Gold Price Eying Gains Above $1,831 as US Dollar Loses amid Fed

- Gold remains around highs as the US dollar loses momentum.

- Fed shows less hawkishness, giving no room for dollar bulls.

- Technically, wait for a breakout or reversal around the $1,831 area.

The price of gold is about to move higher, approaching daily highs and returning above its closing price on Thursday. Gold is up about 0.18% in the current session, while the dollar is down about 0.17%.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

It seems that the dollar cannot withstand the correction, which plays into the hands of the gold bulls. After the index sold out this week, the DXY is 2 points away from a new breakout low. As the index crosses the 94.50 mark, the next reading will be 94.00, which could give gold bulls a lifeline as they near $1,850.

US 10-year bond yields dropped 2.5 basis points to 1.718% as the DXY fell 0.4%. ANZ Bank analysts say that the continued weakness of the US dollar has not led to a rise in gold prices as investors remain concerned about hawkish measures taken by the Fed to contain inflation.

However, that does not explain why the US dollar and yields continue to fall. After Fed members Chairman Jerome Powell and Philadelphia Fed President Patrick Harker used less bellicose rhetoric, the bond market appears to be reassessing the pace of recent Fed balance sheet changes.

The analysts at TD Securities said retail sales likely fell in December, but higher prices led to a higher face value. Spending has likely been curtailed by the loss of fiscal incentives, repayments on previous Christmas purchases, and Omicron. As a result, the total sales are expected to decline by 1.4% MoM (consensus: -0.1%) and a more pronounced 2.0% for the control group (consensus: no change). We expect real and nominal expenditures to increase sharply compared to the previous quarter and year-over-year.

The day will be dominated by US meetings with New York Fed President John Williams and retail sales in the US. The Fed will then enter the shutdown phase until the next interest rate decision later this month. US data will be the focus during this period.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

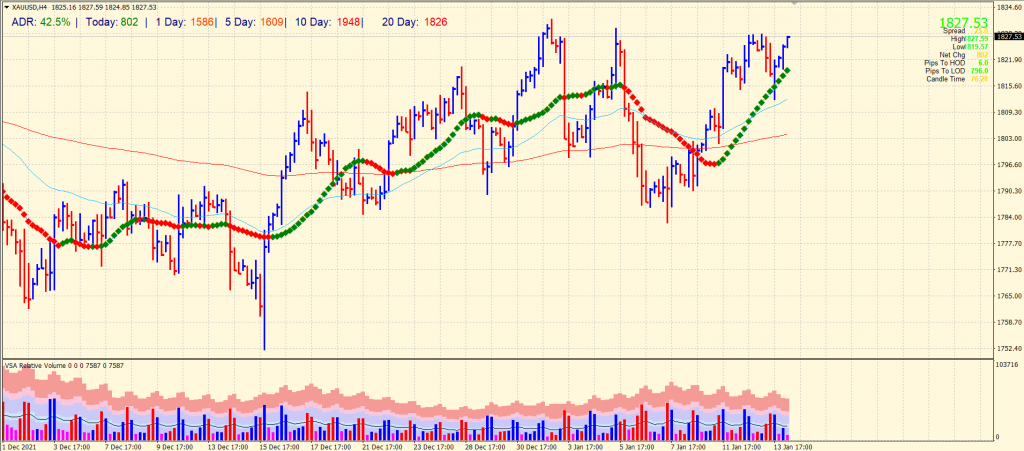

Gold price technical analysis: Breakout or reversal?

Gold price is wobbling near the swing high of $1,831 while staying above the key SMAs on the 4-hour chart. The gold has done 40% average daily range so far, which is higher than the usual. However, the volume data does not support further bullish action. Hence, it is prudent to watch the price action around the swing highs and wait for a breakout or reversal.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link