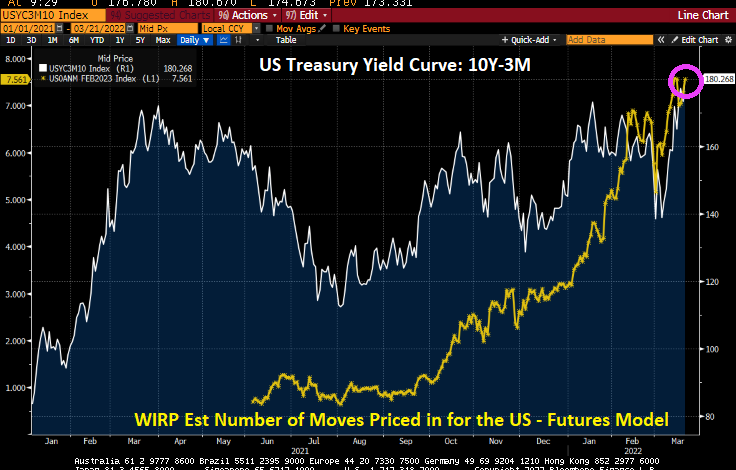

US 10Y-3M Treasury Curve Steepest Under Biden Presidency While 10Y-2Y Curve Flattest Under Biden As inflation, Oil Soar (Gasoline UP 10% In New York Port, Mortgage Rates Climb) – Confounded Interest

Oil prices are soaring as US President Biden pleads like a homeless person to foreign countries for oil rather than let the US produce more oil to drive down prices. Meanwhile, the US Treasury yield curve 10Y-3M is at its steepest (rising 10Y yields while The Fed keeps short rates at near zero).

But if we look at the belly of the beast, so to speak, the 10Y-5Y slope, we can see that the Treasury curve has declined to a mere 0.278 basis points as inflation rages.

Bankrate’s 30-year mortgage rate keeps on climbing and has hit 4.55% as the 2-year Treasury yield rises rapidly.

The US Dollar Index has risen dramatically as US inflation has increased dramatically.

Oil? Oil is up over 4% in the US. Mexican Mix (not a #3 meal at Chuy’s) is up 7.32%.

Gasoline? NY prices are up over 10%.

Russian oil is up 9.35%.

Ah, for the good old days of 30 cents a gallon gasoline, although I always wondered about Gulf’s marketing campaign. “Good Gulf” seems to imply that the other Gulf gasolines aren’t good. And Gulf’s “No-nox” seems to imply that the other Gulf gasolines knock like Biden’s knees as he pleads for foreign oil.

Source link