AUD/USD Boosted by Rising Iron Ore Prices Amid Increased Equity Market Volatility

Australian Dollar, AUD/USD, Risk Trends, Ukraine, RBA Lowe – Talking Points

- Asia-Pacific markets may pullback to end the week after volatile US session

- RBA Governor Philip Lowe spoke Friday morning as rate hike bets firmed up

- AUD/USD may target 2022 high after slicing above the 200-day SMA

Friday’s Asia-Pacific Outlook

Asia-Pacific markets face a potentially downbeat day of trading to close out the week after US stocks fell overnight. A breakdown in negotiations between Ukraine and Russia, along with the highest US inflation print in 40 years, had traders hitting the sell button. The high-beta Nasdaq-100 Index (NDX) closed 1.10% lower on Thursday. Bitcoin fell back below the 40,000 level, sinking more than 5% amid a broader selloff in the cryptocurrency space.

Meanwhile, the Australian Dollar managed to climb despite the risk aversion seen throughout markets, likely aided by climbing iron ore prices. Speaking of iron ore, Reserve Bank of Australia Deputy Governor Guy Debelle unexpectedly announced his resignation Thursday afternoon. Mr. Debelle will join iron ore miner Fortescue Metals Group Ltd. as its chief financial officer. A replacement for the soon departed position will be announced in “due course,” said Josh Frydenberg, Australian Treasurer.

RBA Governor Philip Lowe spoke this morning, saying that inflation is not yet sustainably within the central bank’s 2-3% target range but is moving closer. Mr. Lowe also stated that rates may rise later this year. Market expectations for an RBA rate hike this year have grown since the start of the month despite the market volatility stemming from the Ukraine conflict. Cash rate futures are currently pricing in over 100 basis points of tightening by the December RBA meeting.

Today, the Philippines will report its trade balance data for January along with a retail price index for December. Chinese February vehicle sales will cross the wires, and India’s industrial production numbers for January will follow later this afternoon. Chinese lending data is expected to be released before March 15. Meanwhile, the conflict in Ukraine will likely continue to have an outsized impact on risk trends, with the potential for extreme volatility remaining elevated.

AUD/USD Technical Forecast

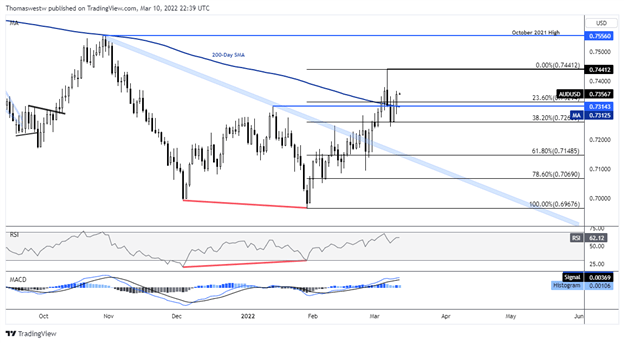

AUD/USD rose back above the January swing high and 200-day Simple Moving Average (SMA) overnight. The 2022 high at 0.7441 may shift into focus if bulls press prices higher. Alternatively, a pullback could see support from those recently breached levels. The Relative Strength Index (RSI) is rising along with the MACD oscillator, although the pace higher has slowed recently.

AUD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link