at February’s gains. The RSI and MACD oscillators are moving higher, showing bullish energy remains intact.

NZD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link