Headaches On Headaches! 10Y Treasury Rates Rises 8.6 BPS, But REAL 10Y Is -5.50% Thanks To 40-Year High Inflation – Confounded Interest

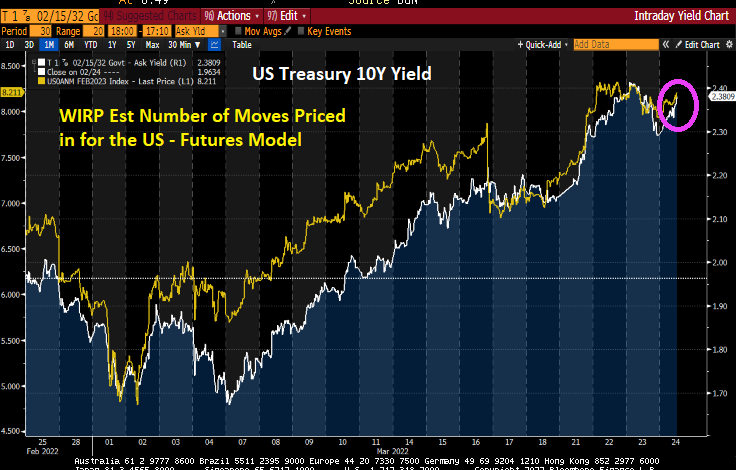

Overnight, the US Treasury yield rose to 2.38% as the number of forecast Fed rate hikes rose to 8.211. So, enjoy “low” rates while you can.

If we back out the highest inflation rate in 40 years, the REAL 10Y Treasury yield is -5.50%.

And the REAL 30Y mortgage rate is -3.57%.

Of course, the meteoric rise in inflation is due largely to Biden’s attack on the fossil fuel industry (until Russia’s invasion of Ukraine distracted from Biden’s inflation fiasco). Remember, Russia didn’t invade Ukraine until February 2022.

But rather than relax Biden’s anti-fossil fuel executive orders, Congress is now considering the “Gasoline Rebate Act” to give people gasoline stimulus checks to offset the alarming rise in gasoline prices. California governor Gavin “Nancy Pelosi’s nephew” Newsome is proposing a similar measure to give auto owners a $400 rebate to cover rising gasoline prices. Of course, Newsome is up for reelection and there are the midterm elections approaching, so I rule out true concern for citizens as a motive.

Wait. I thought the purpose of Biden’s executive orders was to reduce dependence on fossil fuels by driving up gasoline and natural gas prices producing a shift to “green energy.” Won’t these “gas rebates” simply continue the consumption of gasoline and natural gas? And increase inflation??

As Winston Churchill once said, “Never let a crisis go to waste.”

Source link