What Will Eventually Cause the Collapse?

Subscriber Steve F. asked Chuck Butler and me what we meant when we said the Fed and government is destroying the economy and wealth of the nation:

“That seems like a subject the average Joe can get his or her head around. Why not put together what that would really look like for us?”

We discussed the subject at great length and wrote about it. I want to expand the discussion with some outtakes of our conversations.

| “Markets can stay irrational longer than you can stay solvent.”

— John Maynard Keynes |

I was uncomfortable with our response. What if we are wrong? We have been anticipating an economic collapse for over a decade, for good reason, yet it has not happened – yet!

Chuck says, “I’ve been like the doomsayer with the sandwich board that says the end is near, for a long-time regarding debt… Just because something is inevitable, doesn’t mean it is imminent.”

Hmm…. what will cause inevitable and imminent to meet?

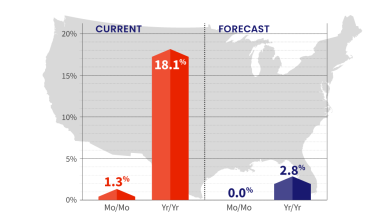

Start with irrational government spending. Here’s the US Debt Clock, dated February 2012.

Our national debt was just under $15 trillion and our annual budget deficit was $1.2 trillion.

Fast forward to February 2022.

In a decade, US debt doubled, and the budget deficit is approaching $3 trillion.

If the Fed stops buying government and corporate bonds, the additional interest cost could easily add $1 trillion to the annual deficit.

The US Debt clock allows us to peer into the future. I wondered if they factored this into their projections. They go out four years to 2026.

It looks like they did; it won’t be long before we owe $100 trillion.

How far apart is inevitable from imminent?

Does the Fed have the courage to keep their promise and stop buying government and private debt?

| “People with good intentions make promises. People with good character keep them.”

— unknown |

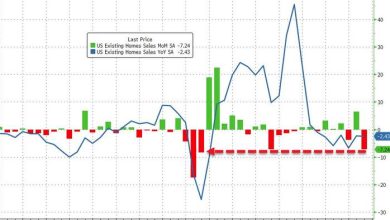

Wall Street On Parade reports, “Since the Fed Announced It Was “Tapering” Last November, it’s Actually Added $332 Billion in Liquidity with New Debt Security Purchases.”

The Fed creates the illusion they are sitting in mission control, like the Space Center, and can effortlessly guide our economy to a “soft landing.”

Illusion?

Common sense says the Government must continue to borrow to cover annual deficits, plus interest. The market can stay “irrational” – so long as people and foreign banks continue buying debt, ignoring the FACT that our government is bankrupt, unable to ever repay our debts.

The idea that the Fed can control interest rates, while NOT buying government bonds is baloney.

Until recently, the Treasury would auction government bonds. They capped the interest rate they would pay. When the market no longer accepted that rate, they stopped buying.

The Fed bought the remainder of government debt by creating money out of thin air. Now they promise to stop that process.

In a free market, borrowers continue to raise the interest rates until all their debt is sold. Chuck feels interest rates could easily rise to 3.5-4%. What if creditors (like China) demand even more and stops rolling over our debt?

Chuck weighs in:

“I don’t believe we as a country will get to $50 Trillion in debt. We will either say uncle, or default on a bond issue being unable to pay, putting the kybosh on Congress’s deficit spending.”

Congress is supposed to oversee the Fed and spend our tax money wisely. What the hell happened?

Economist John Mauldin writes about this in his weekly letter, “Thoughts from the Frontline”:

“They need a complete restructuring because the Fed isn’t accomplishing what we all need it to. Worse, it is causing problems we could do without.

…. Fed officials are largely responsible for the cycles of bubbles, booms, and busts over the last 30 years. Further, they share some of the blame for the growing divisions and tribalism in our society….

The forward-looking Fed still faces a critical tactical question: What federal funds rate should it target to address the most likely inflation rate 12-18 months from now? ….

‘No one has a clue, including the Fed and the financial markets.’ ….

As I keep saying, we will eventually come to a financial reckoning I call The Great Reset. It will require us to rationalize debt, reduce government spending, and increase taxes. Otherwise, we will fall into very difficult economic times….

The Fed will continue doing what it does, up to the moment of actual crisis, helping bring it about, and then offer to put out the fire it helped create. Failure to reform the Fed will let it continue to create bubbles and distort the economy.”

Congress has ignored their oversight responsibility for decades. Mauldin discusses the law that passed to begin a breakup of Microsoft’s monopoly: (Emphasis mine)

“I think the Microsoft case had deeper effects than realized at the time. A deep-pocketed industry began seeing government as a barrier, and started investing some of its abundant capital in political influence. It worked, too. Washington adopted a more laissez-faire attitude, allowing today’s tech giants to carve out highly profitable niches in which they face little competition.”

Mauldin adds, “Five banks control about half the nation’s assets”. Those five banks own and oversee the Federal Reserve.

Ummm, what does, “Investing some of its abundant capital in political influence” mean?

Chuck and I spent part of our youth in tough, inner-city neighborhoods. There were few $2 words used; short words were clearly understood – like bribe.

“Bribery refers to the offering, giving, soliciting, or receiving of any item of value as a means of influencing the actions of an individual holding a public or legal duty.”

“Bribery refers to the offering, giving, soliciting, or receiving of any item of value as a means of influencing the actions of an individual holding a public or legal duty.”

Might some “abundant capital in political influence” have corrupted congress? Top banks have been fined billions for felonies. Why has no one gone to jail?

The mystery suicide of Jeffrey Epstein, and now his chief pimp, taught us one who has engaged in high level favors with politicos has an unwritten “get out of jail free” card, until the elite/politicos are made uncomfortable.

