Gold bounces as dollar weakens, investors watch Ukraine-Russia talks

Argor Heraeus SA-branded one kilogram gold bars are arranged for a photograph at the Chinese Gold and Silver Exchange Society in Hong Kong, China.

Brent Lewin | Bloomberg | Getty Images

Gold rose 1% on Thursday, supported by a retreat in the U.S. dollar and Treasury yields, with investors cautiously watching developments in peace talks between Russia and Ukraine.

Spot gold was up 0.8% to $1,943.30 per ounce by 1:41 p.m. EDT (1741 GMT).

U.S. gold futures settled up 1.8% to $1,943.20 per ounce.

With a weaker dollar and the Ukraine situation still in the background, people have started piling into gold, said Miguel Perez-Santalla, head of trading sales and marketing at Heraeus Metals Management in New York.

Signs of progress in talks to end the war in Ukraine, which Russia calls “a special military operation,” had helped global stocks surge this week, but the Kremlin said there was no deal yet.

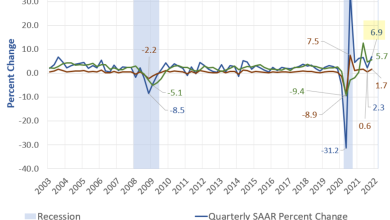

The dollar and Treasury yields eased a day after the Federal Reserve raised its benchmark overnight interest rate by a quarter of a percentage point, with some investors having priced in an even stronger rate hike.

While rising U.S. interest rates normally tend to pressure gold since they increase the opportunity cost of holding the non-yielding asset, bullion investors seemed to take the Fed rate hike in stride, given that it was mostly aimed at tackling soaring inflation.

“If you had to look at one single thing to encourage you that this bull run has got legs, you’d be looking at ETF (exchange-traded fund) flows, and that’s really positive,” independent analyst Ross Norman said.

Holdings of the world’s largest gold-backed ETF, SPDR Gold Trust, have risen to the highest level since March 2021 at 1,070.53 tons.

Palladium rose 4.1% to $2,507.42 per ounce, though it is down almost $1,000 from its March highs.

With producers not having any issues moving the metal, there doesn’t seem to be much of a supply shortage like previously feared, said Edward Meir, analyst with ED&F Man Capital Markets.

Spot silver rose 1% to $25.31 per ounce, while platinum was up 0.4% to $1,021.95.

Source link