BOJ’s Kuroda Vows to Stick With Stimulus After Fed’s Rate Hike

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Most Read from Bloomberg

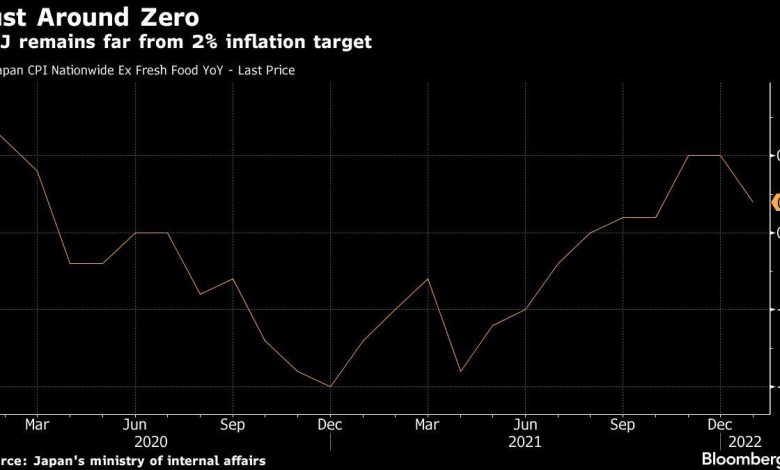

Bank of Japan Governor Haruhiko Kuroda says monetary stimulus must continue as the country’s different inflation dynamics compared with the U.S. keep his price goal out of reach.

“We are not in a position at the moment where inflation is going to reach 2% in a stable manner,” Kuroda said Thursday, responding to questions by a lawmaker in parliament, just hours after the Federal Reserve raised interest rates to help tame U.S. prices.

The Fed’s first rate increase since 2018 and its mapping out of an aggressive path of further hikes this year has made abundantly clear the growing policy divergence with the BOJ.

Japan’s central bank will announce its latest decision on Friday and is expected to leave all its main settings unchanged, with the war in Ukraine seen strengthening the likelihood the BOJ will stand pat for some time to come.

Read More: BOJ to Sit Tight on Policy in Contrast With Fed: Decision Guide

By emphasizing that the price goal must be met in a sustainable manner, Kuroda’s remarks on Thursday appear aimed at keeping a lid on speculation the BOJ may consider normalization steps as inflation picks up in Japan, U.S. interest rates rise and the yen continues to weaken.

Prices are expected to jump from next month when the downward impact of cheaper cell phone fees starts dropping out of calculations. An increasing number of economists say that, together with a recent surge in commodity prices, inflation could hit 2% or higher even as wages continue to show little growth.

Unlike the U.S., Japan’s economy has struggled to regain its pre-pandemic level. According to a Bloomberg survey, economists expect the recovery to stall again this quarter as omicron-linked restrictions hit consumption again.

A growing policy gap between the Fed and the BOJ could fuel a further weakening of the yen and a corresponding rise in import prices, adding to the headaches for Kuroda. The yen hit its weakest level against the dollar since 2016 following the Fed decision.

Asked about the impact of Fed’s policy on the yen, Chief Cabinet Secretary Hirokazu Matsuno told reporters that rapid movements in foreign exchange rates is undesirable.

Kuroda’s comments on the currency are set to be a key focus of his post-meeting news conference Friday.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link