ISM Services Slump To 12-Month Lows: Imminent Wage Growth Spiral Means Higher Inflation As “Great Resignation Is Real”

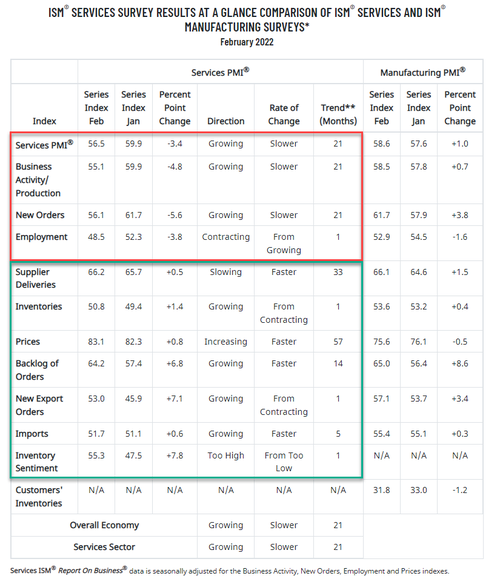

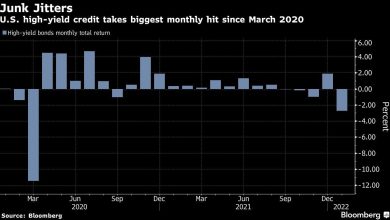

As omicron restrictions faded, US Manufacturing surveys rebounded in February and today analysts expected the Services sector sentiment to also rebound, but the reality was different with the usual complete divergence between the two surveys.

-

Markit’s US Services PMI did indeed rebound, rising from 51.2 to 56.5 (but we note that is a slight drop from the preliminary print of 56.7)

-

However, ISM Services tumbled to its lowest since Feb 2021 (dropping from 59.9 to 56.5, against expectations of a rise to 61.1).

Source: Bloomberg

While, Markit’s survey finds that output charges are rising at the fastest pace on record and the rate of job creation quickens to sharpest since May 2021, ISM’s index of new orders also showed the slowest growth in a year, while a measure of business activity – which parallels the ISM’s gauge of factory production – fell to the lowest level since May 2020. Moreover, an index of employment contracted.

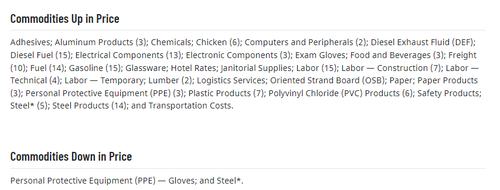

Prices are up in everything… except gloves and steel…

There appears to be a shortage of blood collection tubes…

And here is what respondents are saying..

Additionally ISM’s gauge of services employment fell almost 4 points to 48.5, the weakest since August 2020, and one quote from the ISM Survey really caught our eye:

The Great Resignation is real:

Employees, contractors and consultants continue to quit their jobs and engagements for opportunities that pay more and have more flexible work options. Millions of light industrial jobs remain open in the U.S., with limited interest from job seekers. Severe labor shortages are expected well into 2022. Corporations need to increase wages and salaries to attract talent and get work done. Faster wage growth is expected to lead to increased inflation.

“Respondents continue to be impacted by supply chain disruptions, capacity constraints, inflation, logistical challenges and labor shortages,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement.

“These conditions have affected the ability of panelists’ businesses to meet demand, leading to a cooling in business activity and economic growth.”

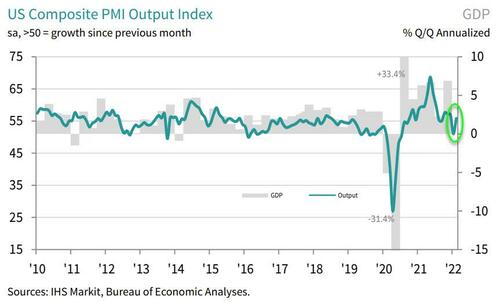

The IHS Markit US Composite PMI Output Index posted 55.9 in February, up from January’s Omicron-induced low of 51.1 (but was also down very modestly from the flash print). The latest data signalled a sharp expansion in private sector business activity, as output growth regained momentum at manufacturers and service providers.

Inflationary pressures remained elevated across the private sector, despite manufacturers recording a slight slowdown in hikes in supplier costs. The rate of charge inflation quickened to a four-month high amid the sharpest rise in service sector output prices on record.

February’s PMI surveys are broadly consistent with GDP rising at an annualised rate of 3.5%, representing a substantial improvement on the 0.9% rate signalled by the January surveys. First quarter GDP growth is therefore currently averaging just over 2%.

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“US service sector companies reported a strong rebound in business activity during February as virus containment measures were eased to the loosest since November. The data add to evidence from manufacturing surveys that the Omicron wave appears to have had only a modest and short-lived impact on the economy.

“Supply chain bottlenecks and poor labor availability remain widespread constraints on output , however, limiting economic growth in manufacturing and services, meaning demand continues to rise faster than output, resulting in unprecedented price pressures.

“The Ukraine conflict is leading to further upward movements in energy and broader commodity prices, which will add further to US inflationary pressures. More uncertain will be the extent to which business confidence is being affected by the war. Business optimism about the year ahead had surged across manufacturing and services in February to the highest for 15 months, as firms looked ahead to looser COVID-19 restrictions and saw signs of easing supply constraints. However, the resilience of this optimism will be tested by the conflict in Europe and will need to be monitored in the coming weeks as a barometer of risk appetite in terms of both spending and investment.”

So – take your pick – PMI strong rebound (Fed can’t hold); ISM plunge (Fed could hold)… and is bad news, good news?

Source link