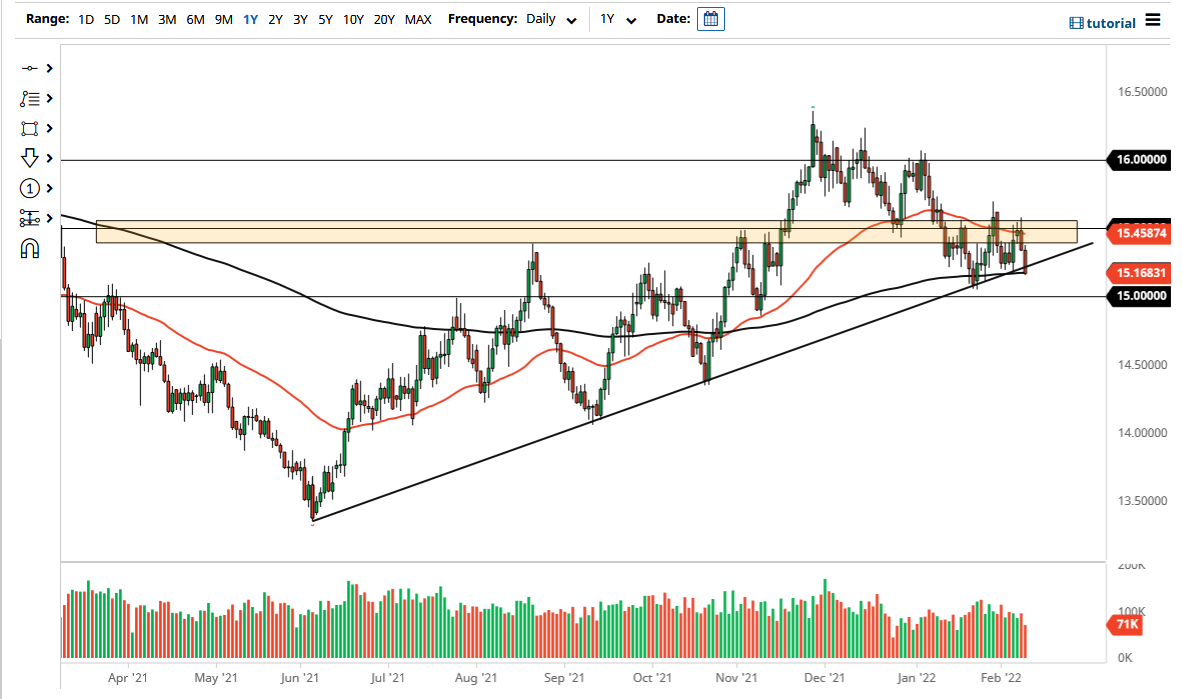

USD Falls to Test 200-Day EMA Against ZAR

The market is likely to be one that you need to pay attention to on a longer-term move, as emerging markets continue to be a trending type of situation.

The US dollar fell a bit on Wednesday to fall towards the 15.16 level against the South African rand. The 200 day EMA sits here as well, and it is an area that has been supportive. Furthermore, you can make an argument for a significant trend line sitting here as well, and the fact that we have the CPI numbers coming out during the day on Thursday gives even more credence to what could be an important inflection point.

With that being the case, I think that if we continue to break down, then we could go looking towards the 15 rand level, which is a large, round, psychologically significant figure, which will attract a certain amount of attention. If we can break down below there, then it is likely that we will go much lower, perhaps down to the 14.25 rand level initially. On the other hand, if we get a hotter than anticipated CPI figure, we could see the US dollar turn around and try to reach towards the 15.50 rand level. That would be a bounce off of the trend line and could suggest more sideways action over the next couple of weeks. If we can break above there, then obviously it would be good for the US dollar.

The great thing about trading the US dollar as you typically see strong correlation between all of the currency pairs. In other words, what I mean by that is that the US dollar rallying here will probably wreak havoc against almost all emerging market currencies. This is because EM economies are very sensitive to interest rates, as a lot of these economies are highly correlated to commodities sales. Commodities of course are highly correlated to the US dollar.

In general, we are at a major level that needs to be paid attention to. That being said, the market is likely to be one that you need to pay attention to on a longer-term move, as emerging markets continue to be a trending type of situation. Furthermore, you should keep in mind that the South African rand is considered to be a “highflyer” when it comes to risk appetite, so that also has a lot of potential to be a factor in this market.

Source link