Cautious Move Ahead of US Data

The EUR/USD price may have bottomed out in January and could now be in the process of pulling back in the wake of the European Central Bank’s monetary policy decision for February. However, some analysts say the scope of the EUR/USD recovery US dollar potential. to be very limited. The change in the tone of the European Central Bank’s policy recovered, pushing the price of the currency pair EUR/USD towards the resistance level of 1.1483 before it was exposed to selling operations after ECB Governor Lagarde’s adjustment to the level of 1.1395 and settled around the level of 1.1435 at the time of writing, before the announcement of the important US inflation figures.

The euro, tumbled near the 1.11 figure in January, its lowest level in nearly two years, as it bore the brunt of the dollar’s rally due to the prevailing perception that the European Central Bank is unlikely to respond this year to the latest. Developments in inflation in the euro area. But last week’s monetary policy decision turned out to be a watershed moment for the euro after European Central Bank President Christine Lagarde acknowledged the upside risks of the bank’s forecast and refused to repeat earlier assertion that eurozone interest rates would be “highly unlikely” at all this year.

Commenting on this, Jane Foley, FX Analyst at Rabobank, said: “Before last week, we had seen that the issue of ECB policy normalization was likely to lift the euro in the second half of this year. Obviously that has now been introduced,” she added, “We were expecting EUR/USD to head lower towards 1.10 around the middle of the year as the Fed started its rate hike program and that the currency pair would then start to rise. The hawkish inclination of the European Central Bank forces us to re-evaluate this view. Certainly, the 1.10 support for EUR/USD looks far from what was previously expected.”

European Central Bank forecasts indicated that eurozone inflation is likely to peak in January before declining steadily during the year, enabling the bank to be patient in its approach to normalizing its monetary policy settings than its peers in other jurisdictions such as the UK and US New Zealand and Norway to name a few.

But January data showed annual inflation is slowly rising again and led President Lagarde to warn at the February press conference that a longer period of higher price pressures was likely to come, necessitating along the way a more flexible policy stance from the European Central Bank.

“The ECB’s shift from monetary policy divergence to monetary policy convergence is significant and the euro faces a rally in the coming weeks as the FX markets adjust,” says Emyr Daly, FX and Emerging Markets Analyst at Barclays Bank. “We stick to our EUR/USD forecast at 1.19 by the end of 2022 and see the euro gaining the most momentum against currencies as domestic inflation dynamics point to a slowdown in monetary policy tightening, for example, the Japanese yen and the Swiss franc. “We still recommend buying EUR/JPY with a target of 137,” the analyst added.

Last week’s press conference sparked a flurry of expected improvements from economists and analysts, many of whom are now looking forward to the European Central Bank starting to raise its deposit rate by 0.50% during the final months of the year before returning the benchmark index to zero percent. In another time. In early 2023.

But President Lagarde’s testimony on Monday before the Committee on Economic and Monetary Affairs made clear that this path is far from certain.

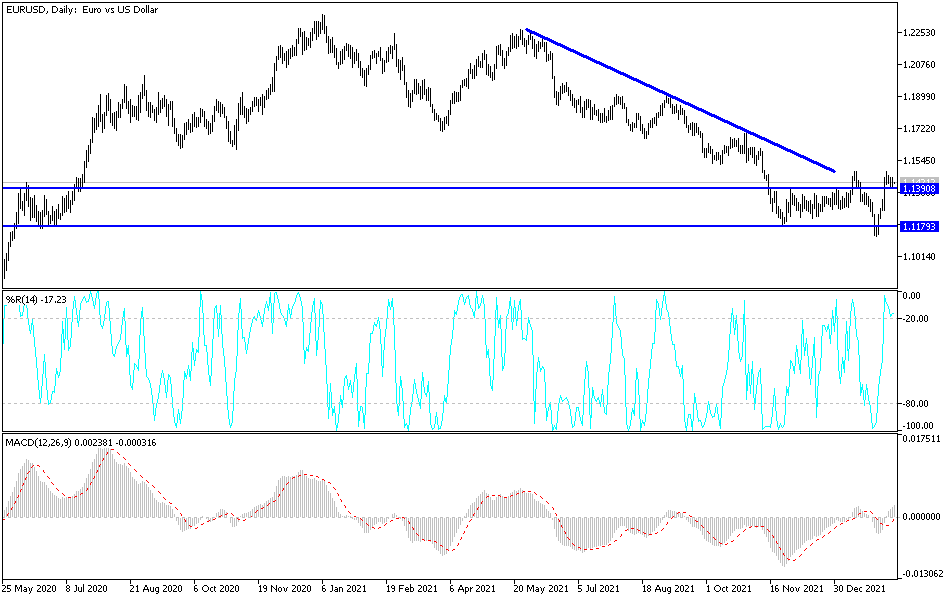

According to the technical analysis of the pair: I do not change my technical view of the performance of the currency pair EUR/USD, as the trend still has the opportunity to rise and US inflation data may support that or vice versa. Profit taking may occur in the event that the data come out today in favor of expectations of a rise in US interest rates. Accordingly, the pair may collapse towards the support levels 1.1375 and 1.1280, respectively.

On the upside, a break of the 1.1490 resistance is important for the bulls to gain more control over the trend. I still prefer selling the currency pair from every upside level.

Source link