Why? Speaking out might embarrass and incriminate government authorities. Ask Prince Andrew how his mama feels. Threatening to speak out also has consequences.

Chuck weighs in on congress:

“Congress was much like a small-time crook… The crook, does a few small crimes, finds that he can get away with it, and then moves on to higher crimes, continuing until he doesn’t. Eventually his life comes crashing down.

Congress started deficit spending small, found that it didn’t hurt the economy, dollar, or them politically. Today it is spiraling out of control. Just like the small-time crook, behavior has consequences

Think about this… if we as a country had enforced balance budgets, we would have built a treasure chest of surpluses, we could have drawn on those surpluses when needed, instead of going deeper and deeper into debt….”

The Fed, and Congress are caught in a vice. Continued high inflation and raising taxes continue to bring the gap between the elites, working and welfare class to a boil.

Raising rates to tame inflation will clobber the stock market and the casino banks will put tremendous pressure on congress, while the Fed fiddles and the nation burns.

The illusion fools no one, the emperor has no clothes.

Chuck continues:

“Getting back to what’s going to happen is the U.S. We will default when no one wants our debt, that will be the beginning of the end of the U.S. Empire… I feel we stepped over the line at the turn of the century…

Yes, our debt was rising, and I was screaming from the rooftops about it in my Pfennig at the time, but in looking back, it was chump change compared to now…”

When no one wants our debt at any reasonable price, the bubble must pop. It’s unlikely congress is mature enough to make realistic spending cuts, nor will they crack down on the big banks. The Fed owner’s investment of “abundant capital in political influence” will come into play. Politicos and media will scream “crisis”; providing the excuse for the Fed will resume buying government debt, fueling the inflation fires.

Congress gets automatic budget increases; if inflation goes up 7.5%, so does their budget – promoting reckless spending. Departments spend their entire budget, wasting billions to get a larger budget next year. Stop that immediately! Reward the proper behavior, cutting spending and saving taxpayer money.

Citizens will scream; however, everyone is being treated equally. Don’t even think about raising taxes until this is done.

During the Gingrich era, they said, “If congress froze dollar spending at current levels, our budget would be balanced in five years. Let’s find out!

Perhaps a revolution at the ballot box, with many new members of congress who the Fed has yet to influence? Find those who benefitted from “investments in political influence” and prosecute them criminally.

Our system theoretically provides for a peaceful revolution.

| “All tyrannies rule through fraud and force, but once the fraud is exposed, they must rely exclusively on force.”

— George Orwell |

I’ve spoken with people from Argentina and Zimbabwe about what happened when inflation destroyed their nation’s wealth. They declared martial law, the government could not protect the citizens.

Many ambitious politicians will swoop in like Mighty Mouse proclaiming they will save the day – with the mainstream media cheering.

Time Magazine – January 1959.

Fidel Castro, Time Magazine “man of the year”. Praised by the media, Castro was the savior of the common man. How did that work out? Americans need to choose wisely!

|

A little help means a lot! Seven years ago, I vowed to keep our newsletter FREE! I plan to keep my promise. It’s an expensive, time-consuming hobby, but also a labor of love. Recently a reader asked why I didn’t charge for our weekly letter. I explained that I want it available for everyone. Some readers may be on limited budgets and may benefit the most from our advice. He pressed on with his questions. How much does your letter cost? How many readers do you have? He concluded, “If each reader paid $10/year, you would be fine. I responded, “Yes, $10 per reader would work, BUT I am committed to keeping it FREE even if it costs me money.” Several readers suggested we add a donations button to help us offset the cost of our publication. It helps when people pitch in and we certainly appreciate it. If readers want to donate, it sure helps out, however, it’s strictly voluntary – no pressure – no hassle! Click the DONATE button below if you’d like to help. You do not have to sign up for PayPal to use your credit card. And thank you all! |

On The Lighter Side

Last week Jo woke me from a nap, “Come see this amazing hail.” It was coming down like the biggest blizzard of snow I have ever seen. I’ve seen plenty of hail, but not like what I was witnessing. We grabbed the phone and took photos but it didn’t clearly show.

A little over an hour north, Flagstaff (7,000 feet) got several inches of snow and very cold weather. We are at 1900 feet and seldom see snow, or snowcapped mountains here in the valley.

The next morning, we were surrounded by several, beautiful snowcapped mountains. We shot this photo right down the street from our home.

The next morning, we were surrounded by several, beautiful snowcapped mountains. We shot this photo right down the street from our home.

We had a cool week so the snow stayed with us, but it will soon disappear. Not quite short-sleeve weather for most of us yet; however, the Canadians love it.

Last year I wrote about the TV show, America’s Got Talent. One special contestant, a thin young 30-year-old woman from Zanesville, Ohio, calling herself “Nightbirde”. Her real name is Jane Marczewski. She wrote a very moving song titled, “It’s OK,” outlining her experiences with cancer. You instantly loved her…

Sadly, she passed away from cancer on February 19th. Our condolences go to her and her family. They have much to be proud of.

Quote of the Week…

And finally…

Close friend Phil C. sent along some cute “Kids and grandparents”:

A grandfather was delivering his grandchildren to their home one day when a fire truck zoomed past. Sitting in the front seat of the fire truck was a dalmatian dog. The children started discussing the dog’s duties.

“They use him to keep crowds back,” offered one child.

“No,” said another, “he’s just for good luck.”

A third child brought the argument to a close. “They use the dogs to find the fire hydrants.”

And my favorite:

When my grandson asked me how old I was, I teasingly replied, “I’m not sure.”

“Look in your underwear, Grandpa,” he advised. “Mine says I’m 4 to 6.”

Until next time…

Dennis Miller

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure – This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Source link